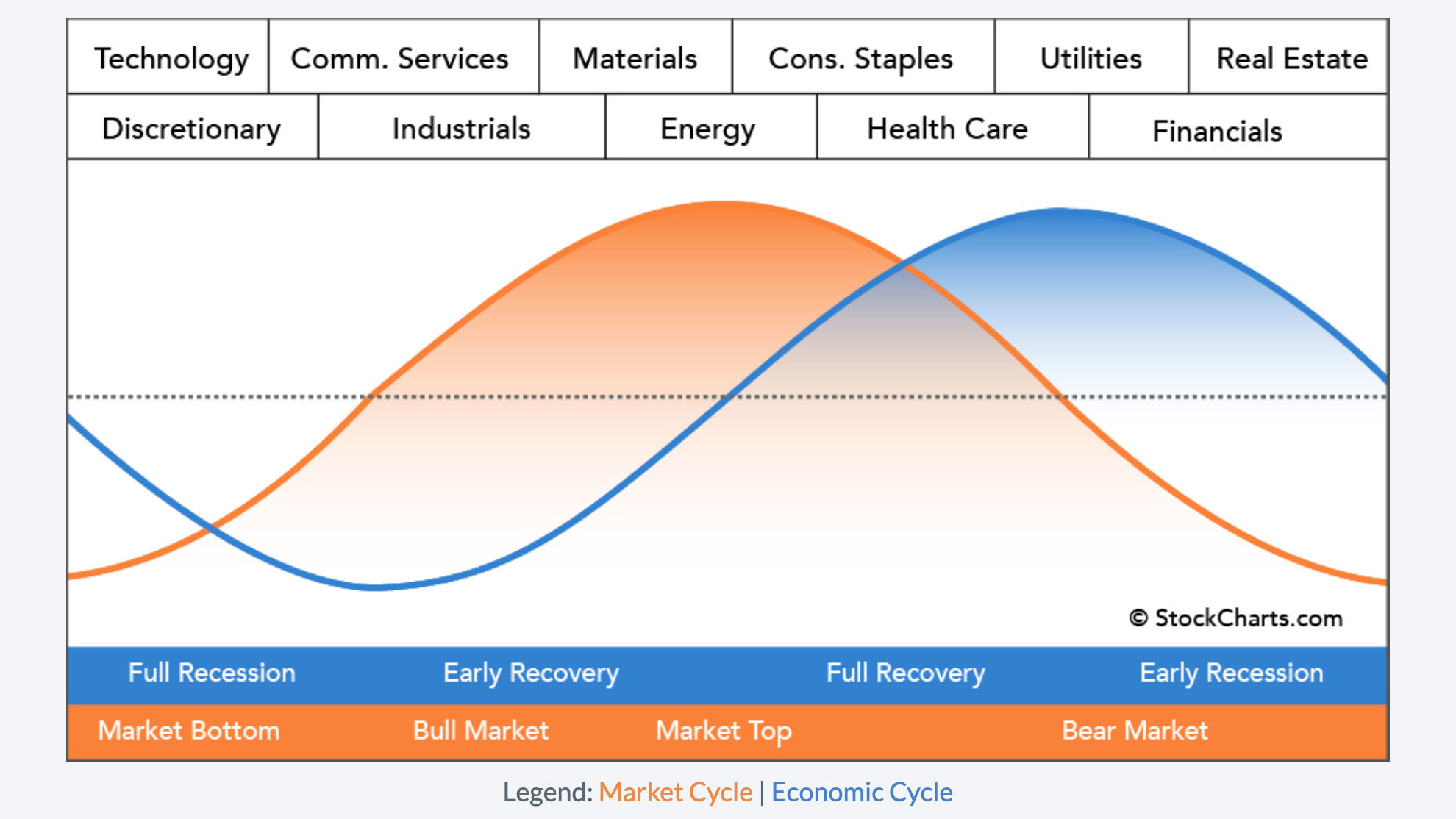

Tonights Stage Analysis Members midweek video begins with a look at the Sector Rotation Model that suggests the sectors that tend to lead the market at the different points in the market cycle and economic cycle. Followed by a brief chat of the recent article on the Top 5 Books To Learn the Wyckoff Method, before discussing the Major Index charts...

