There were 23 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

09 May, 2024

US Stocks Watchlist – 9 May 2024

08 May, 2024

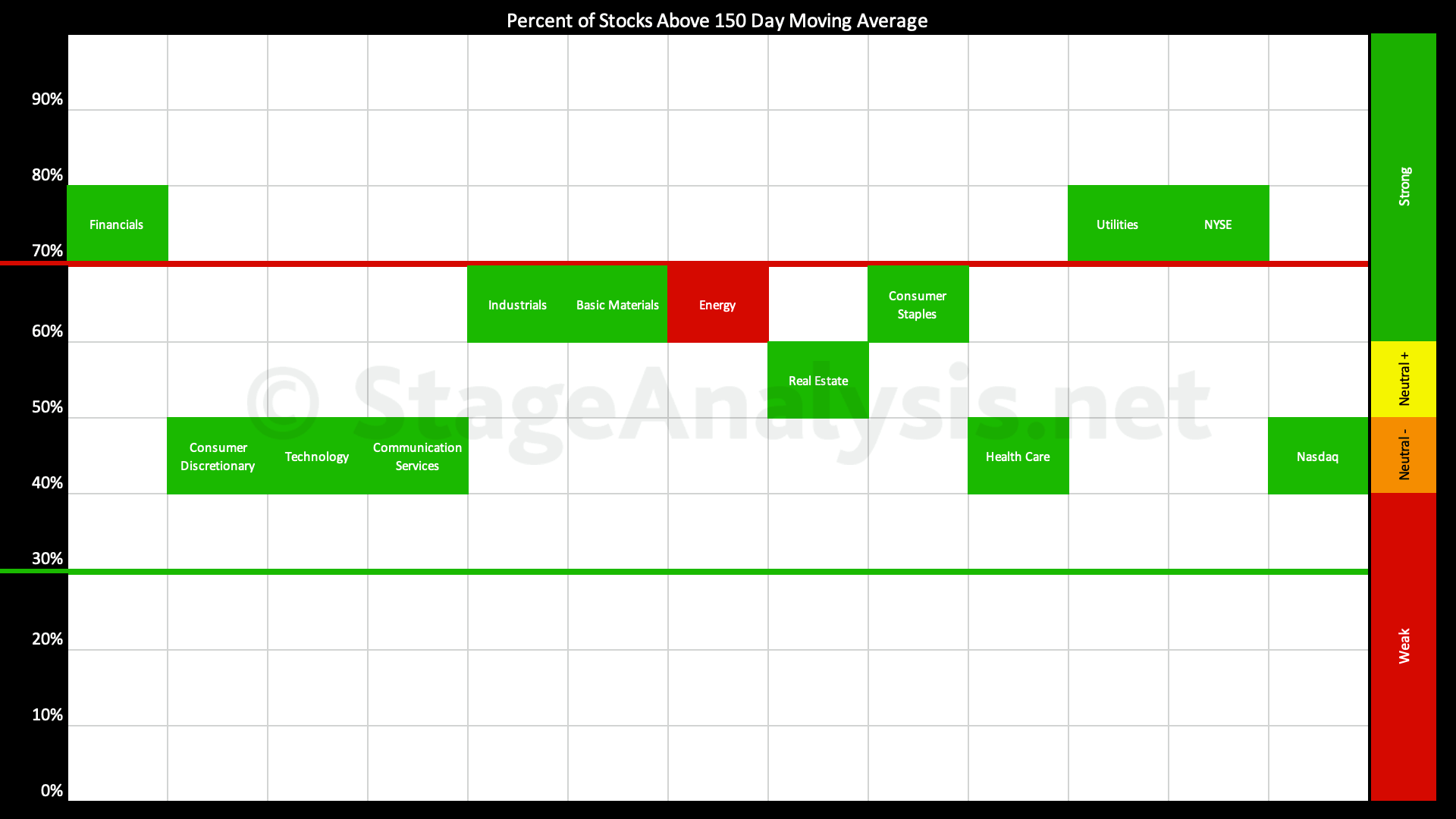

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day moving averages in the 11 major sectors increased by +5.93% since the previous post, moving the overall average to 60.00%, which is the lower edge of the Strong zone (60%+).

