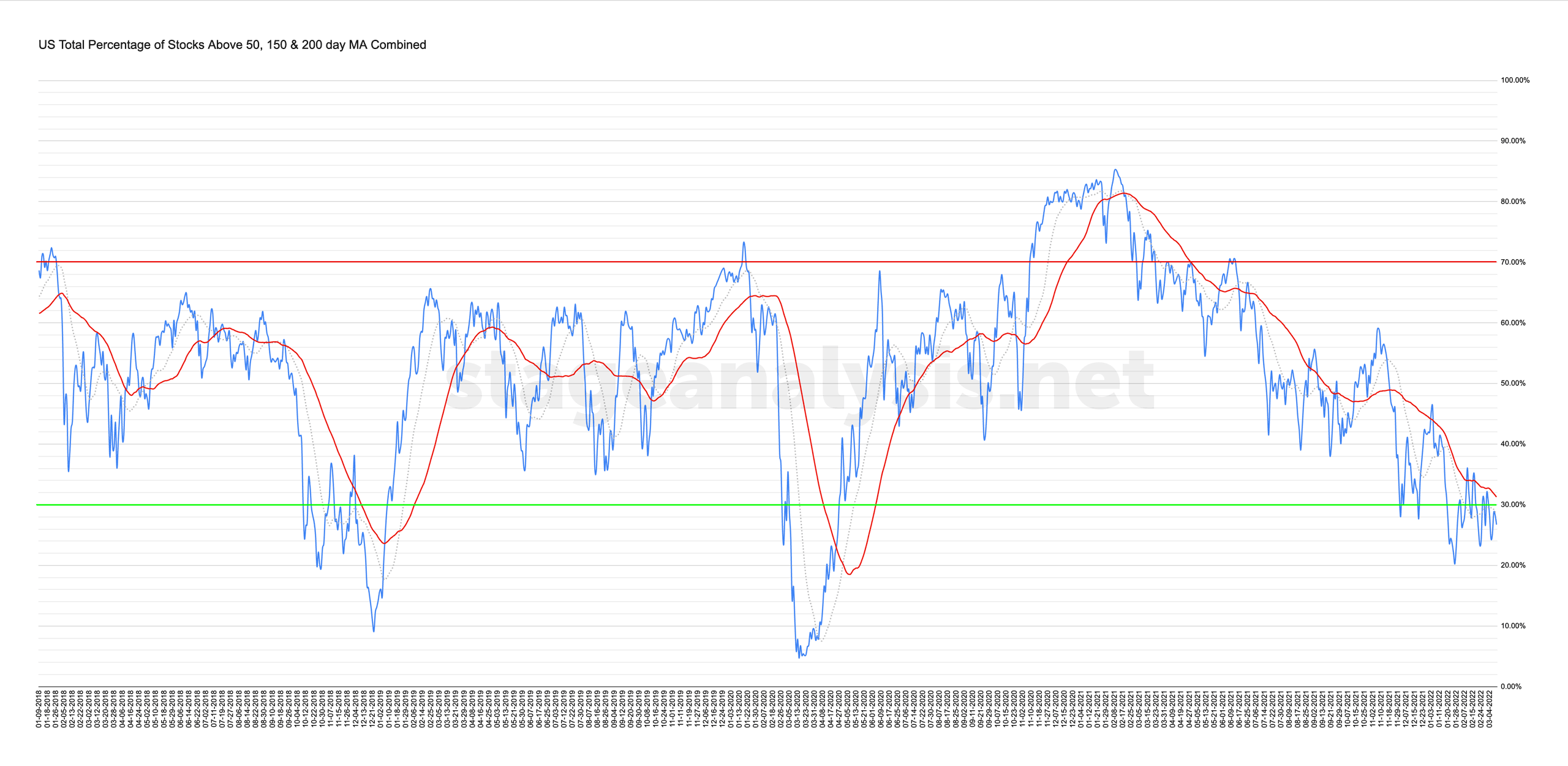

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

10 March, 2022

US Stocks Watchlist - 10 March 2022

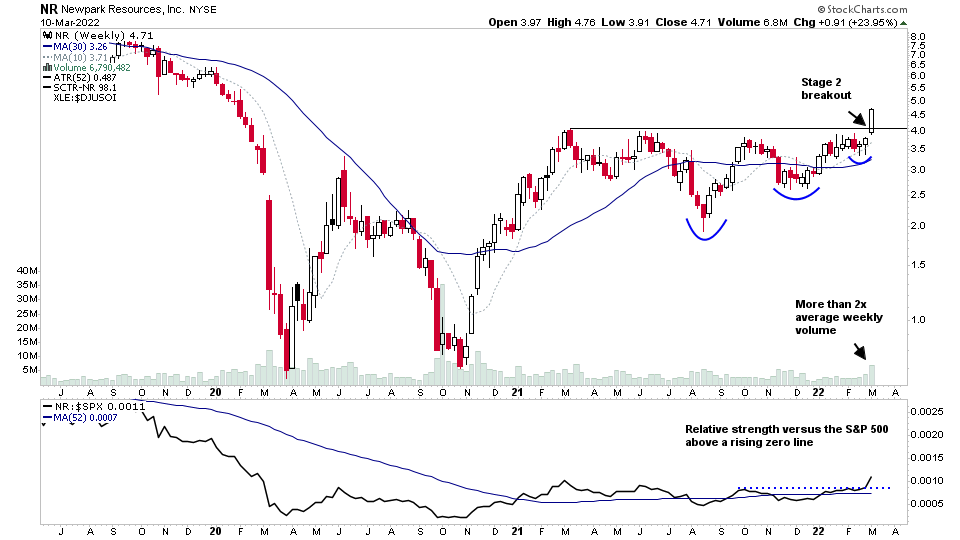

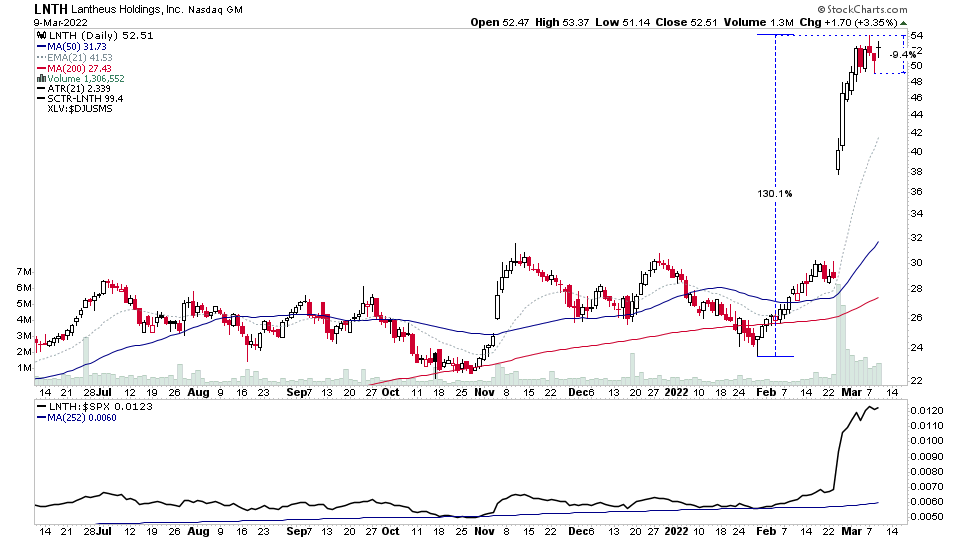

I talked in yesterdays members video about the constructive pullbacks in the strong RS groups and highlighted some group themes in Coal, the Oil Groups, Aluminium, Gold Mining, Uranium, Non Ferrous Metals, Fertilisers / Potash, Steel and a few others...