Read More

Blog

03 July, 2022

Stage Analysis Members Weekend Video – 3 July 2022 (1hr 20mins)

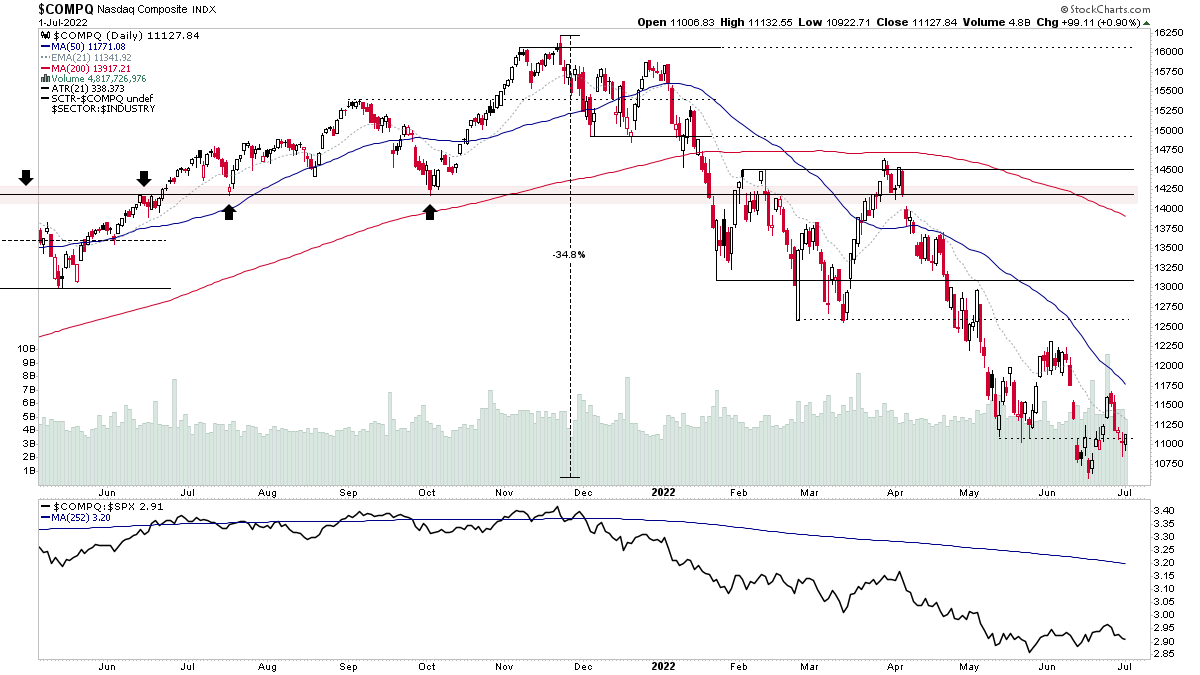

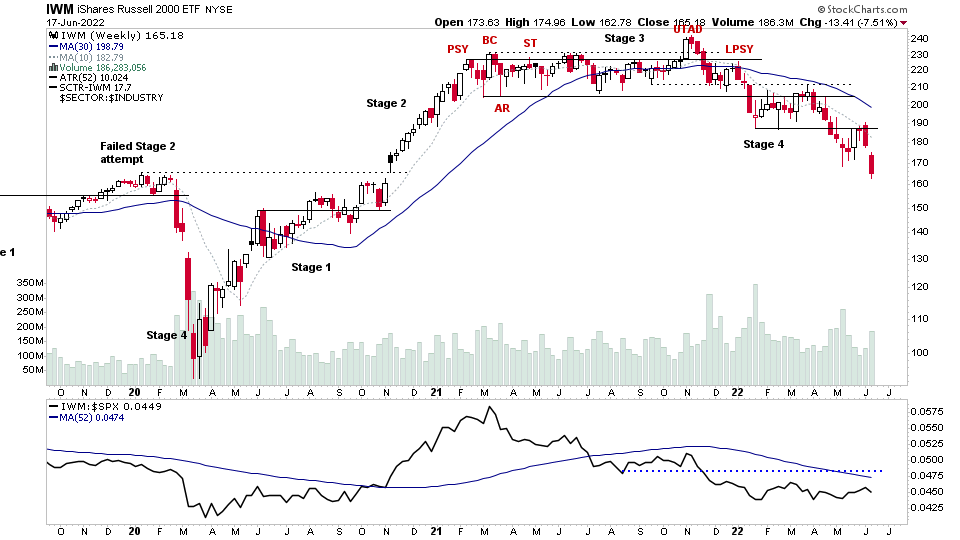

The Stage Analysis Members Weekend Video this week covers the Major Indexes with analysis of S&P 500, Nasdaq, Russell 2000, as well as Oil, Copper, US 7-10 Year Treasuries & Gold...

