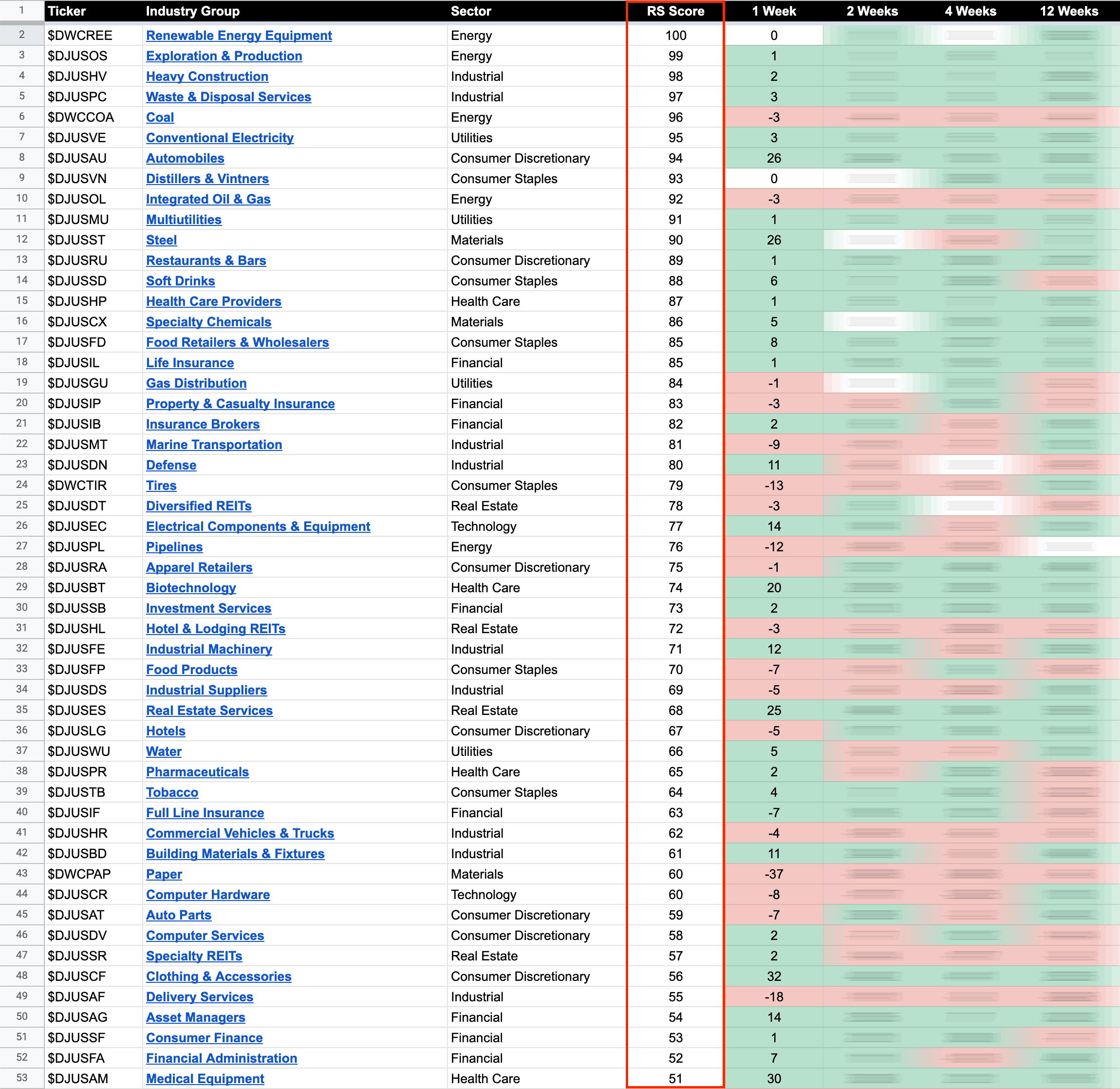

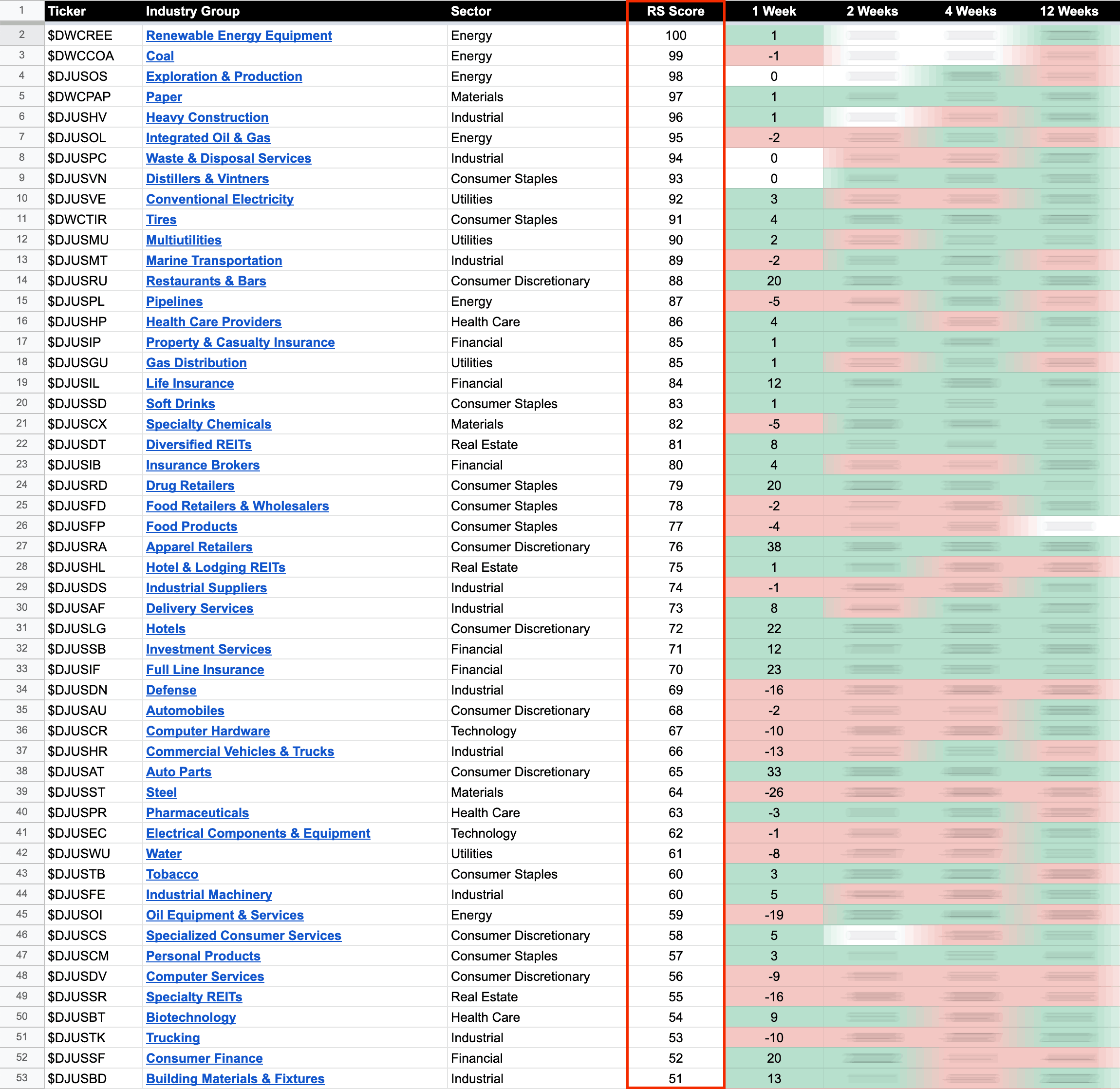

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

Blog

09 September, 2022

US Stocks Industry Groups Relative Strength Rankings

09 September, 2022

Stage 1 Bases in the Financials Sector Stocks Multiply and the US Stocks Watchlist – 8 September 2022