Read More

07 May, 2024

US Stocks Watchlist – 7 May 2024

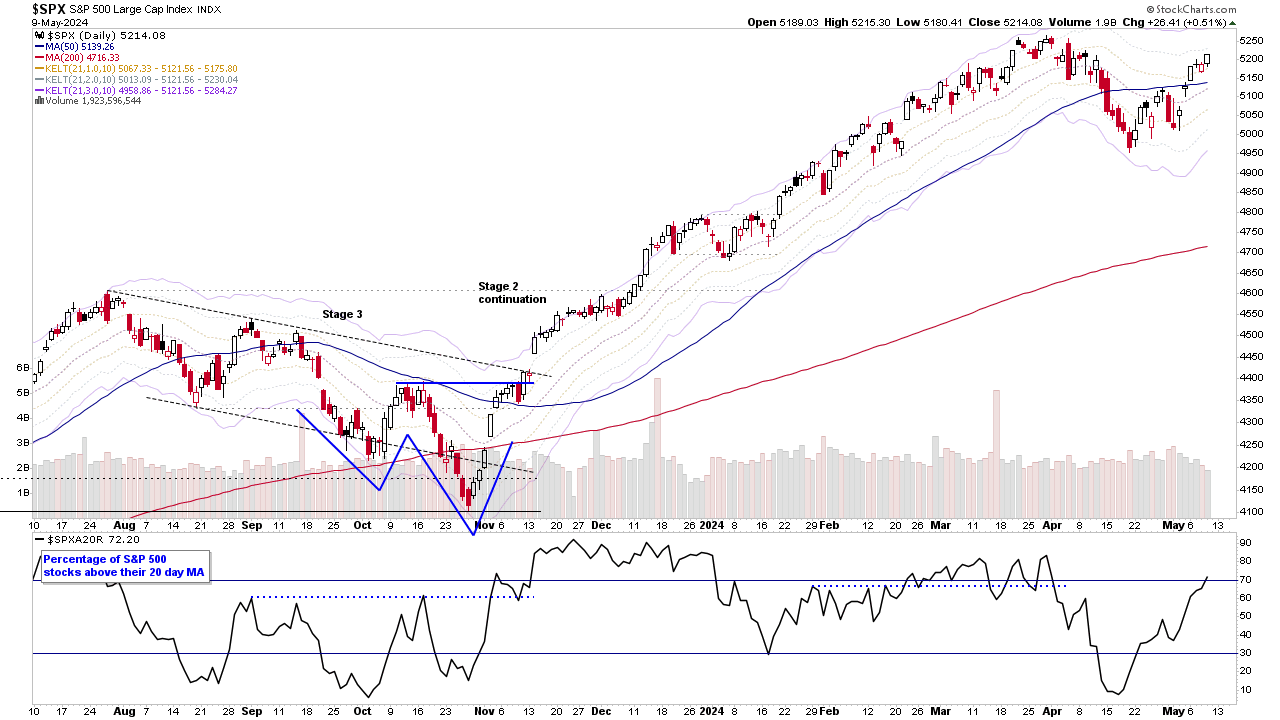

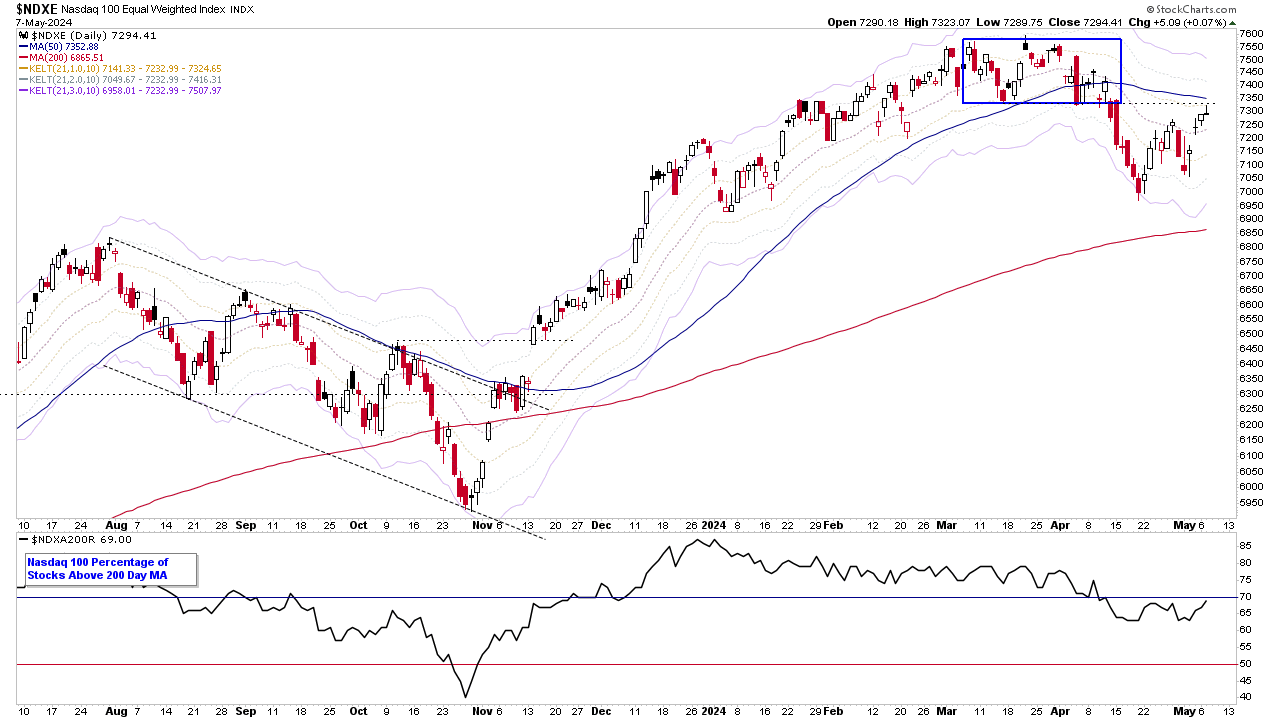

I've included the Equal Weighted version of the Nasdaq 100 in tonights post, as it's at pivotal point below its 50 day MA, and prior upper-range breakdown level from mid April. Plus, it gives a different perspective to the standard Nasdaq 100 chart, which moved above its own 50 day MA two days ago...

Read More

05 May, 2024

Stage Analysis Members Video – 5 May 2024 (47 mins)