Read More

09 March, 2022

Stage Analysis Members Midweek Video - 9 March 2022

Members midweek video covering the market and watchlist stocks...

Read More

09 March, 2022

US Stocks Watchlist - 9 March 2022

Todays watchlist had a number of group themes, but the overall theme was pullbacks in strong RS groups which I talk about in the midweek video...

Read More

08 March, 2022

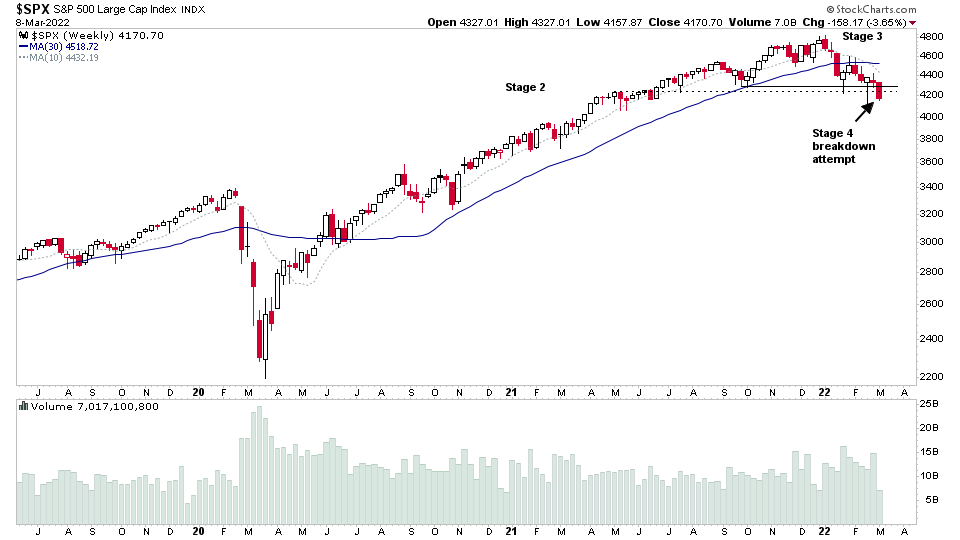

Major Indexes Attempting to Breakdown into Stage 4 and US Stocks Watchlist - 8 March 2022