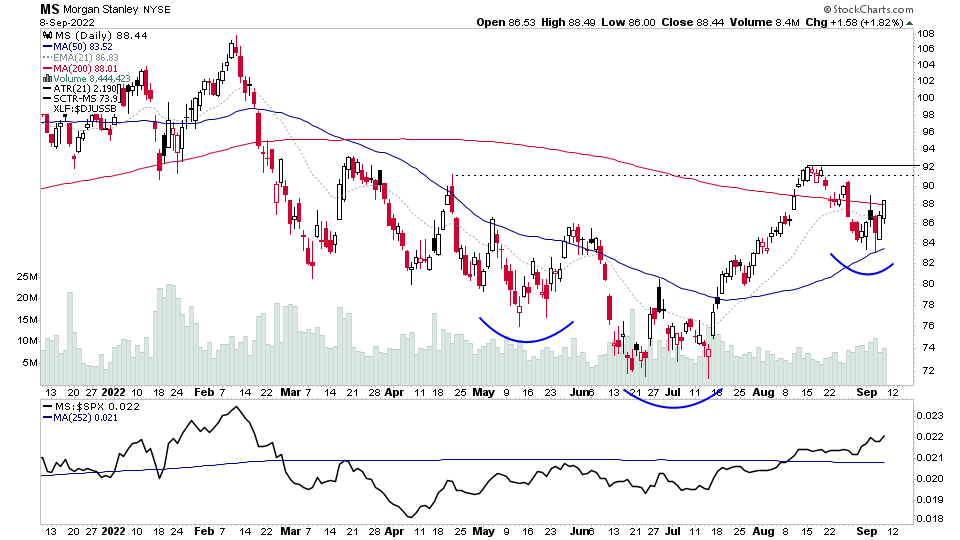

The Financials sector groups dominated the watchlist scans today, and as it's not a group that comes up very often in the watchlist, I've highlighted a number of them, as there's a similar inverse head and shoulders bottom pattern developing across the group...

Read More

07 September, 2022

Video: Software Stocks Group Focus – Early Stage 2 Movers and Developing Stage 1 Bases – 7 September 2022 (1hr 8mins)