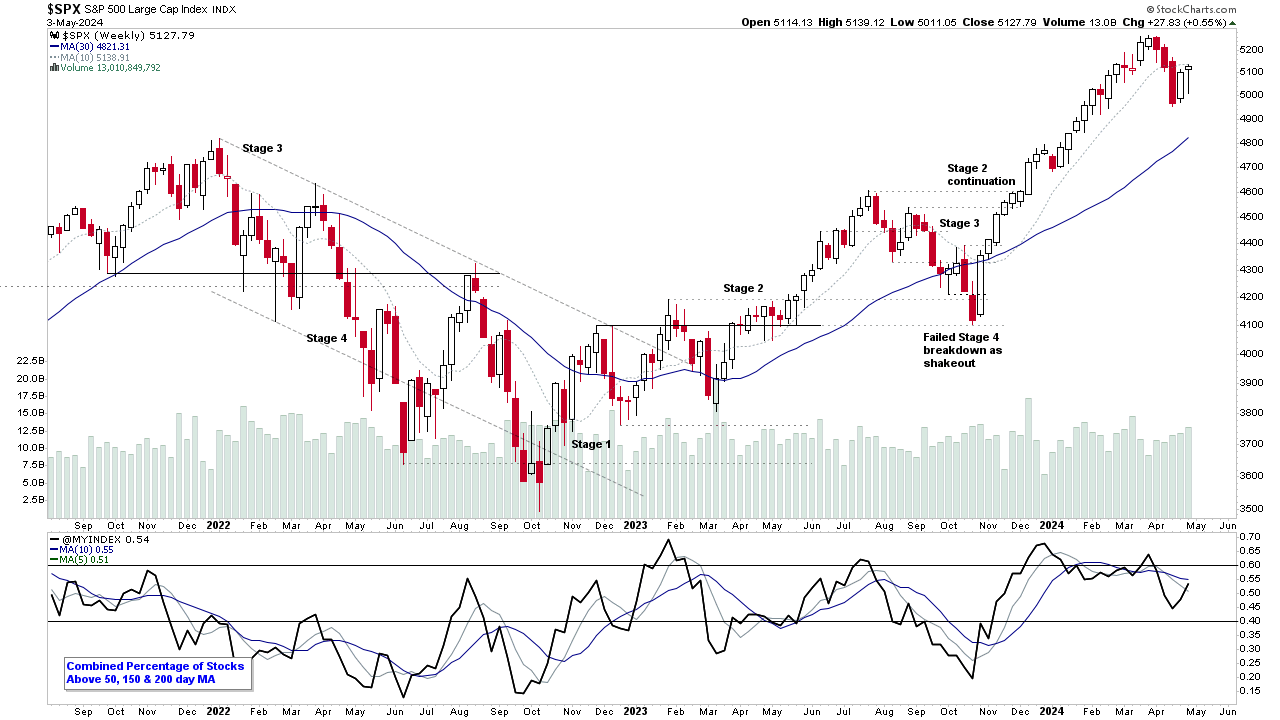

Stage Analysis members weekend video looking at the most recent US watchlist stocks, discussing the New Stage Analysis Screener options and changes to the Members section, the Industry Groups Relative Strength (RS) Rankings, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes.