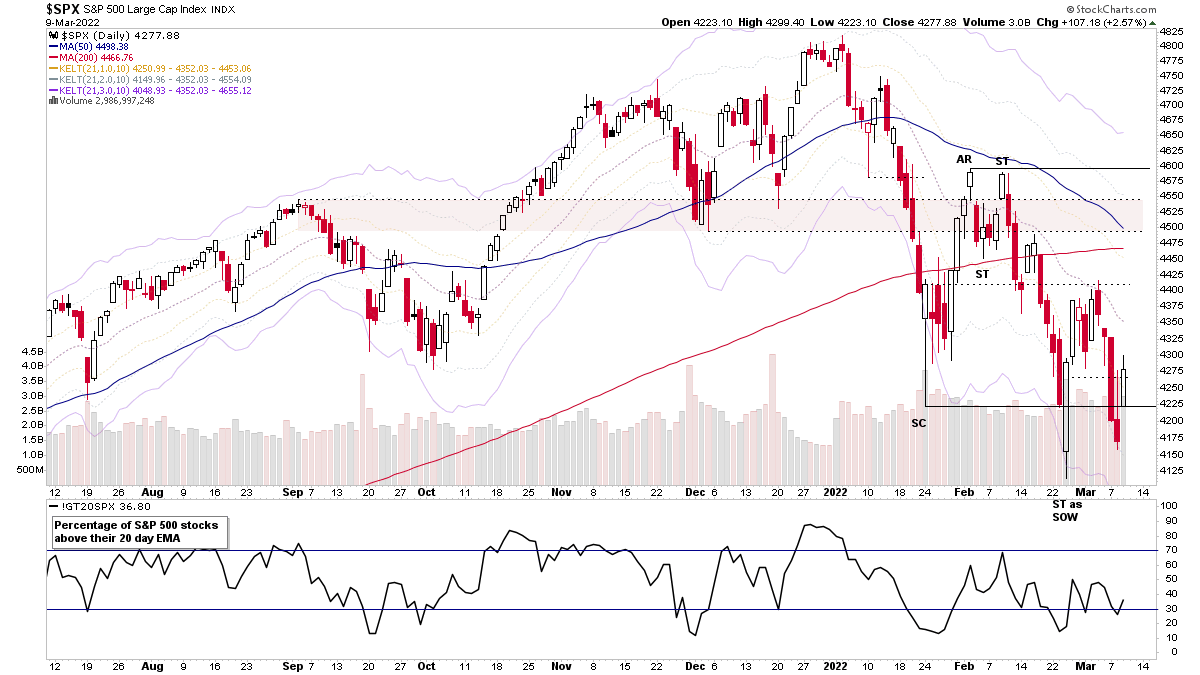

Stocks attempted to rally intraday, but it faded into the close with the major indexes all moving back down towards the recent 24 February low, and so looking through the weekly charts of the S&P 500, NYSE, Nasdaq Composite and Nasdaq 100; they are all making potential Stage 4 breakdown attempts. So a pivotal point for the US markets this week.