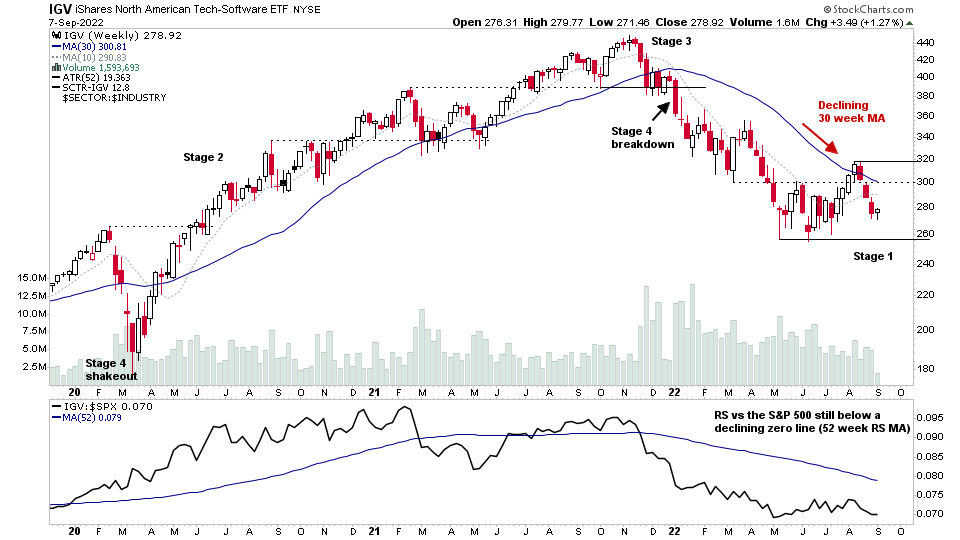

Today's video is a special feature following up on the Software group stocks progression over the last month since I last covered the group in early August: Video: Software Stocks Group Focus – Stage 1 Bases Proliferate – 10 August 2022, as at the time, numerous stocks within the group were showing signs of Stage 1 base structures developing.

Read More

06 September, 2022

US Stocks Watchlist – 6 September 2022

For the watchlist from Mondays scans...

Read More

05 September, 2022

Part 2 – Stage Analysis Members Weekend Video – 5 September 2022 (49 mins)

In Part 2 of the Stage Analysis Members weekend video I discuss the highlighted stocks from the weekend scans as well as Thursday's post. With live markups and discussion on multiple timeframes of why they were highlighted and what part of the Stage that they are in, and what I'm looking for in order for them to become actionable and the group themes appearing...

