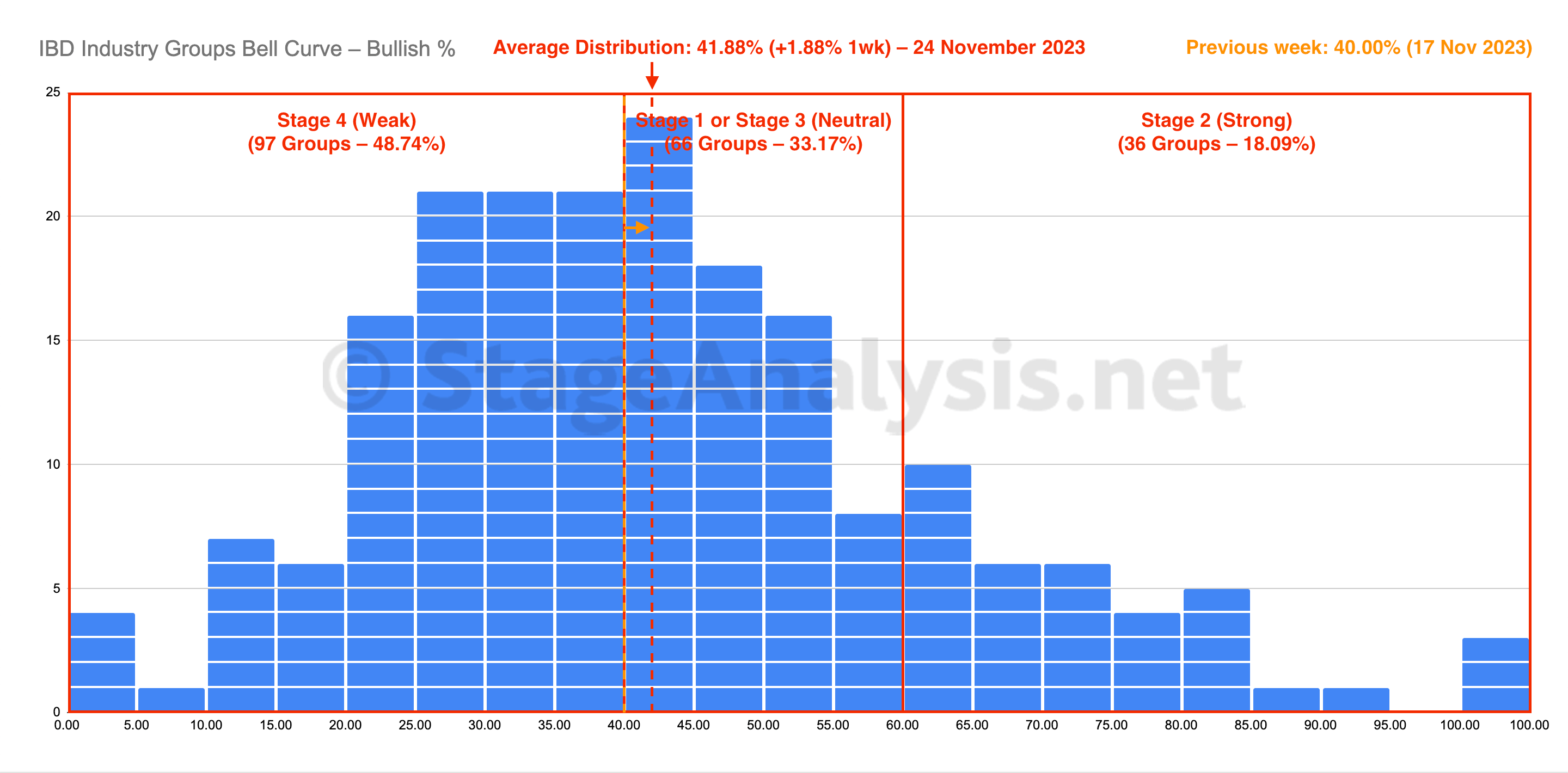

The IBD Industry Groups Bell Curve increased by +1.88% this week to finish at 41.88% overall. The amount of groups in Stage 4 (Weak) decreased by 5 (-2.5%), and the amount of groups in Stage 2 (Strong) increased by 8 (+4%), while the amount groups in Stage 1 or Stage 3 (Neutral) decreased by 3 (-1.5%).