Read More

19 June, 2022

Stage Analysis Members Weekend Video – 19 June 2022 (1hr 24mins)

The Stage Analysis Members Weekend Video this week covers the Major Indexes with analysis of S&P 500, Nasdaq, Russell 2000 and more. Plus a look at futures charts of Oil, Copper, Treasuries & Gold...

Read More

12 June, 2022

Stage Analysis Members Weekend Video – 12 June 2022 (1hr 20mins)

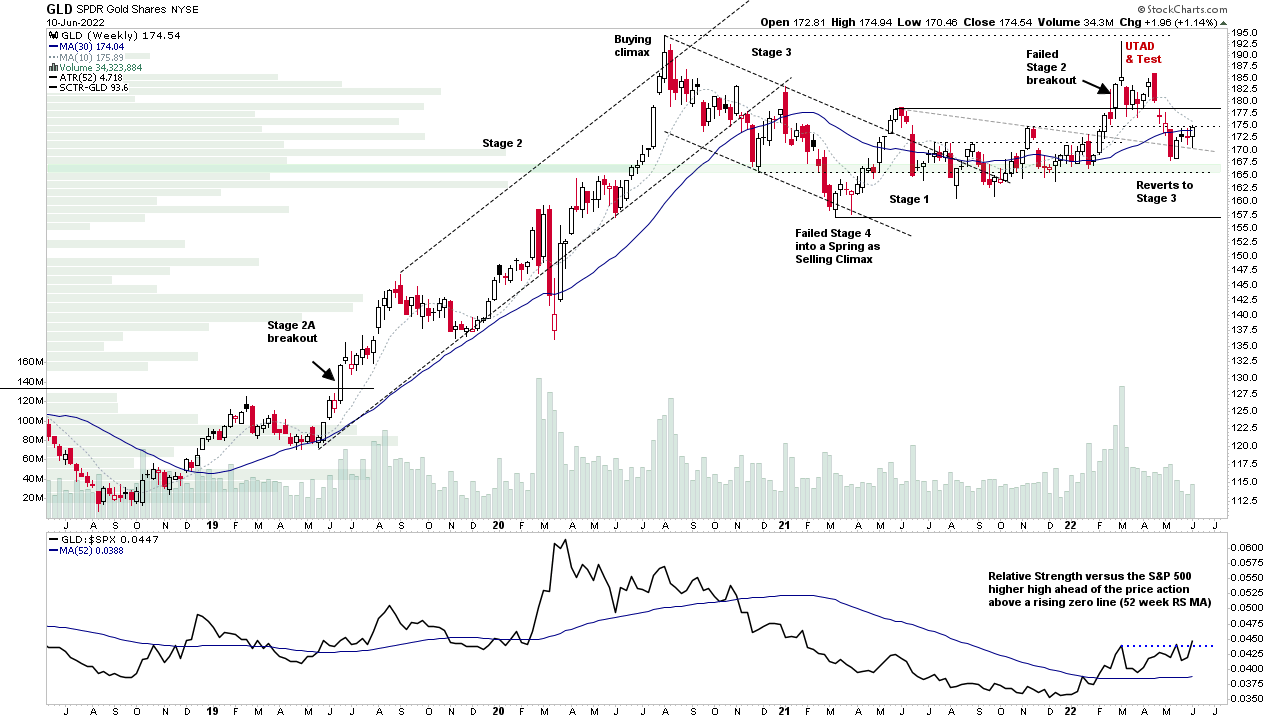

This weeks Stage Analysis Members Video features a special on the precious metals, with Stage Analysis of Gold and Silver on multiple timeframes as well and the most interesting Gold miners and Silver miners charts...