Read More

04 September, 2022

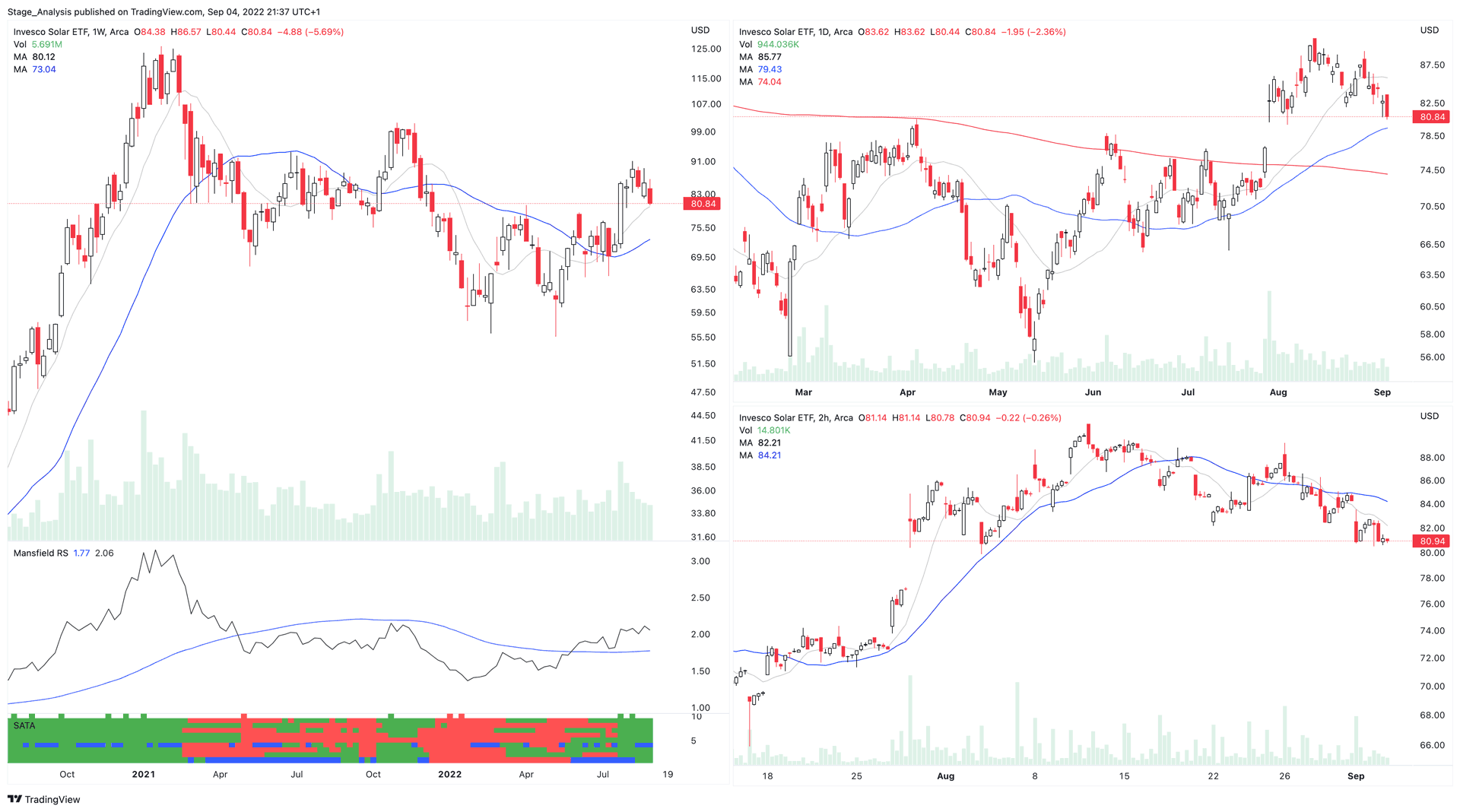

Part 1 – Stage Analysis Members Weekend Video – 4 September 2022 (1hr 3mins)

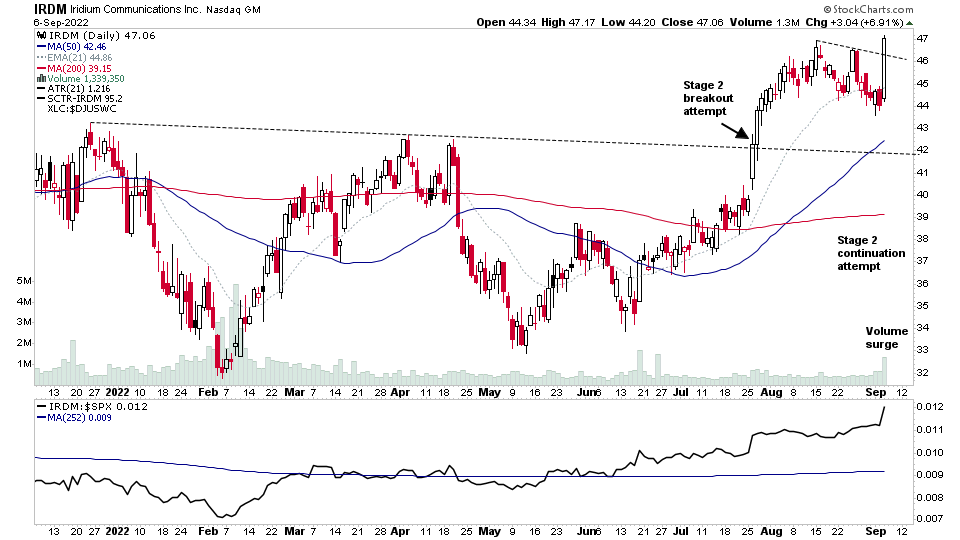

Part 1 of the weekend video begins with an explanation of how to use the new SATA - Stage Analysis Technical Attributes Indicator. Followed by a look at a few of this weeks high volume Stage 2 breakout attempts. Then a rundown of the price action in the major US indexes and Industry Groups RS Rankings...