Read More

05 May, 2024

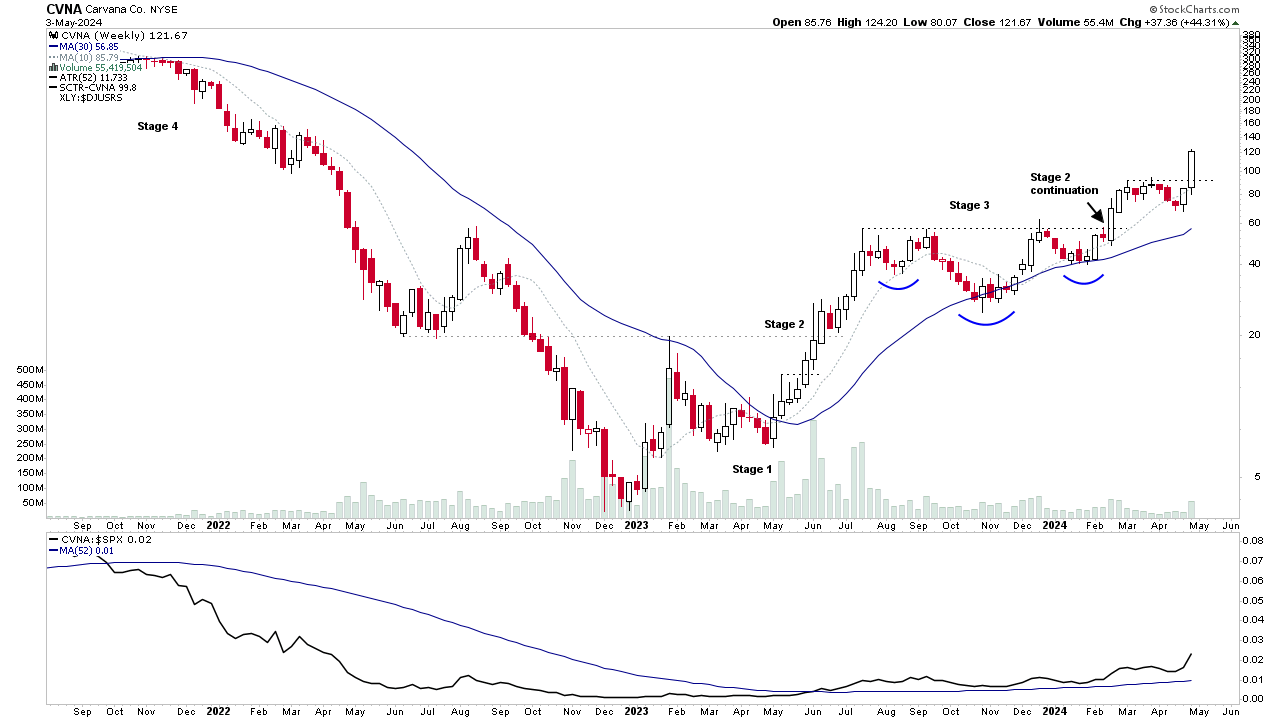

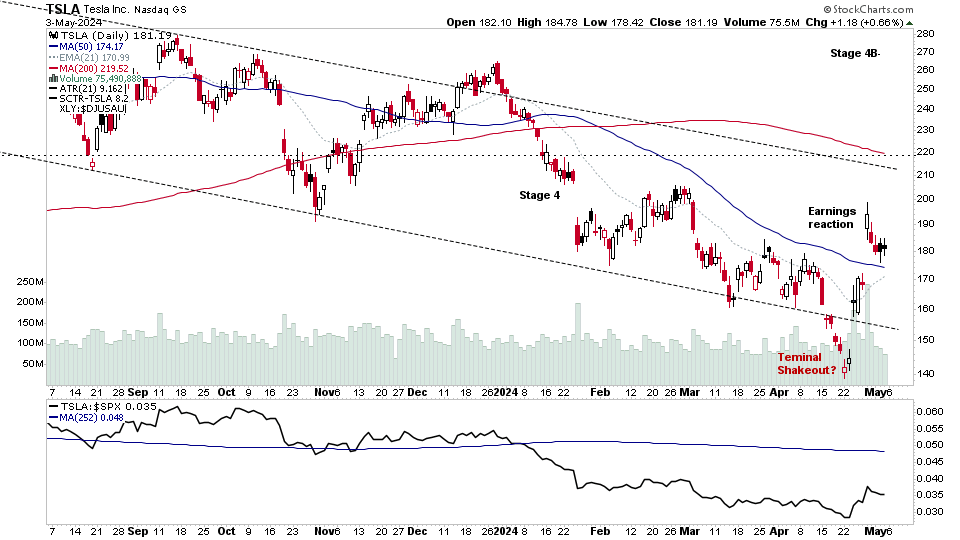

Video: Significant Weekly Bars – CVNA, ASPN, TMDX and More – 5 May 2024 (20mins)

Discussing some of the weeks biggest movers in Stage 2 including CVNA, ASPN, TMDX and more...

Read More

05 May, 2024

US Stocks Watchlist – 5 May 2024

There were 23 stocks highlighted from the US stocks watchlist scans today...