Read More

07 March, 2022

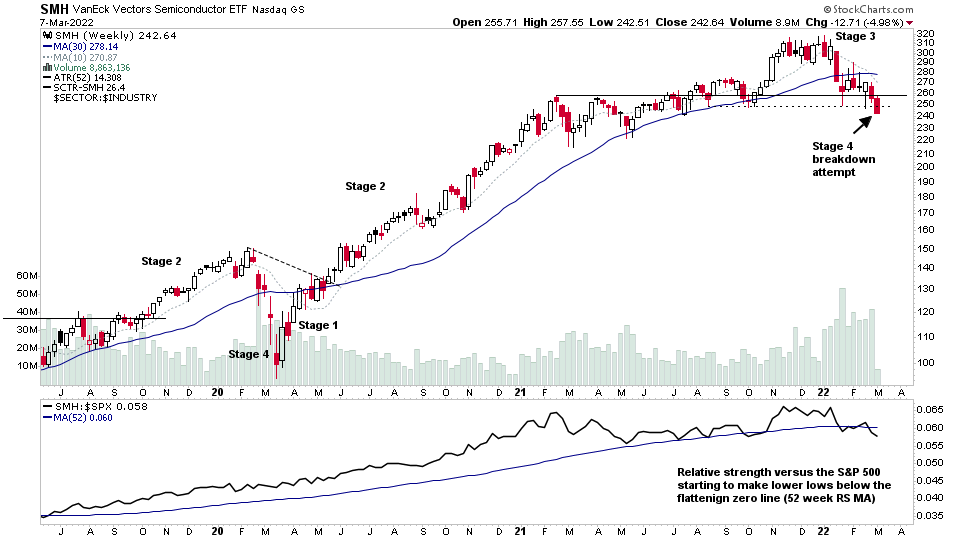

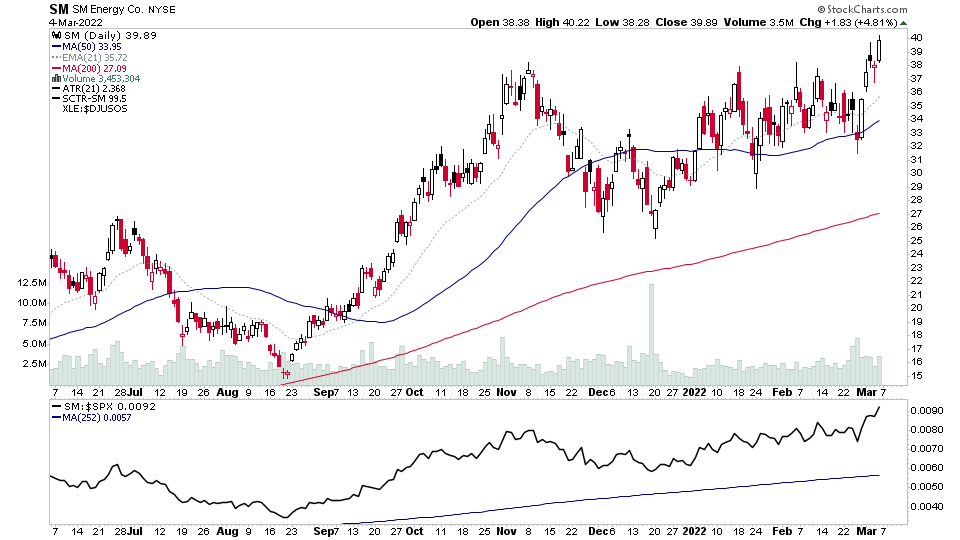

Semiconductors Stage 4 Breakdown Attempt and US Stocks Watchlist - 7 March 2022

There were 20 stocks for the US stocks watchlist today. Here's a small sample from the list: EGLE, GDXJ, TS, USER + 16 more...