Read More

Blog

25 November, 2023

IBD Industry Groups Bell Curve – Bullish Percent

25 November, 2023

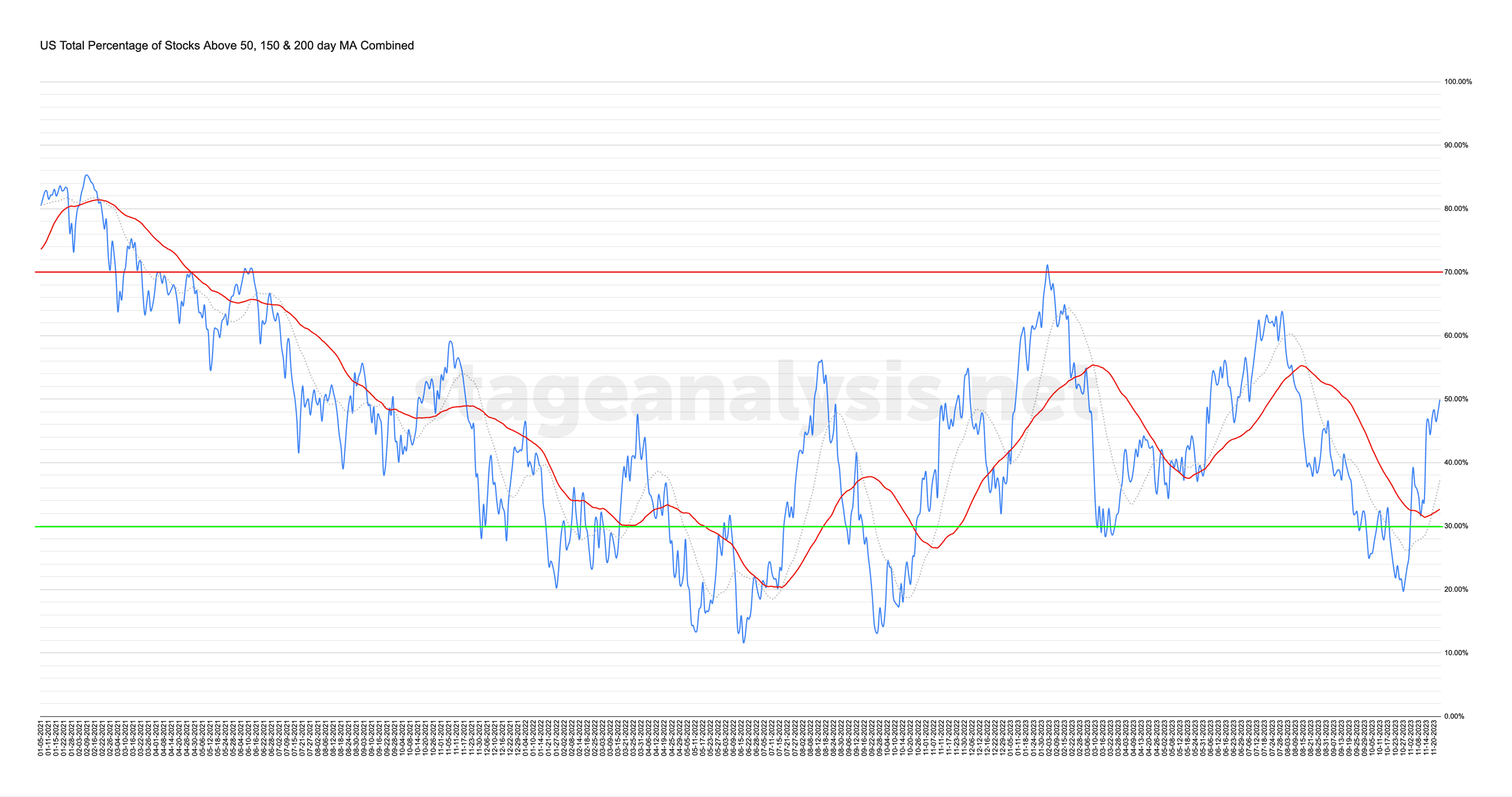

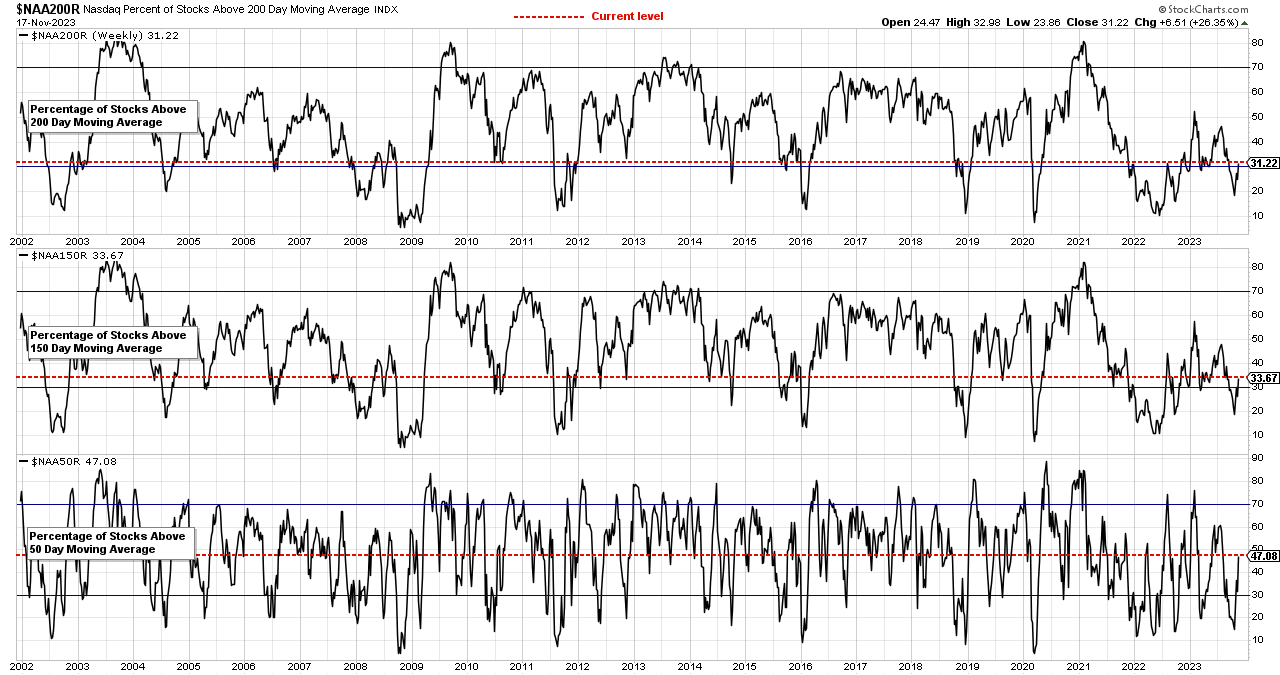

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