Read More

04 May, 2024

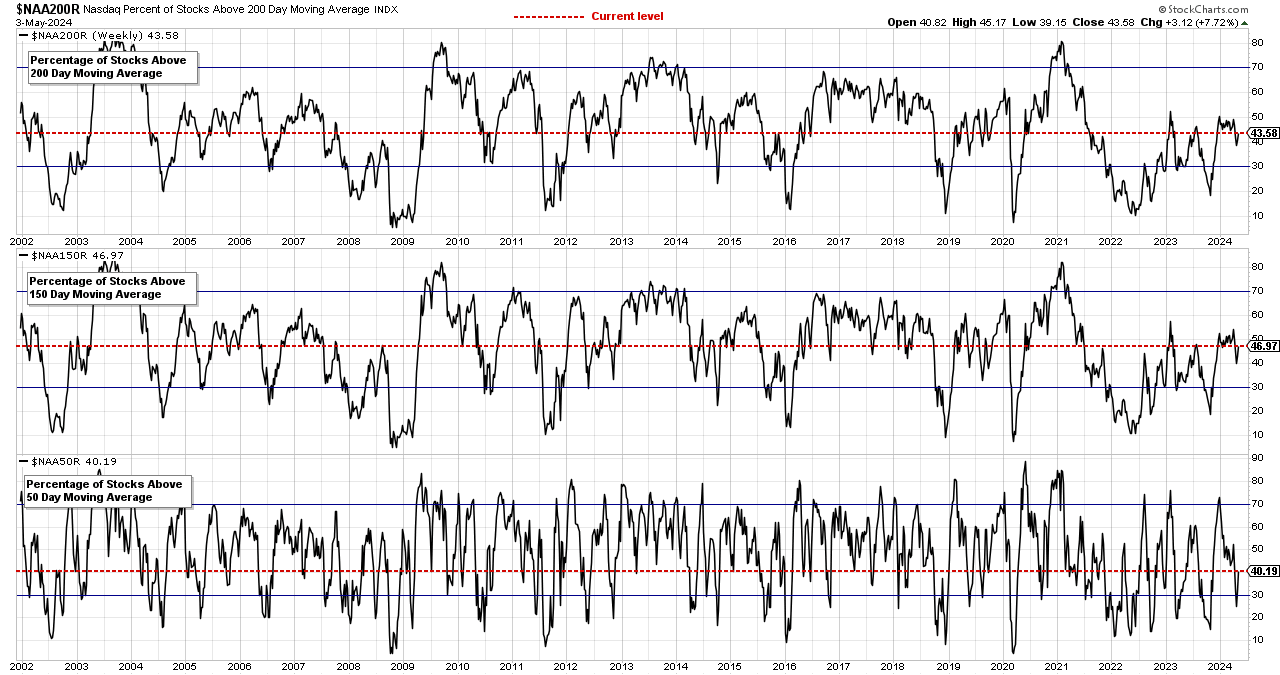

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom percentage of stocks above their 50 day, 150 day & 200 day moving averages combined market breadth charts for the overall US market, NYSE and Nasdaq for market timing and strategy...