Read More

06 March, 2022

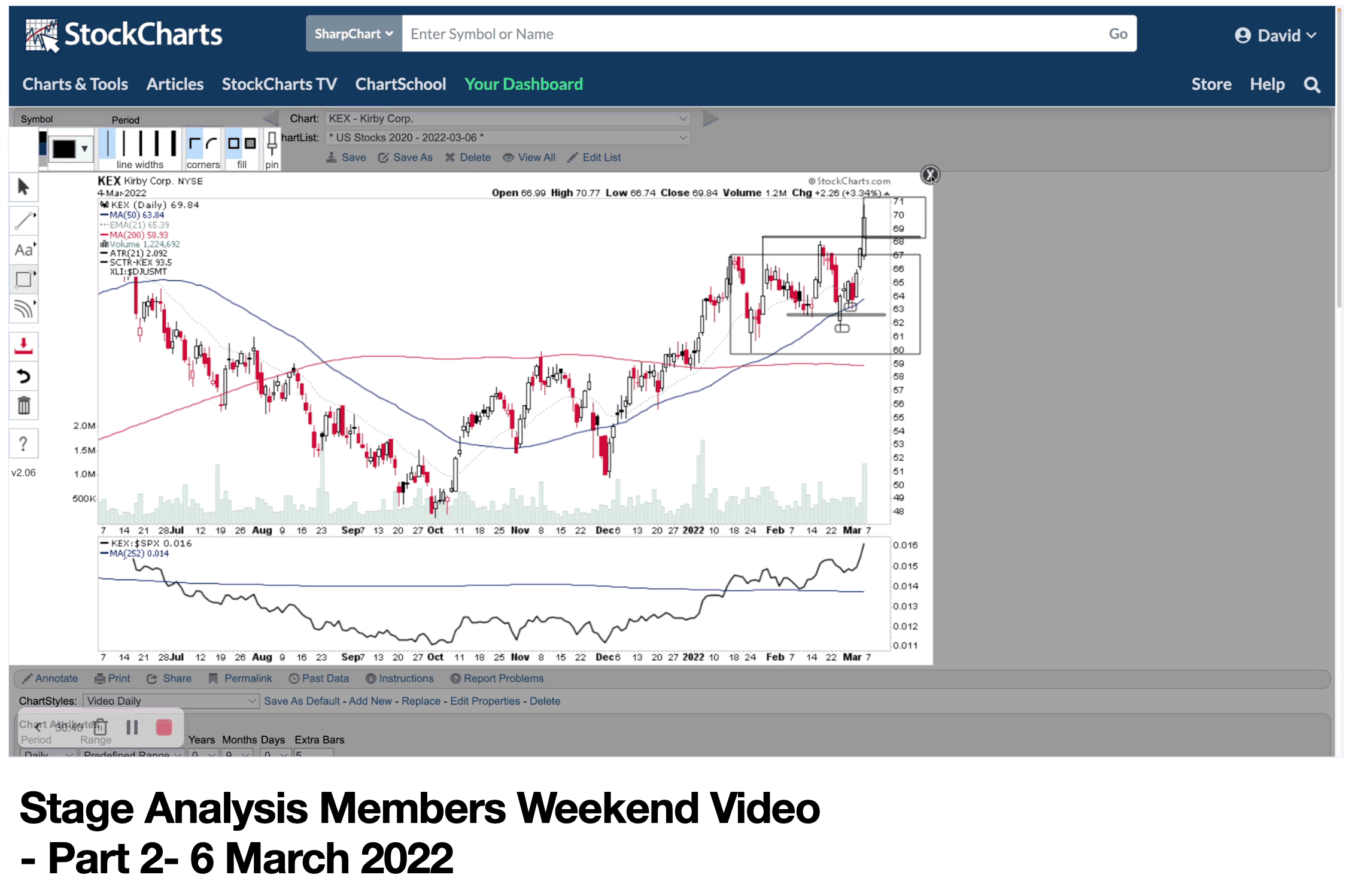

Stage Analysis Members Weekend Video - Part 2 - 6 March 2022

US Stocks Watchlist in detail. Marked up charts of the price and volume action that I'm looking for in the watchlist stocks.

Read More

06 March, 2022

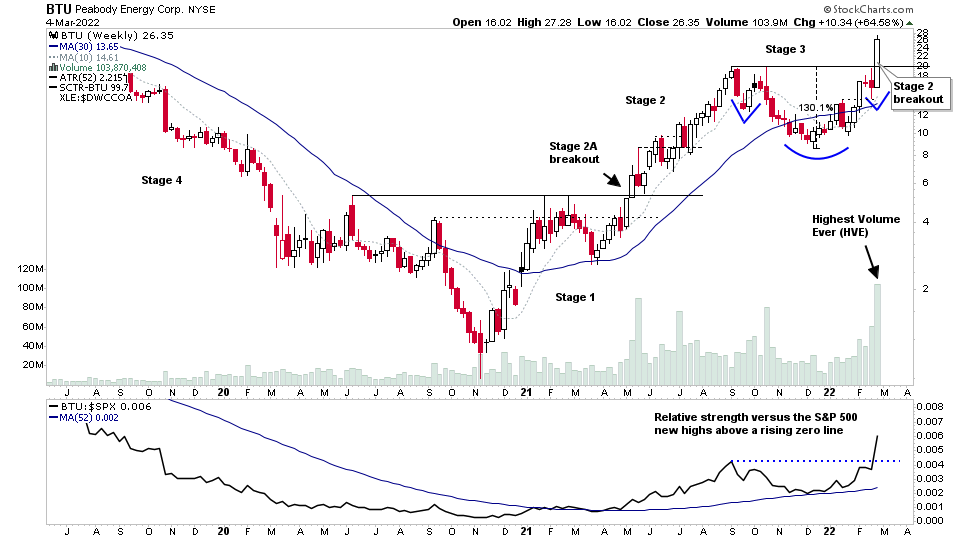

Stage Analysis Members Weekend Video - Part 1 - 6 March 2022

Stage Analysis Members Video covering - BTU Stage 2 Breakout Analysis and Targets. Group Focus on Coal, Defense, Cybersecurity. Major Indexes review: i.e. S&P 500, Nasdaq, Russell 2000 and more Market Breadth Update to Determine the Current Weight of Evidence

Read More

06 March, 2022

US Stocks Watchlist - 6 March 2022

A number of group themes showing up in the watchlist scans this weekend - Aluminium, Coal, Defense, Gold Mining, Nonferrous Metals, Exploration & Production...