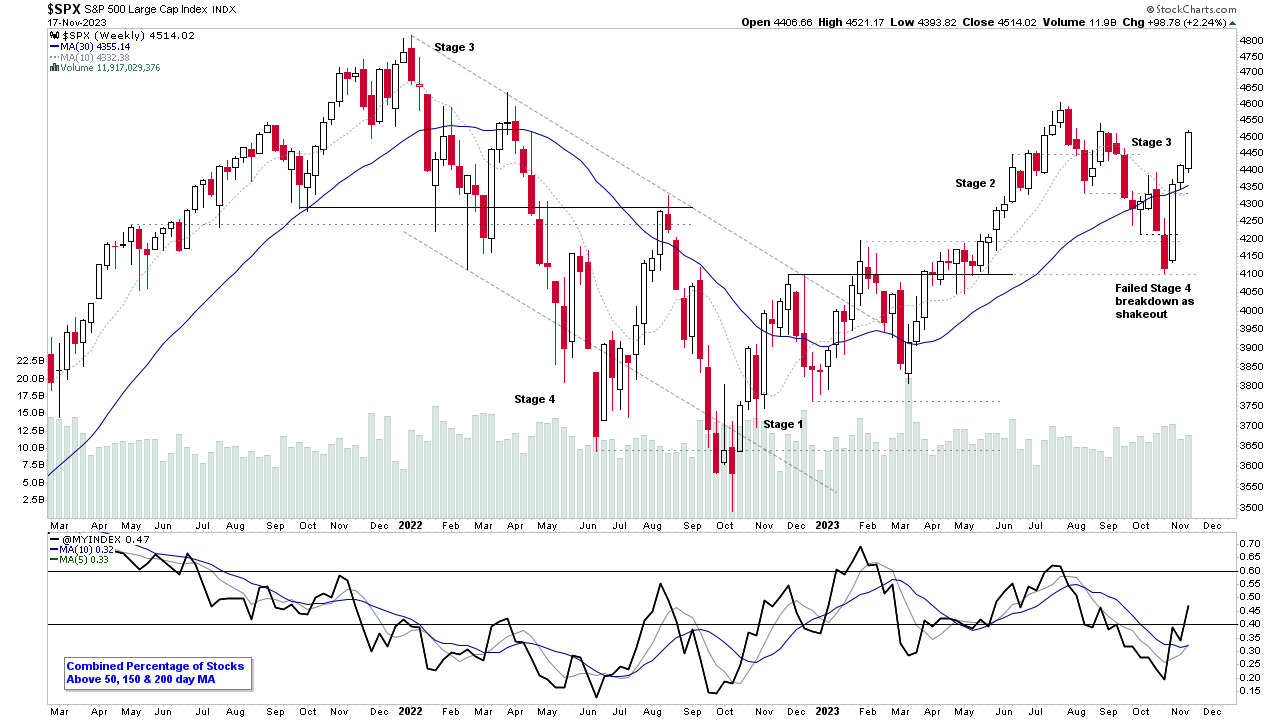

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +2.81% this week. Therefore, the overall combined average is at 49.92% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages...