Read More

03 May, 2024

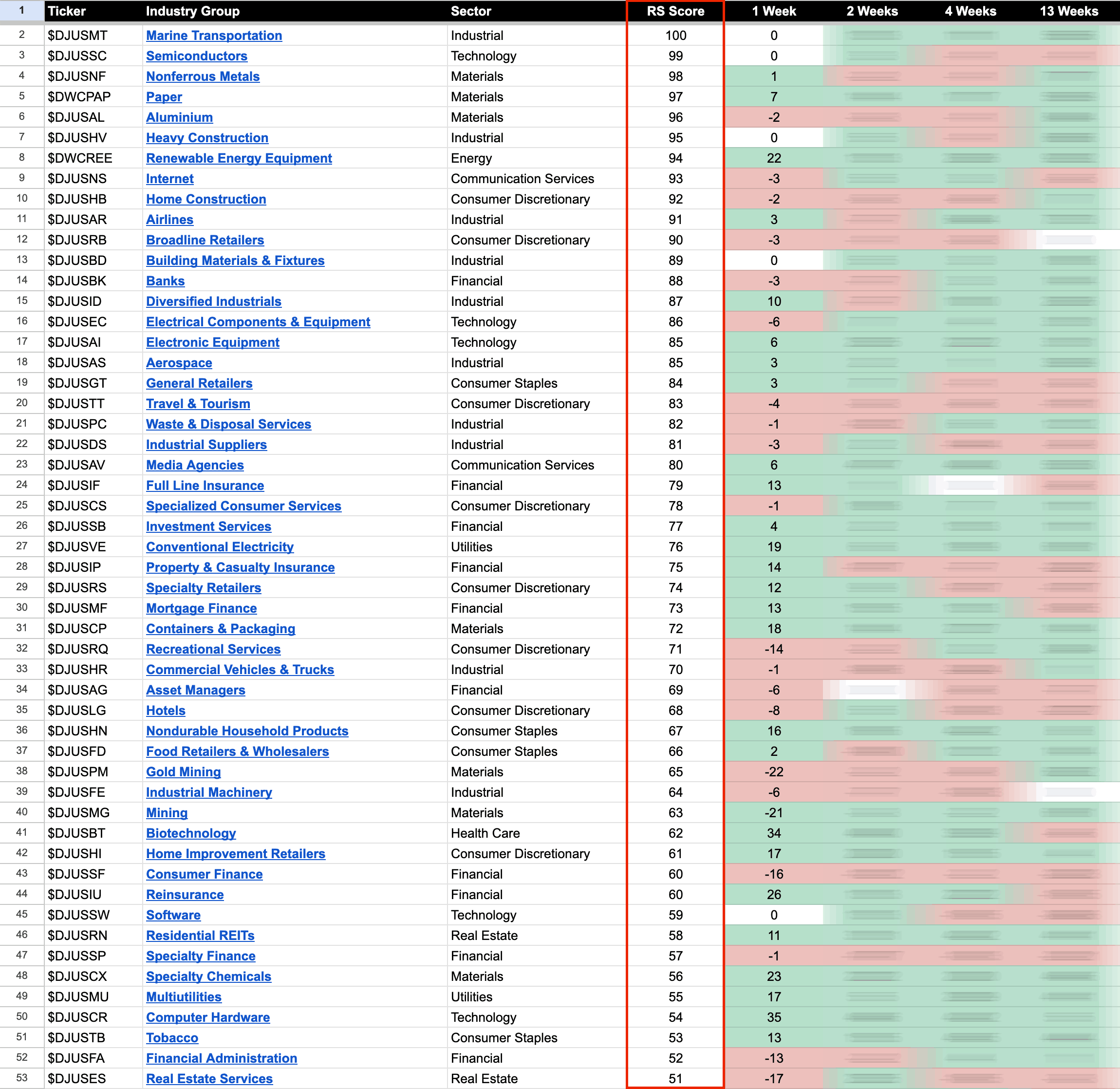

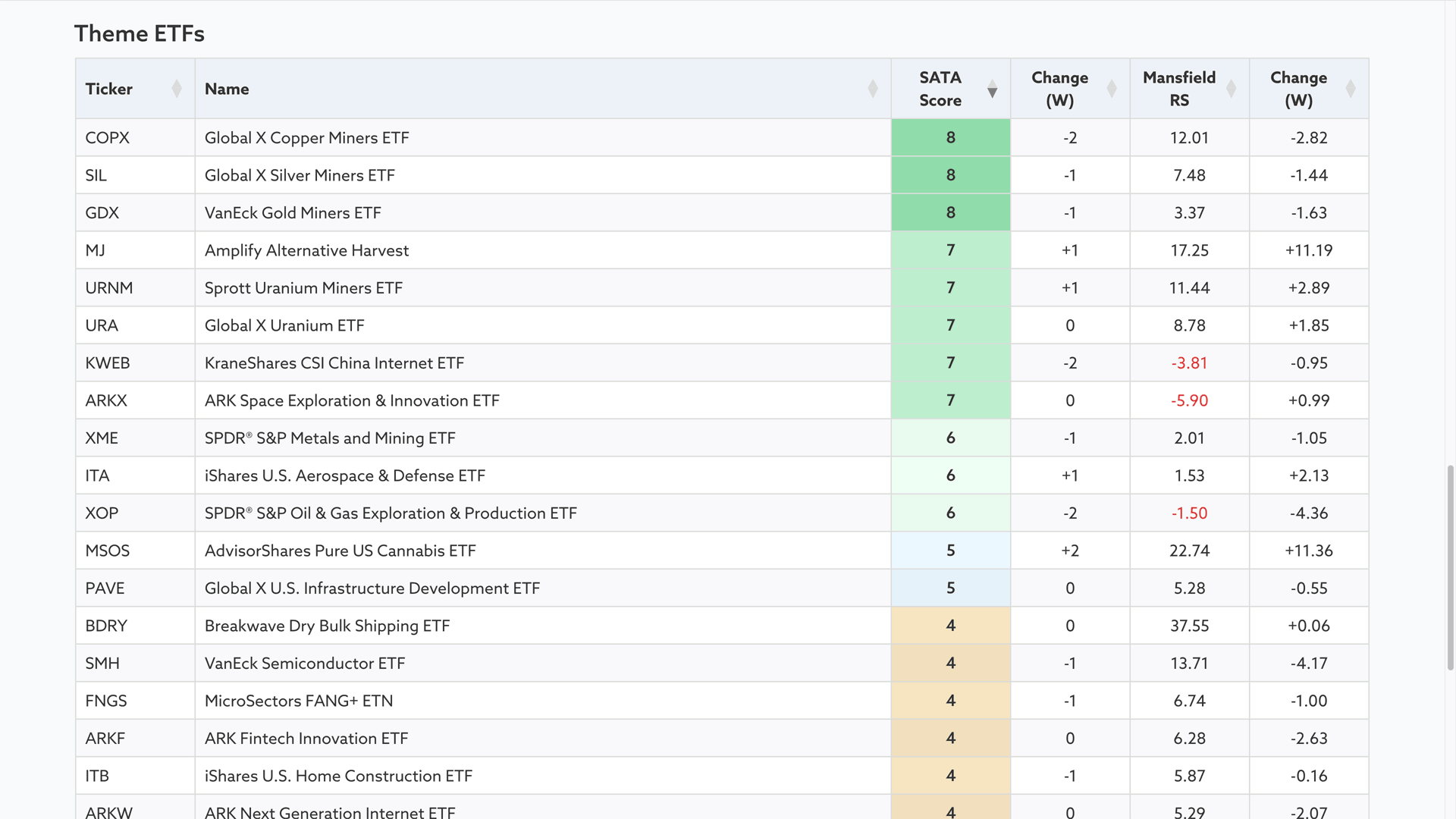

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

02 May, 2024

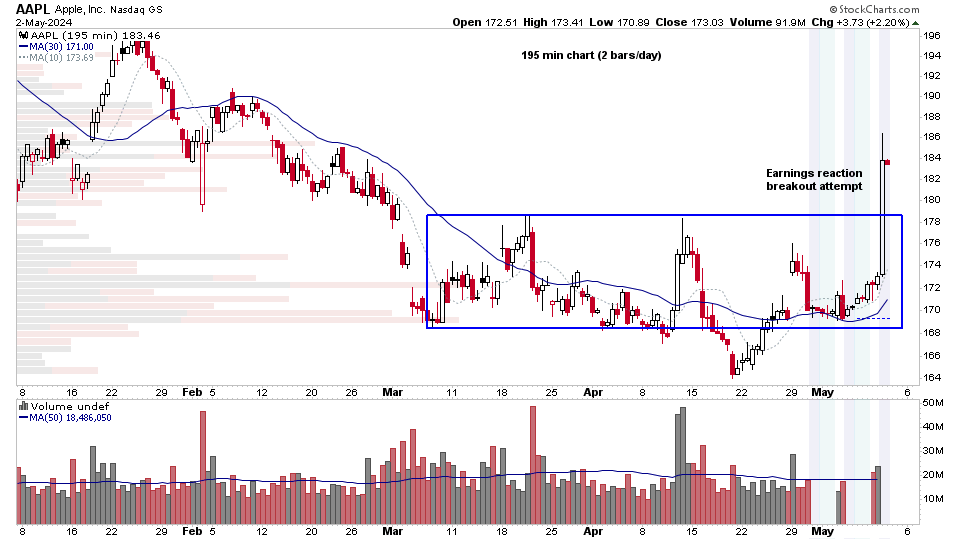

US Stocks Watchlist – 2 May 2024

There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

01 May, 2024

Video: New Features – 1 May 2024 (25mins)

Video discussing more of the new features added in the last week to the Stage Analysis website...

Read More