Read More

04 September, 2022

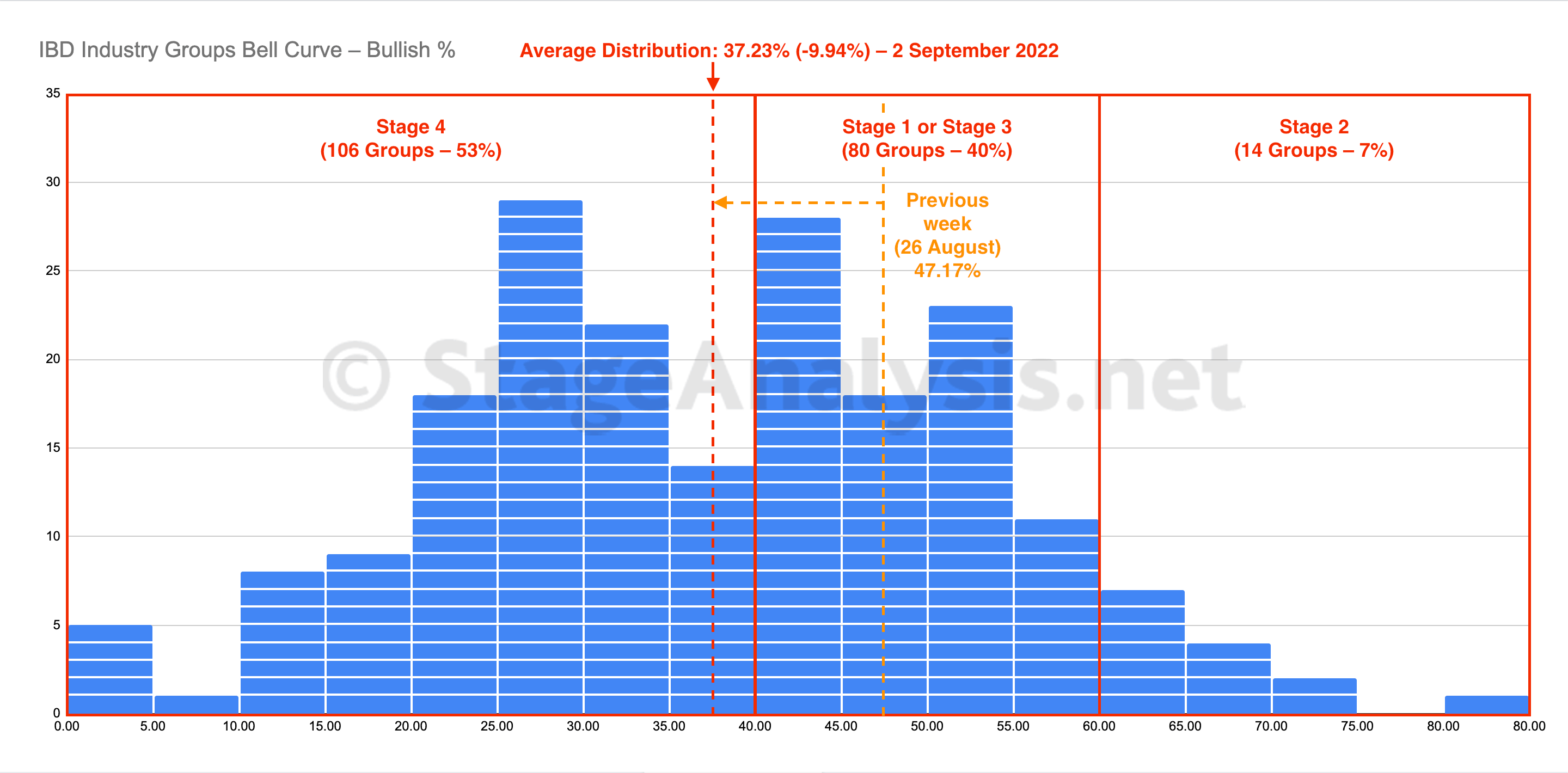

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent average distribution declined by a further -9.94% since the previous week, with an additional 34 groups dropping out of the Stage 2 zone and 46 groups dropping back into the Stage 4 zone. Hence the majority of groups (106 out of 200) are now in the Stage 4 zone...