Read More

24 November, 2023

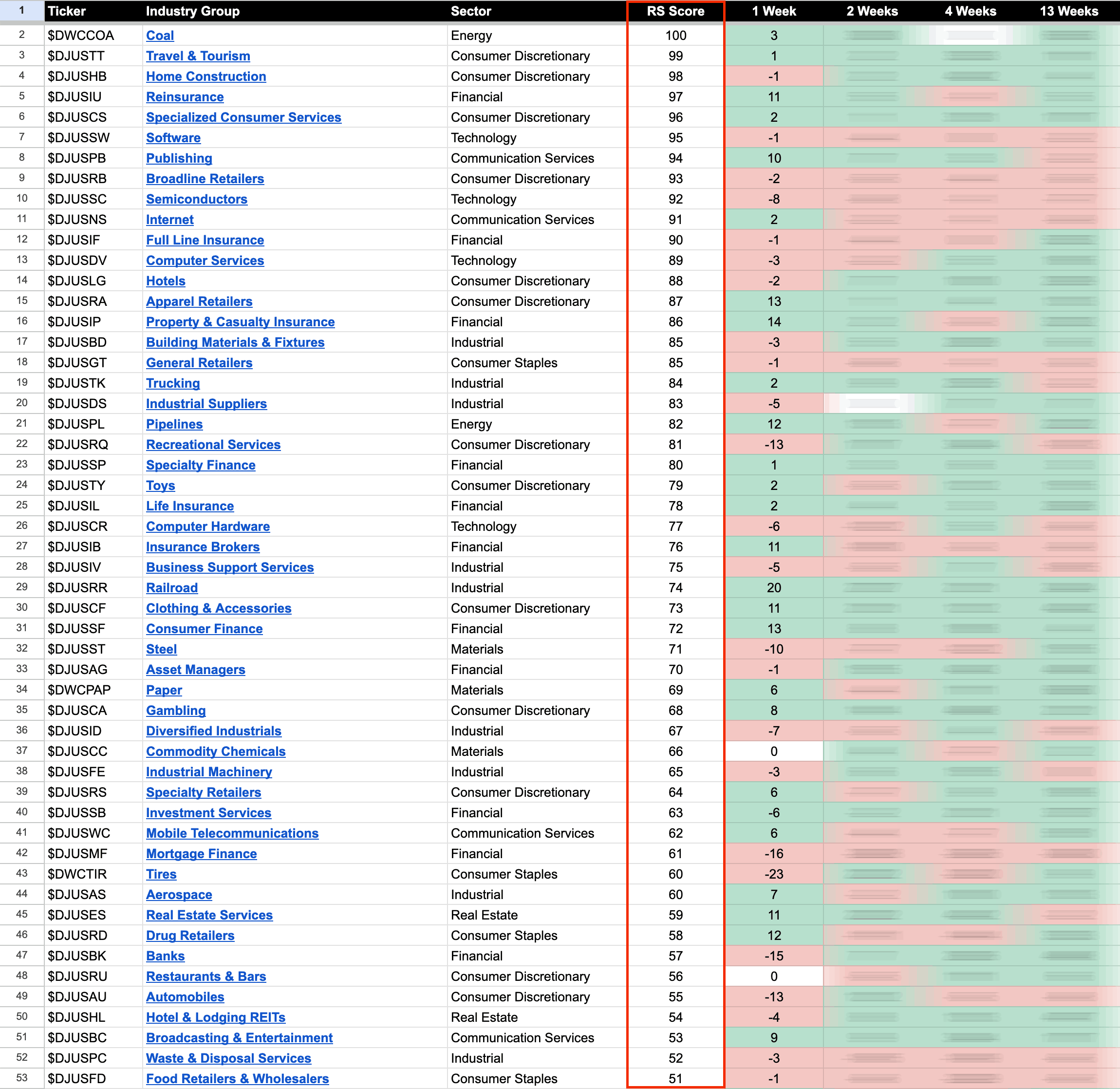

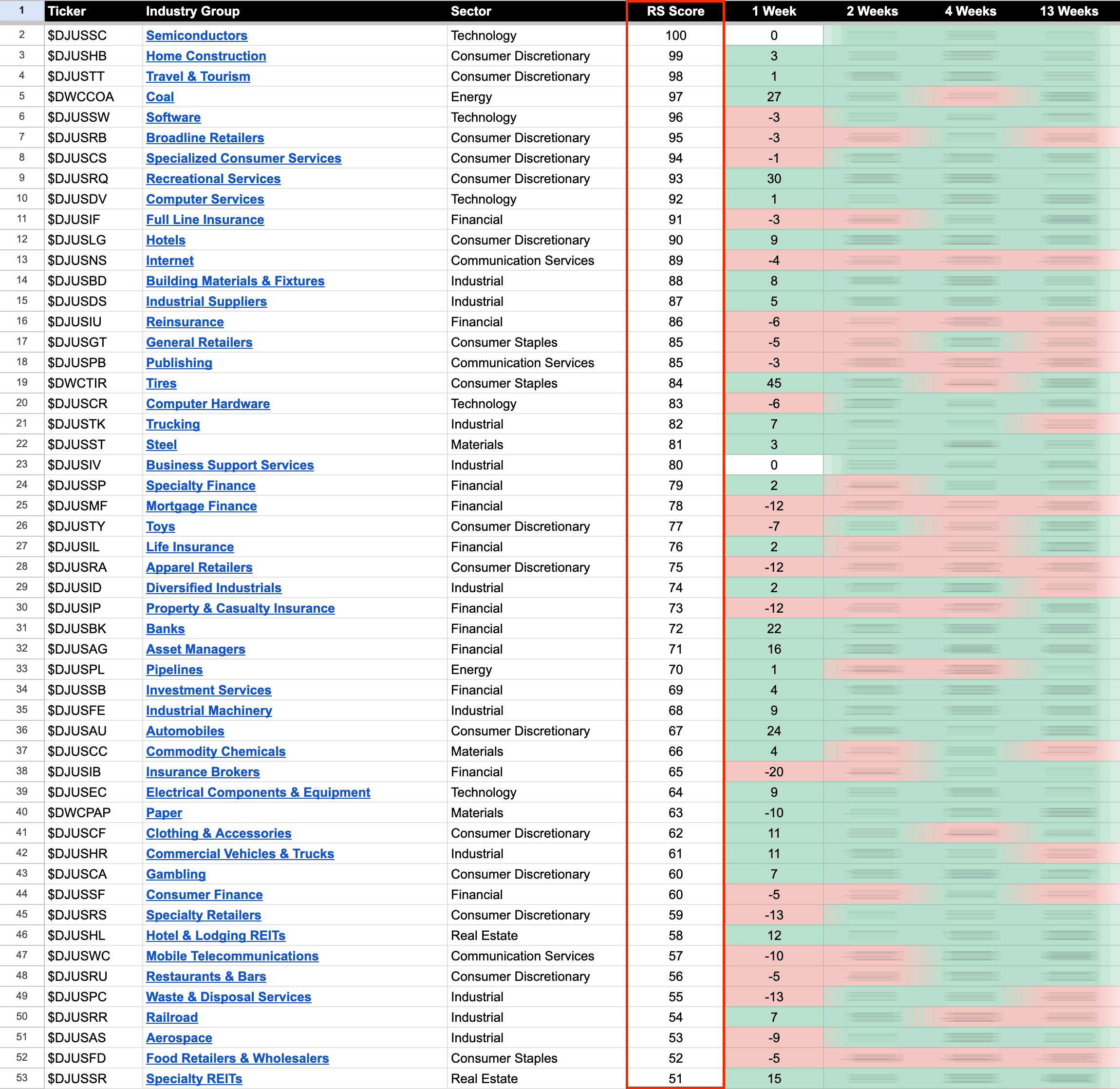

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

23 November, 2023

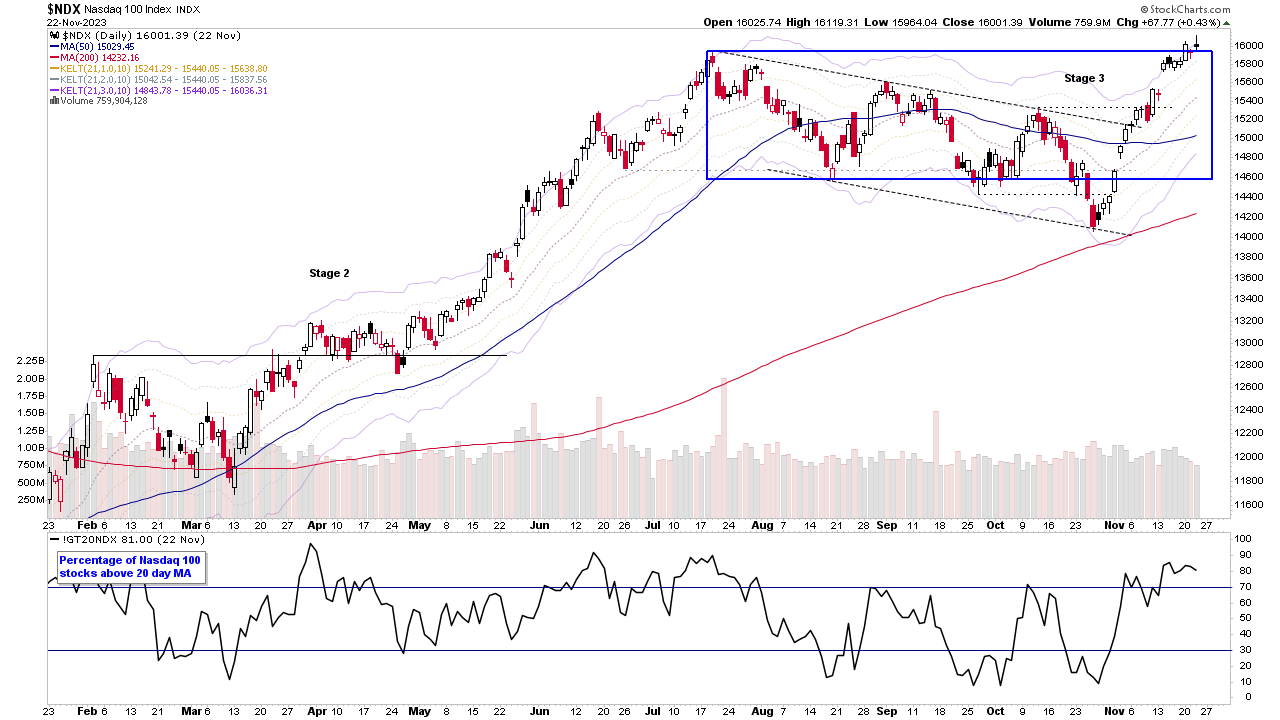

Nasdaq 100 Testing the Top of the Recent Range – Stage 2 Continuation or Developing UTAD?

The Nasdaq 100 has continued to strengthen over the last few weeks with a lockout rally since the Shakeout / Spring and gap at the start of the month. The majority of this price action has occurred in the right hand part of the multi-month base structure so far, clearing two internal swing highs within the range – which is a Change of Character and hence potentially may be Phase D of a re-accumulation base...