Read More

05 June, 2022

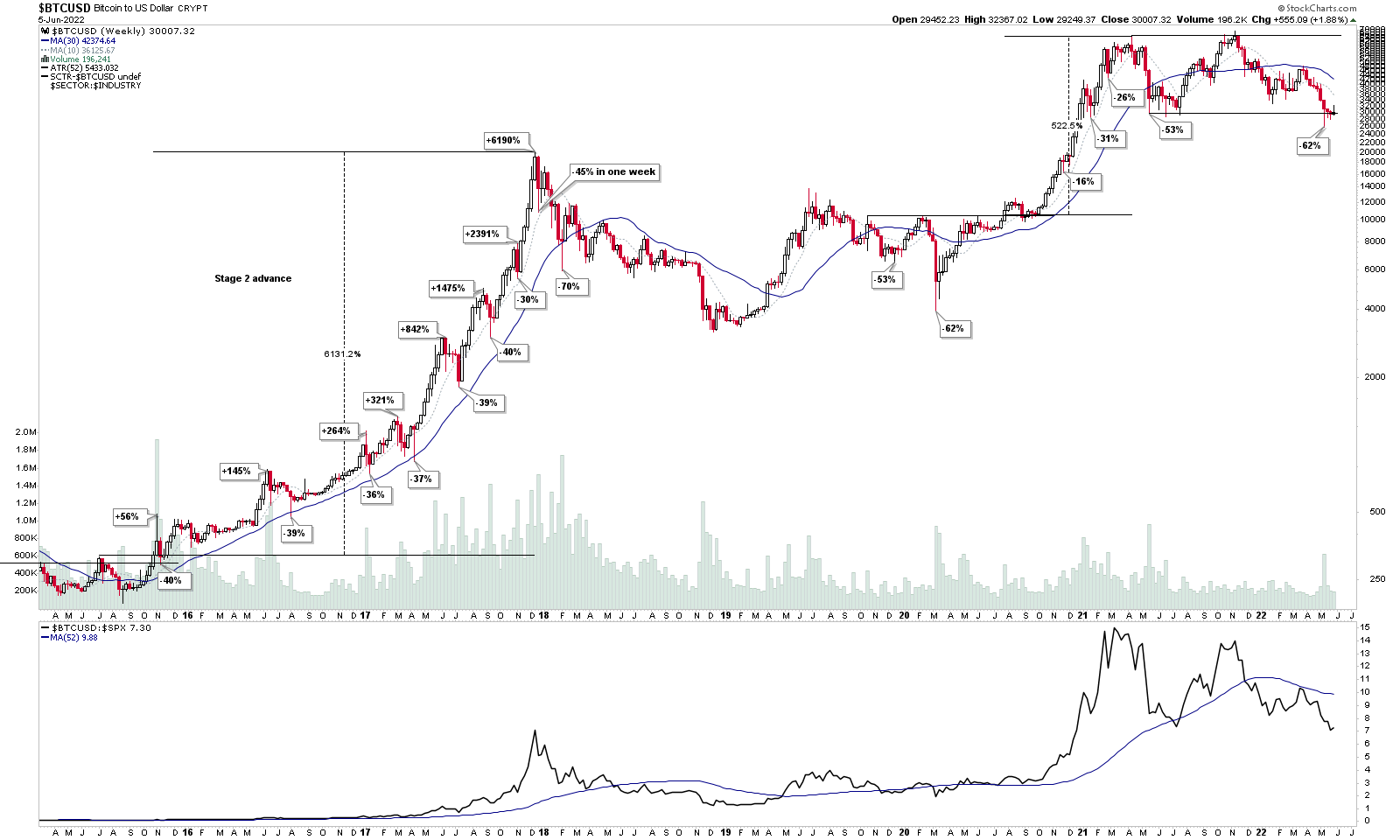

Stage Analysis Members Weekend Video – 5 June 2022 (1hr 36mins)

This weekends Stage Analysis Members Video features Stage Analysis of the major crypto coins – Bitcoin and Ethereum on multiple timeframes. And then in the members only portion of the video the usual Forest to the Trees approach...