Read More

03 September, 2022

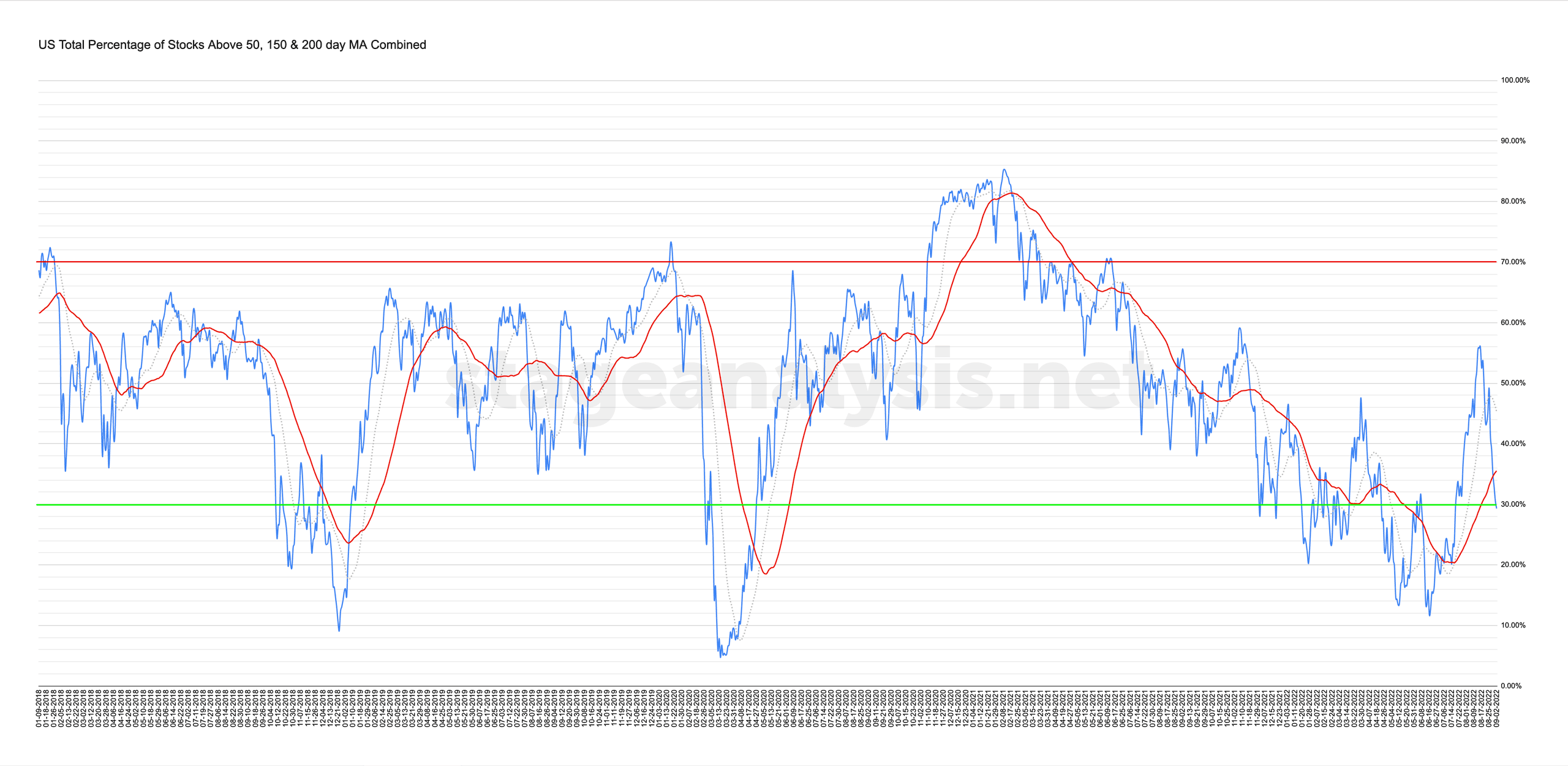

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

03 September, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

02 September, 2022

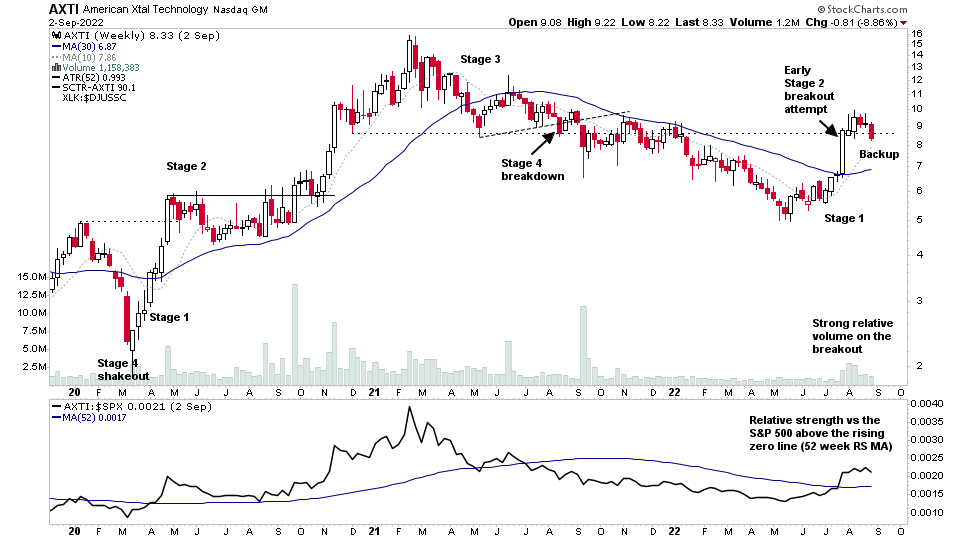

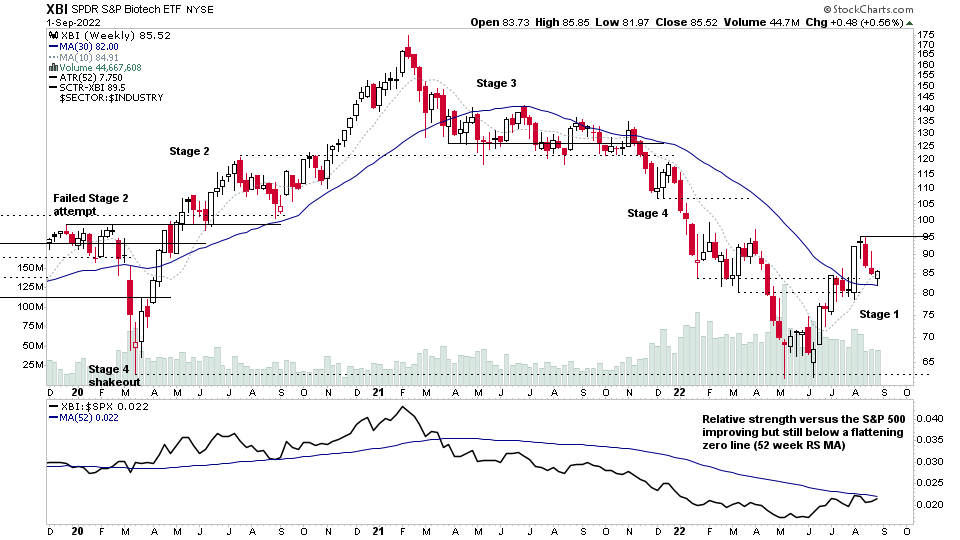

Biotechnology Stocks Back in Focus and the US Stocks Watchlist – 1 September 2022

The Biotechnology stocks dominated todays watchlist scans with multiple stocks from the group in position for potential continuation breakout attempts in early Stage 2 or from within Stage 1 base structures, after consolidating and pulling back for the last month.

Read More