Read More

20 November, 2023

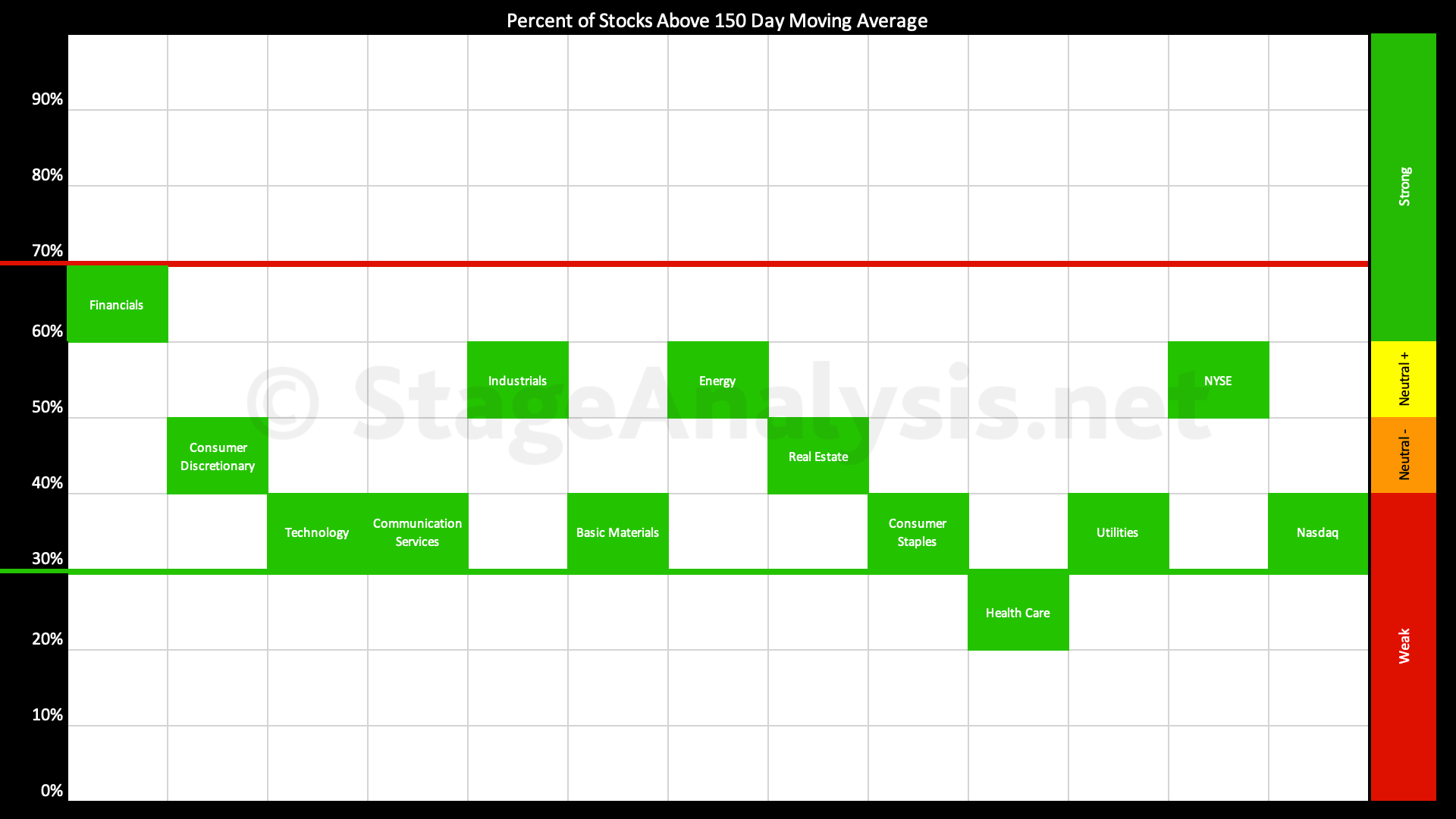

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day moving averages in the 11 major sectors increased by +7.58% since the previous post on the 6th November 2023, with a continued strong rebound that began in the lower zone, and so is a continued positive change for this contrarian breadth indicator.

Read More

19 November, 2023

Stage Analysis Members Video – 19 November 2023 (1hr 15mins)

Stage Analysis members weekend video discussing the Major US Stock Market Indexes, Futures Charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, and the US watchlist stocks in detail on multiple timeframes.