Read More

29 May, 2022

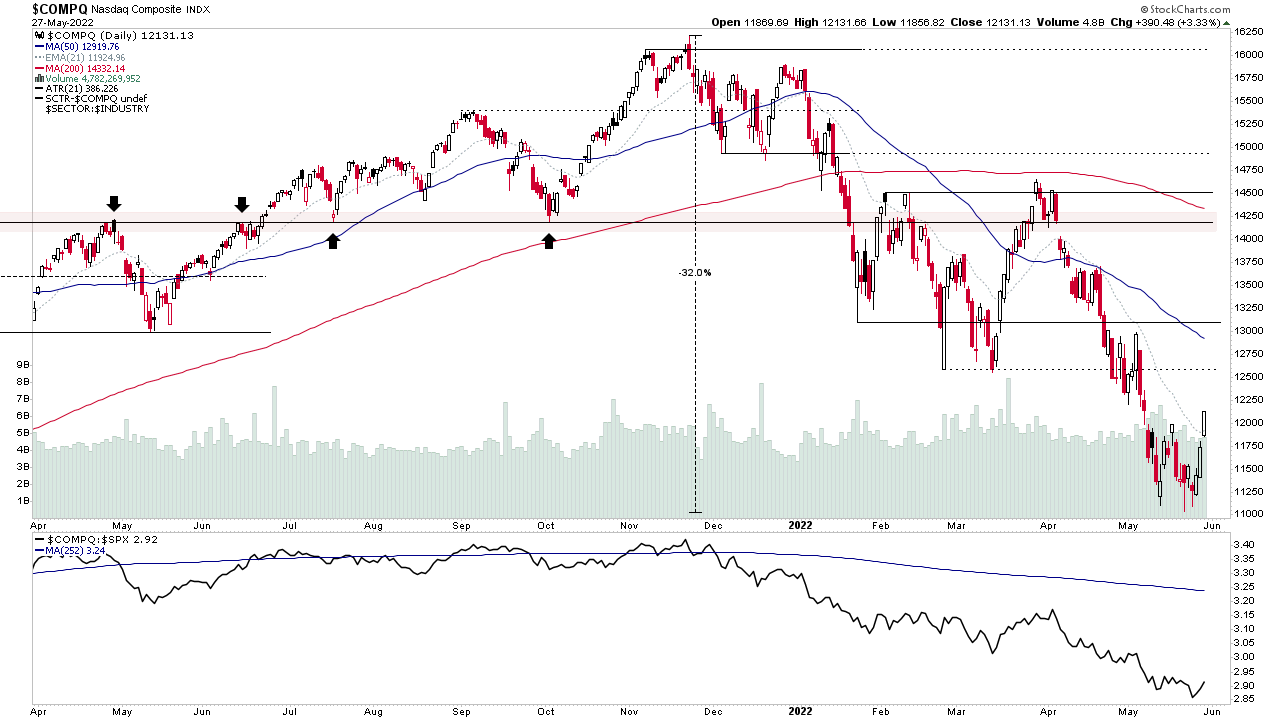

Stage Analysis Members Weekend Video – 29 May 2022 (1hr 43mins)

This weekends Stage Analysis Members Video features analysis of some attempted Stage 2 breakouts on strong relative volume and some strong volume springs. Followed by the Major Indexes Review on Multiple Timeframes, and the IBD Industry Group Bell Curve - Bullish %, as well as the Industry Groups Relative Strength Rankings and groups on the move. I also cover the Market Breadth Charts in detail to help to determine the Weight of Evidence and then I finish with detailed coverage of the weekends watchlist stocks from the US stock market and IPO stocks update from the midweek video.

