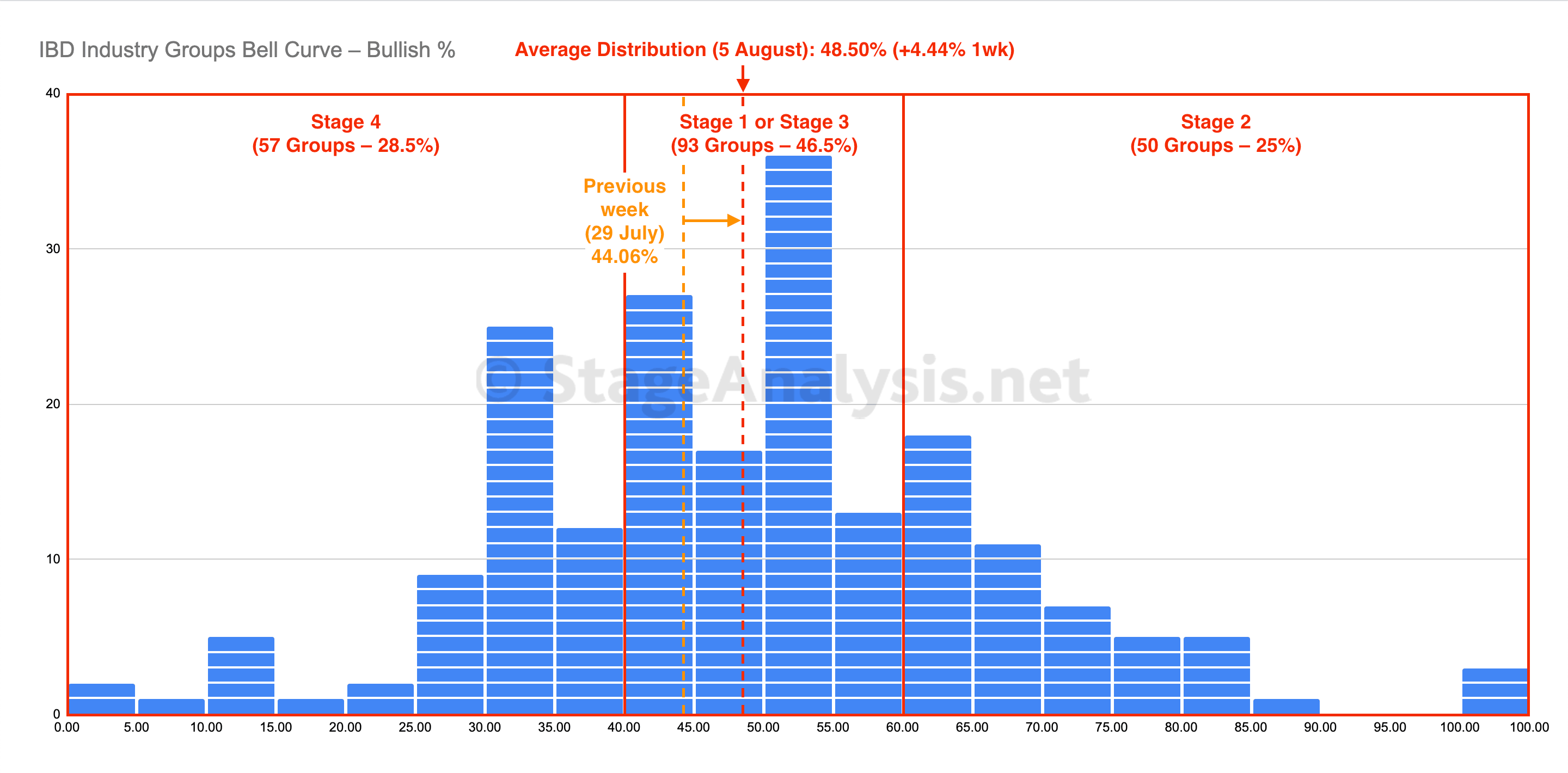

The IBD Industry Groups Bell Curve – Bullish Percent further improved over the last week, moving further into the Stage 1 zone (40% to 60% range), with an additional +10.5% of groups moving out of the Stage 4 zone (below 40%), and an additional +8% of groups moving into the Stage 2 zone (above 60%)...