Read More

05 March, 2022

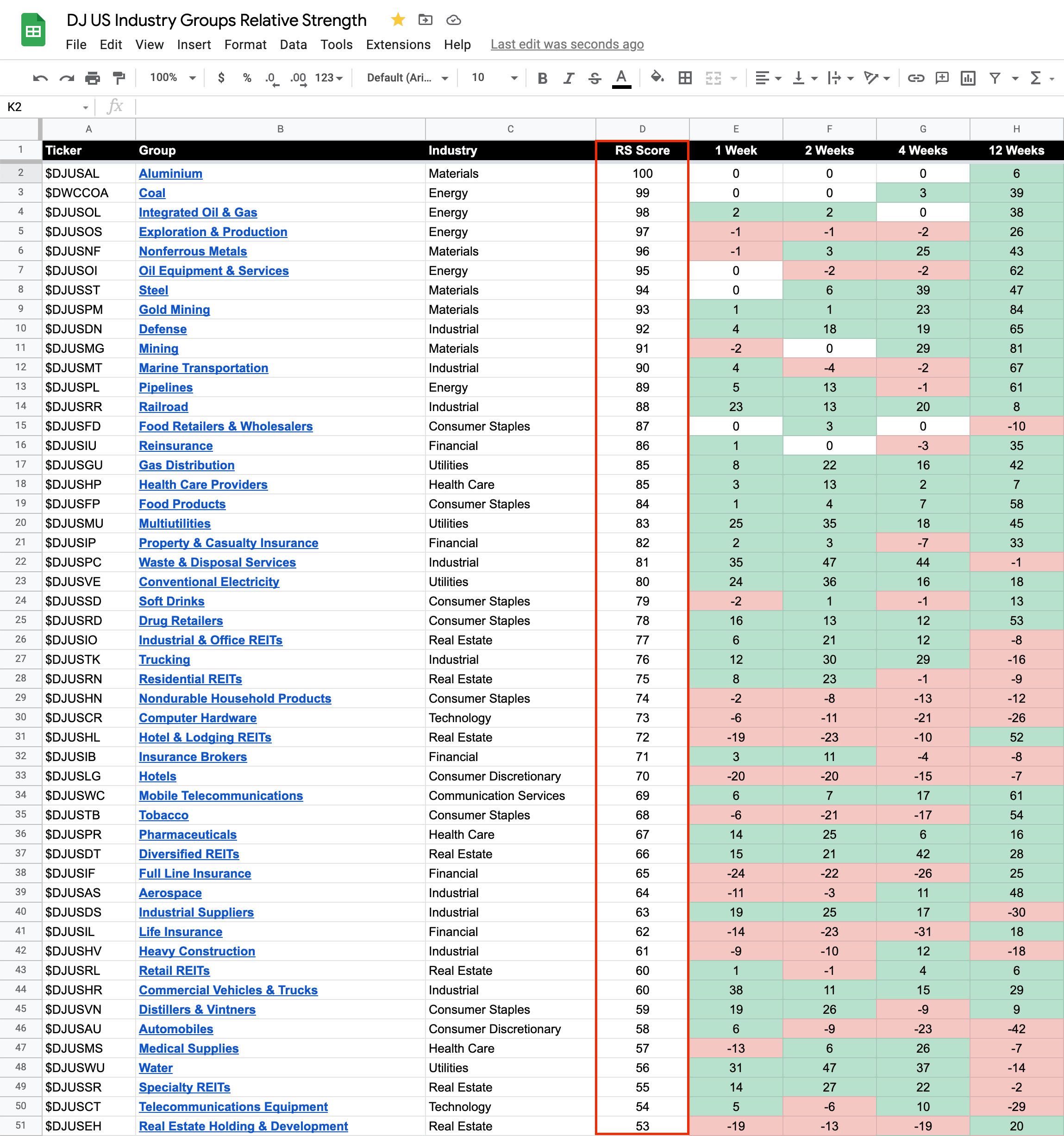

104 Dow Jones Industry Groups sorted by Relative Strength

The purpose of the RS tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More