Read More

19 November, 2023

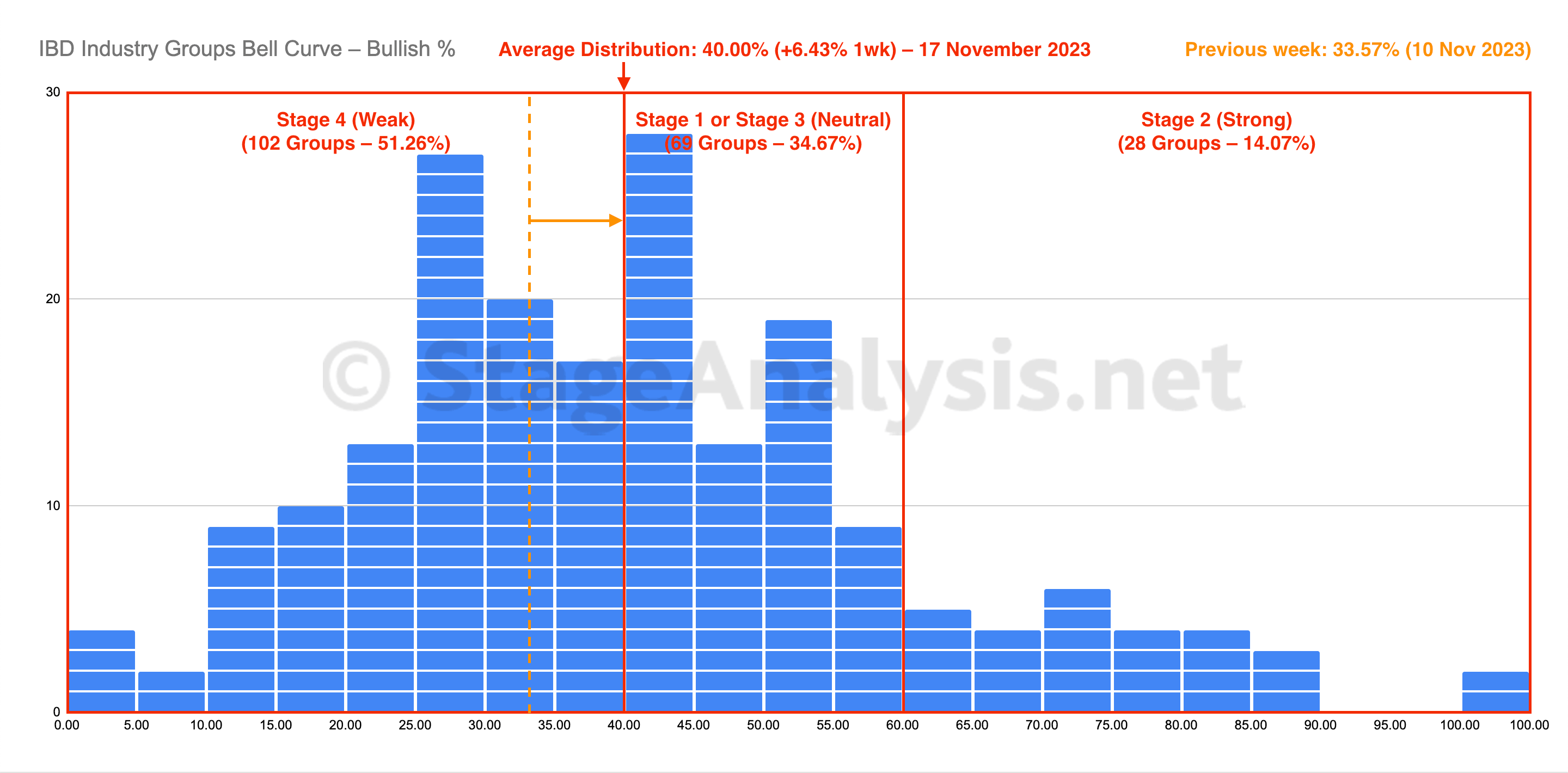

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve increased by +6.43% this week to finish at 40.00% overall. The amount of groups in Stage 4 (Weak) decreased by 34 (-17%), and the amount of groups in Stage 2 (Strong) increased by 10 (+5%), while the amount groups in Stage 1 or Stage 3 (Neutral) increased by 24 (+12%).

Read More

19 November, 2023

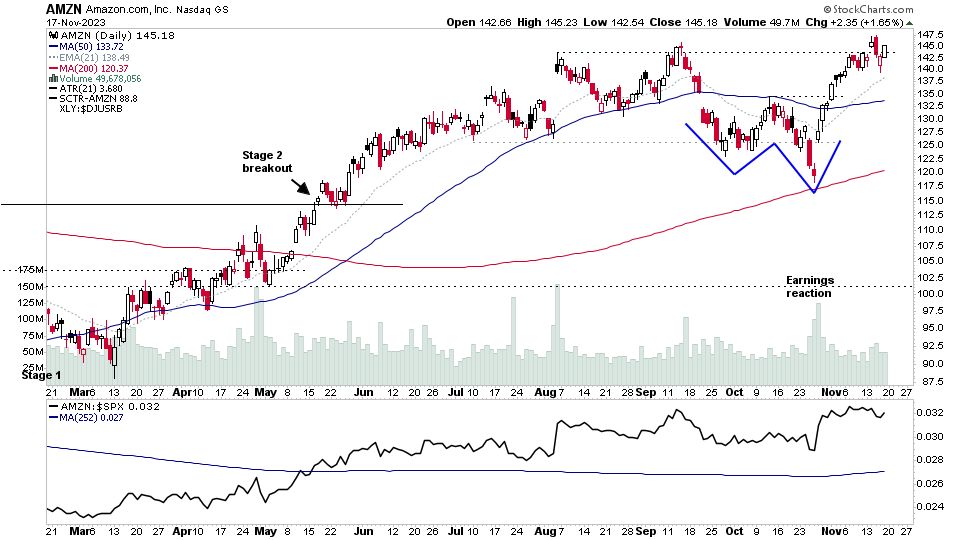

US Stocks Watchlist – 19 November 2023

There were 24 stocks highlighted from the US stocks watchlist scans today...

Read More

18 November, 2023

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

17 November, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More