Read More

Blog

06 August, 2022

IBD Industry Groups Bell Curve – Bullish Percent

06 August, 2022

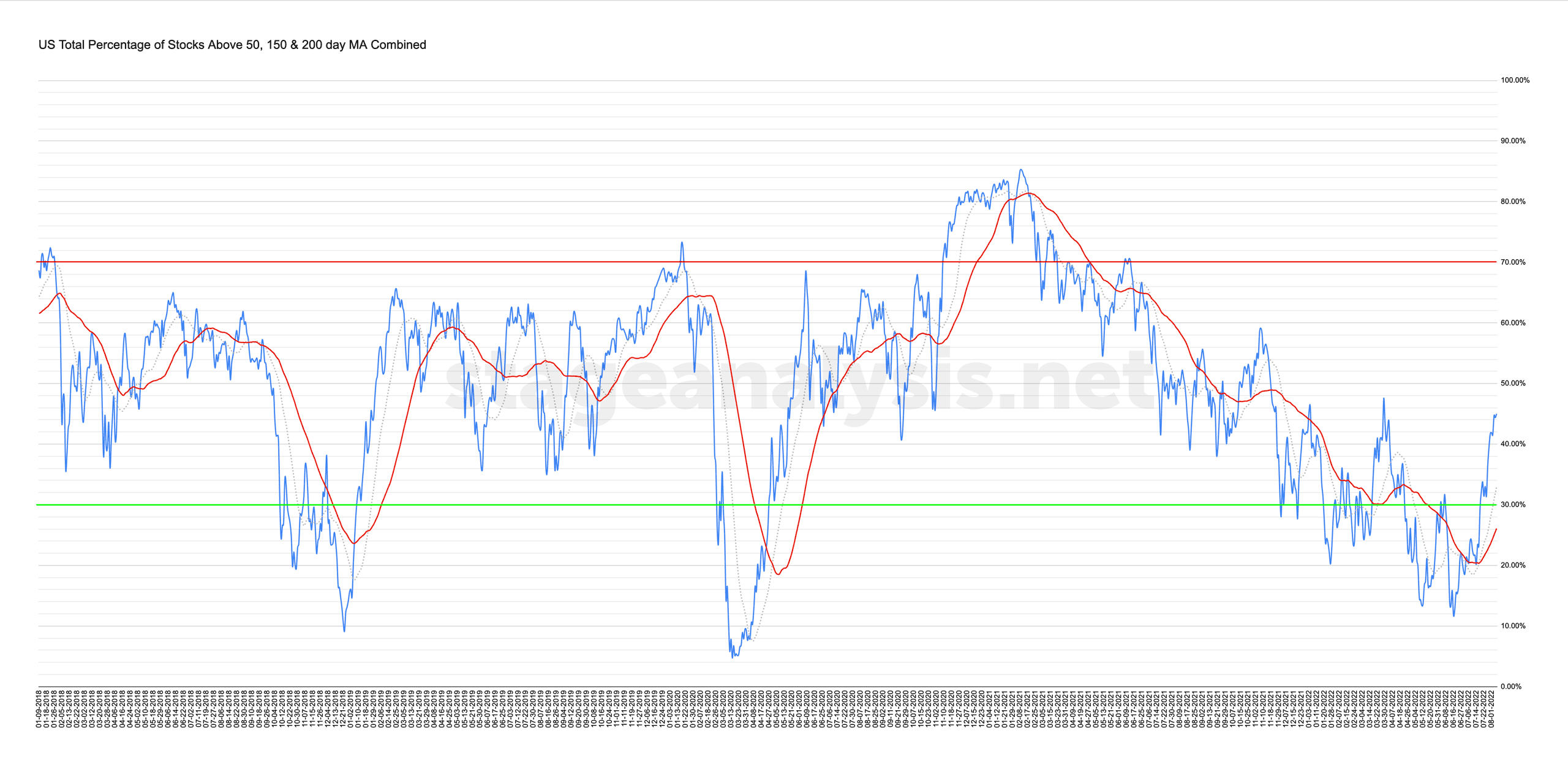

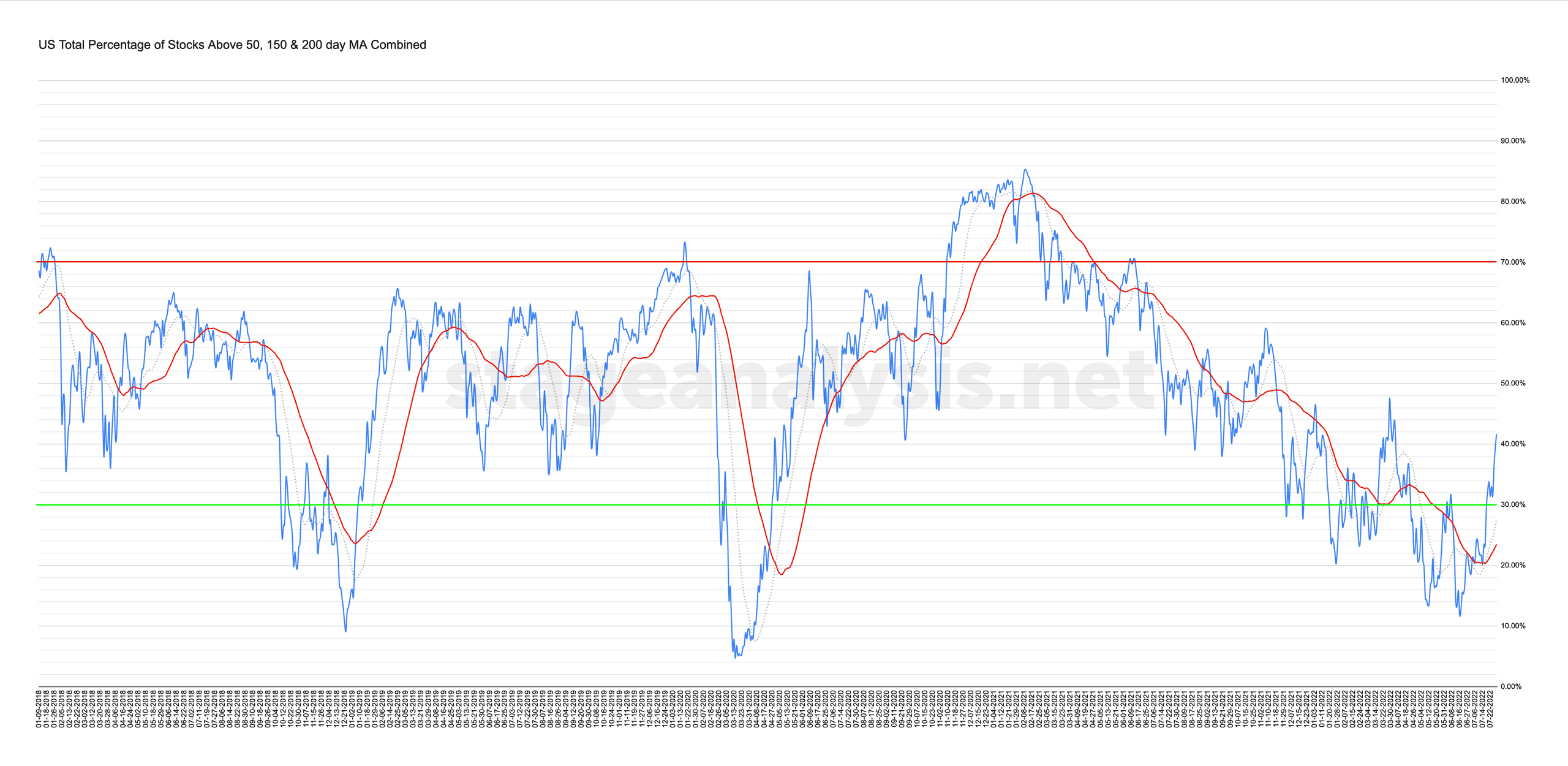

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

05 August, 2022

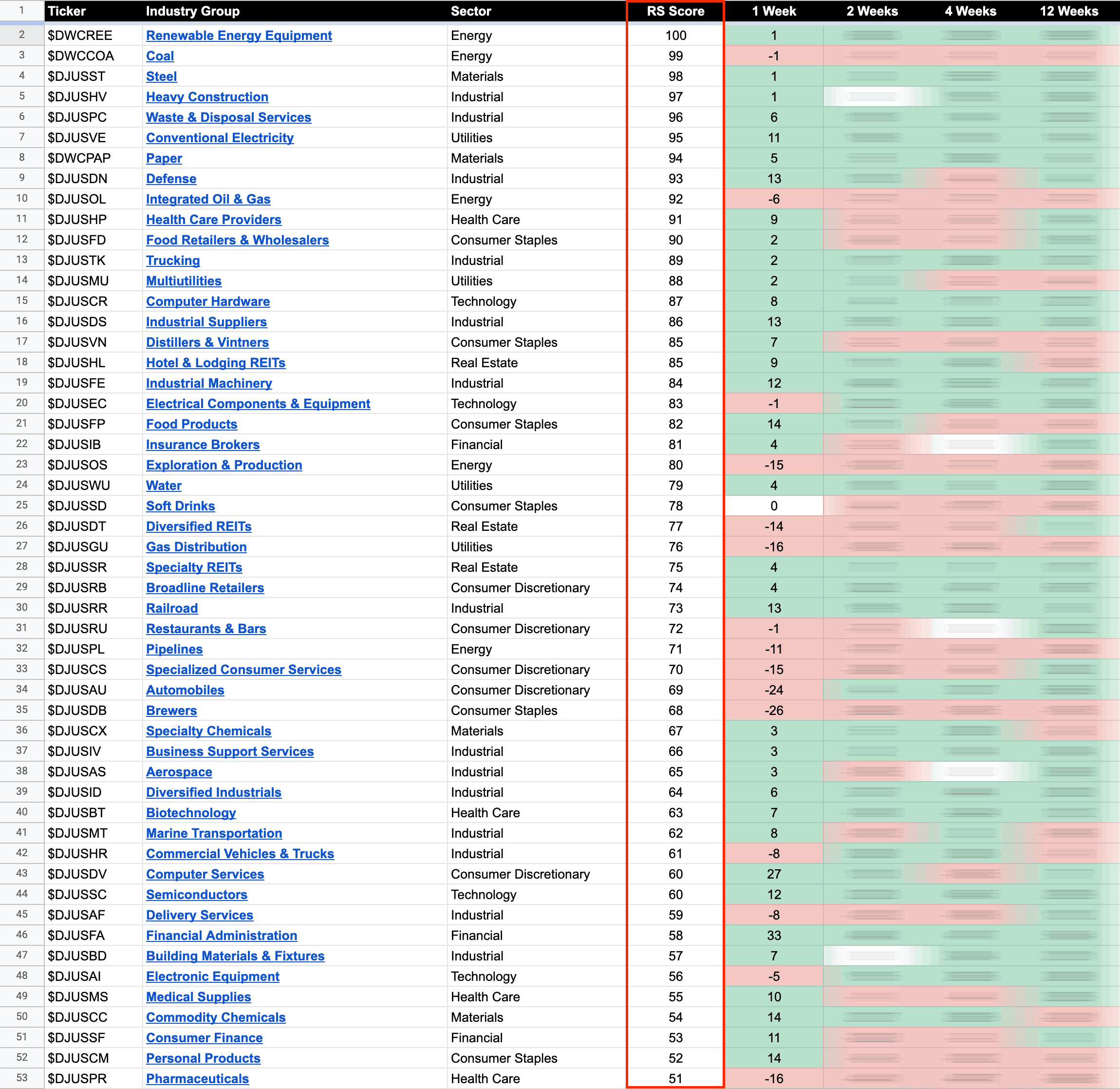

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

05 August, 2022

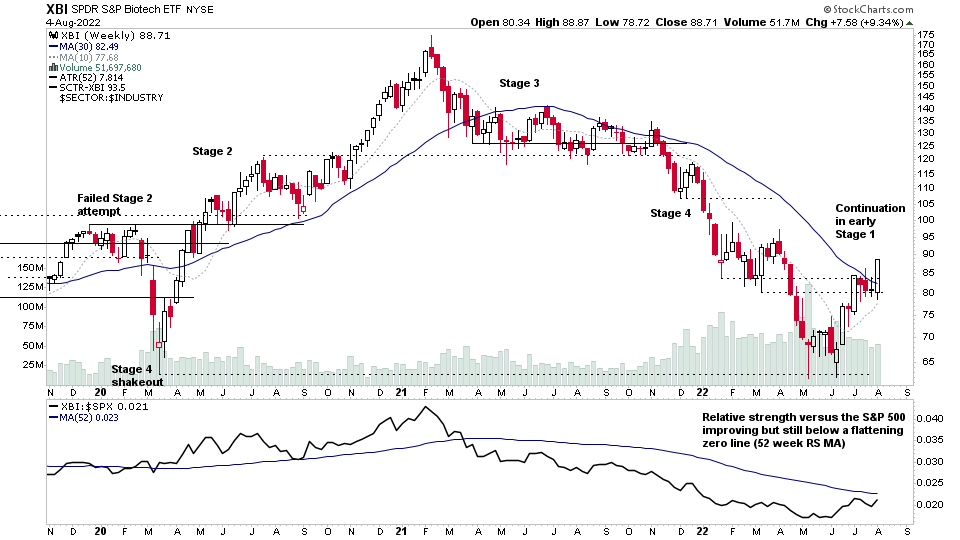

Biotech and Solar Stocks Continue To Be In-Focus and the US Stocks Watchlist – 4 August 2022

Biotechnology stocks group ETFs (XBI and IBB) made a continuation breakout today after a three week consolidation / shallow pullback within their early weekly Stage 1 advance – which has been one of the strongest group moves since the markets June swing low...

Read More

04 August, 2022

US Stocks Watchlist – 3 August 2022

For the watchlist from Wednesdays scans...

Read More

02 August, 2022

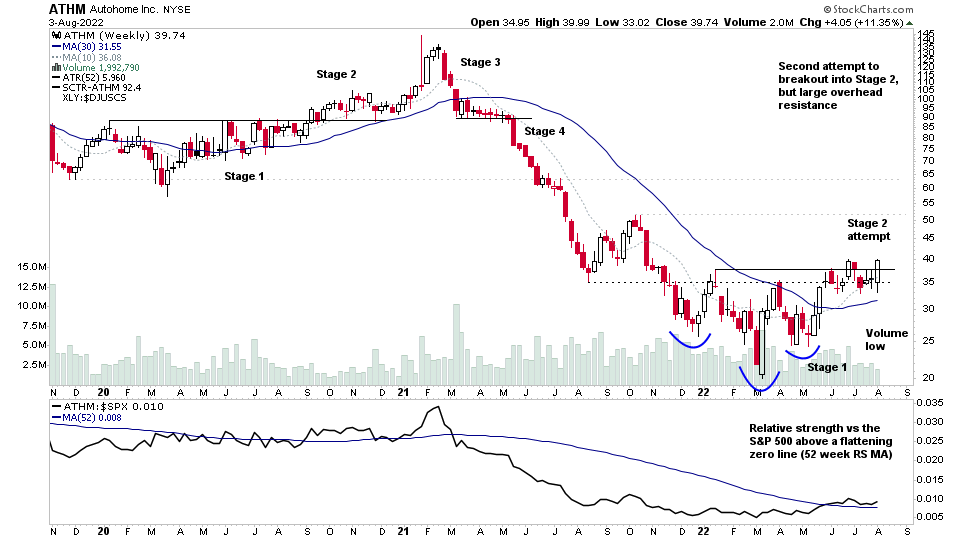

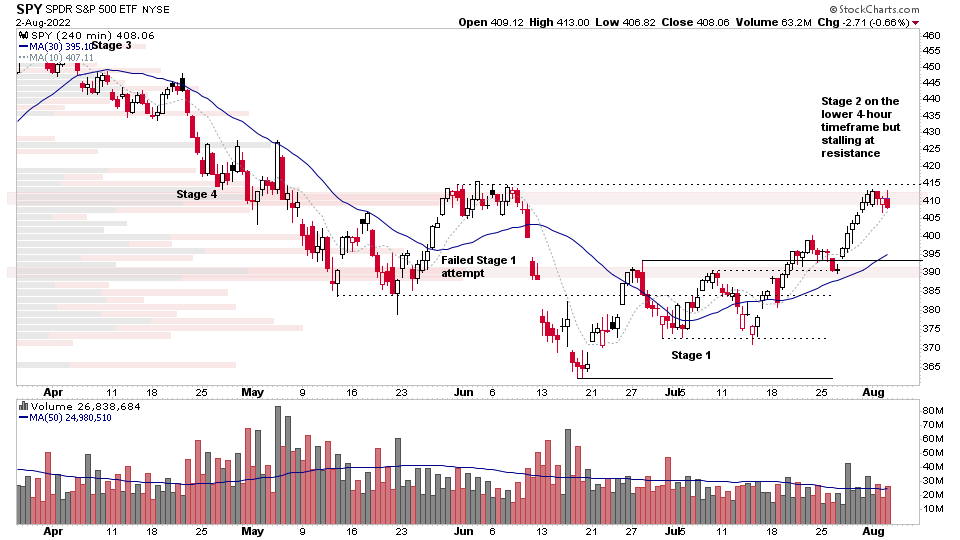

Stock Market Update and US Stocks Watchlist – 2 August 2022

It was a negative day for all the major US stock market indexes today with the S&P 500 closing down -0.67%, while the Nasdaq showed the best relative strength closing down -0.16%...

Read More

31 July, 2022

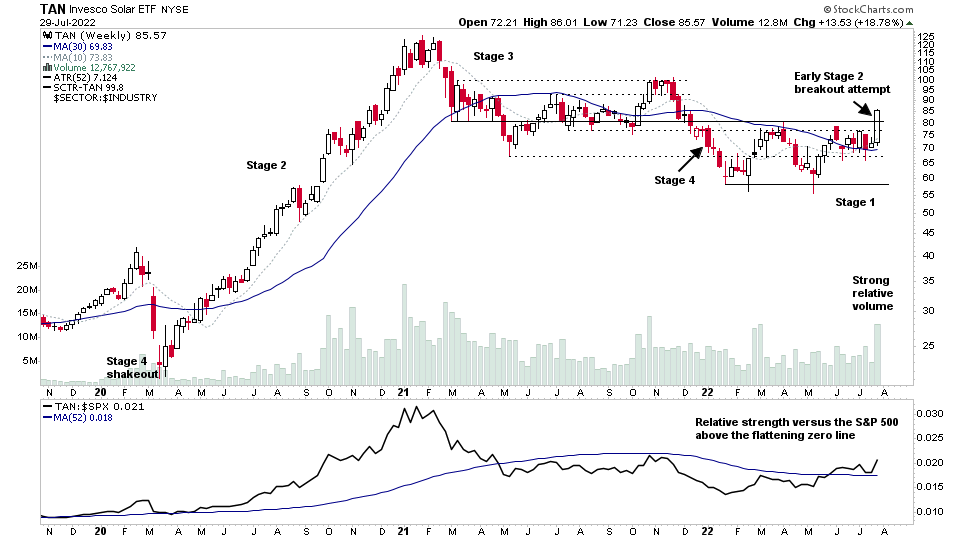

Stage Analysis Members Weekend Video – 31 July 2022 (1hr 36mins)

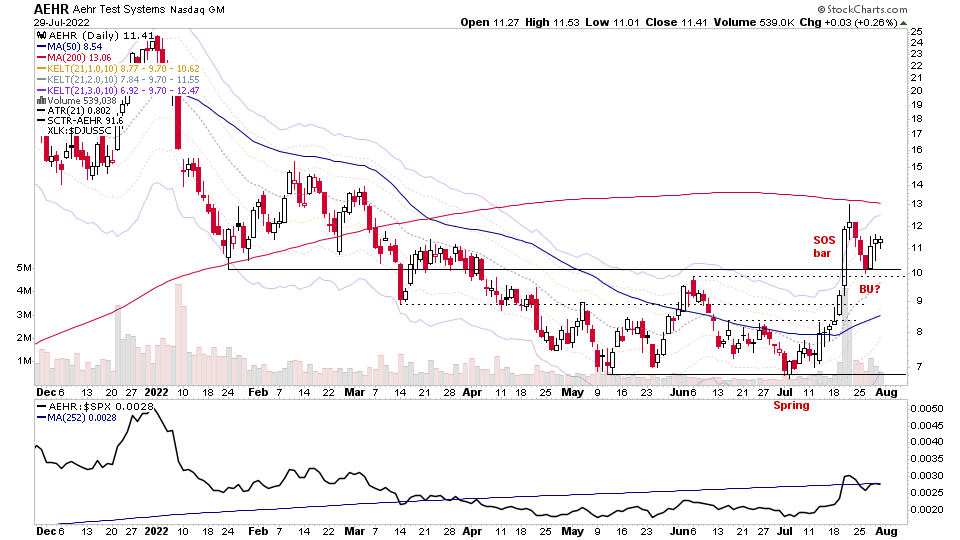

The Stage Analysis members weekend video begins with a focus on the Solar Group following this weeks climate spending deal, plus earnings results in multiple stocks in the group which caused a Stage 2 breakout attempt in the group on strong relative volume...

Read More

31 July, 2022

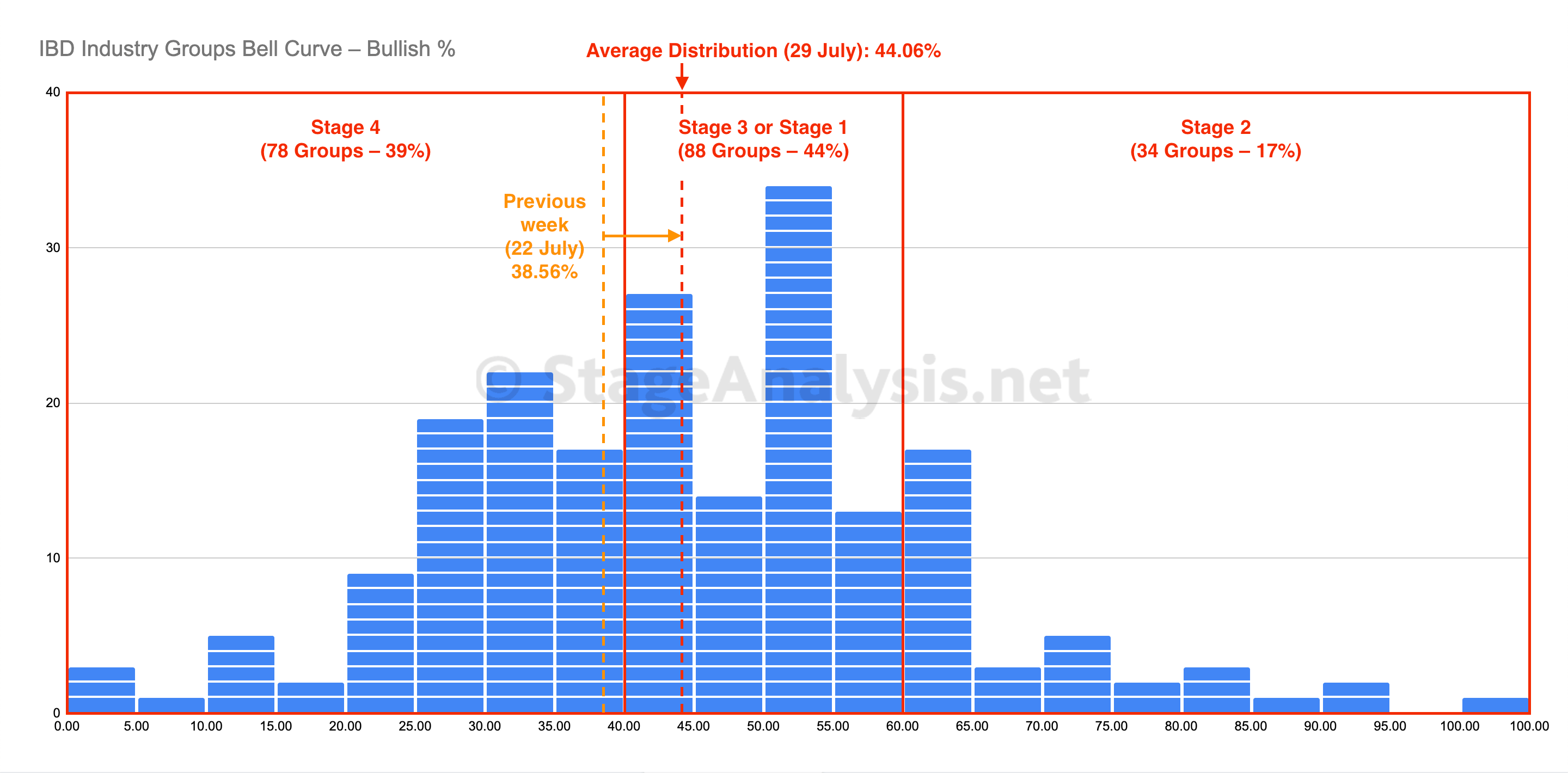

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent continued to improve with more groups leaving the Stage 4 zone and shifting to the Stage 1 zone, as well as an additional 5.5% of groups moving into the Stage 2 zone. The average distribution stands at 44.06%, and so the improvements have moved it out from the Stage 4 zone and back into the Stage 1 zone (between 40% and 60%).

Read More

31 July, 2022

US Stocks Watchlist – 31 July 2022

For the watchlist from the weekend scans...

Read More

30 July, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More