Read More

26 May, 2022

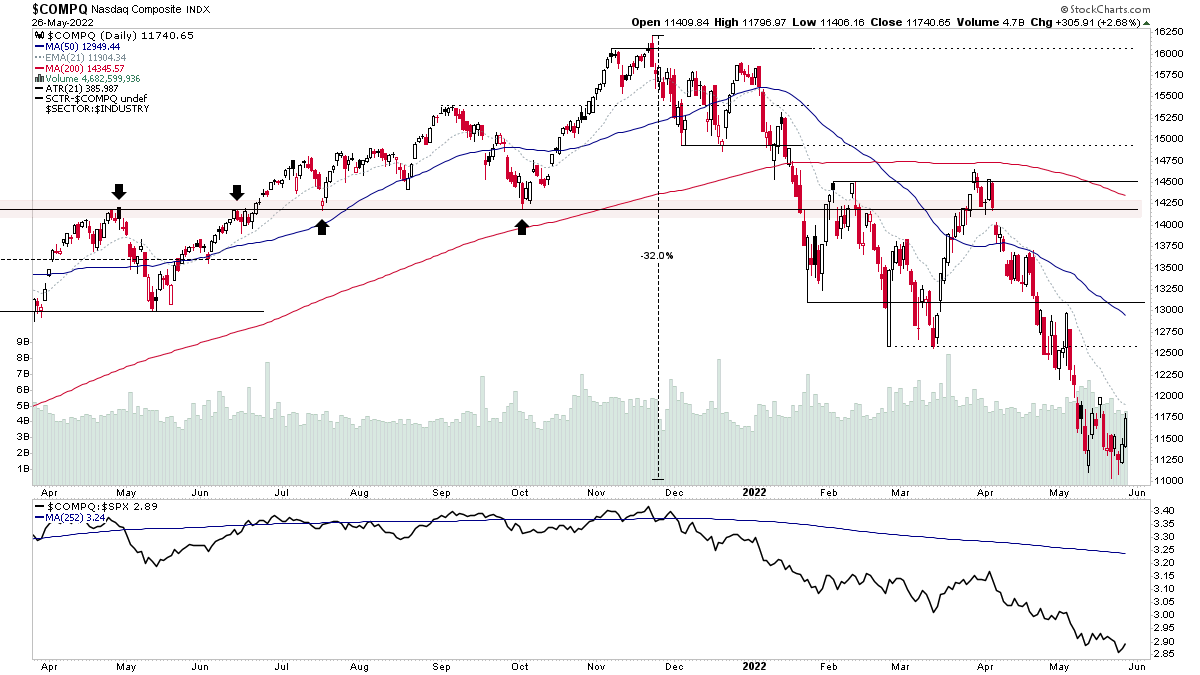

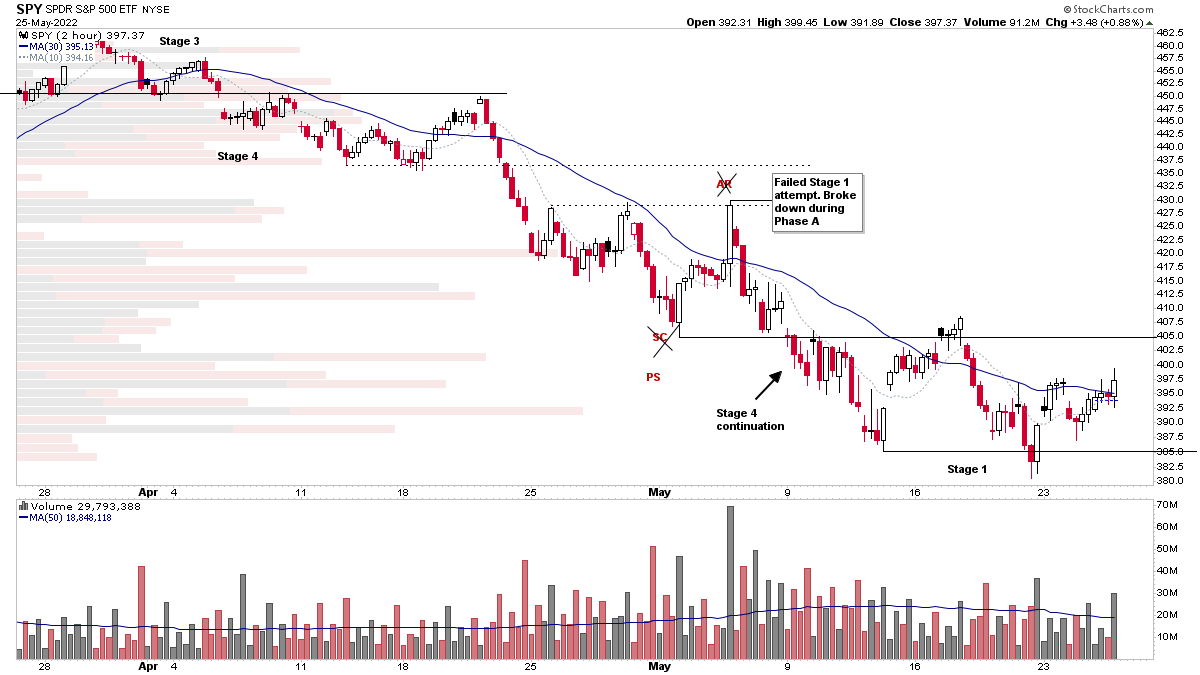

Follow Through Day – Part Four: Oversold Stage 4 Stocks Attempt to Rebound

Today saw strong moves in the more depressed areas of the market with leadership from beaten down areas such as Growth, Consumer Discretionary, Communication Services, Technology, Software, Semiconductors and IPOs and more. Which triggered yet another Follow Through Day (FTD) attempt – the fourth this year – and IBD declaring a Confirmed Uptrend again. However...

Read More

25 May, 2022

Stage Analysis Members Midweek Video – IPO Special –25 May 2022 (1hr 30mins)

Todays Stage Analysis members video includes a special feature focusing on the IPO stocks that listed in the last year and are attempting to build bases. The has been a huge decline in the IPO stocks since November, with a more than -60% decline in the IPO etf for example that covers the group. But some of those younger stocks that have listed could recover and become future leading stocks once the Stage 4 decline ends and starts to transition into Stage 1.

Read More

22 May, 2022

Stage Analysis Members Weekend Video – 22 May 2022 (1hr 18mins)

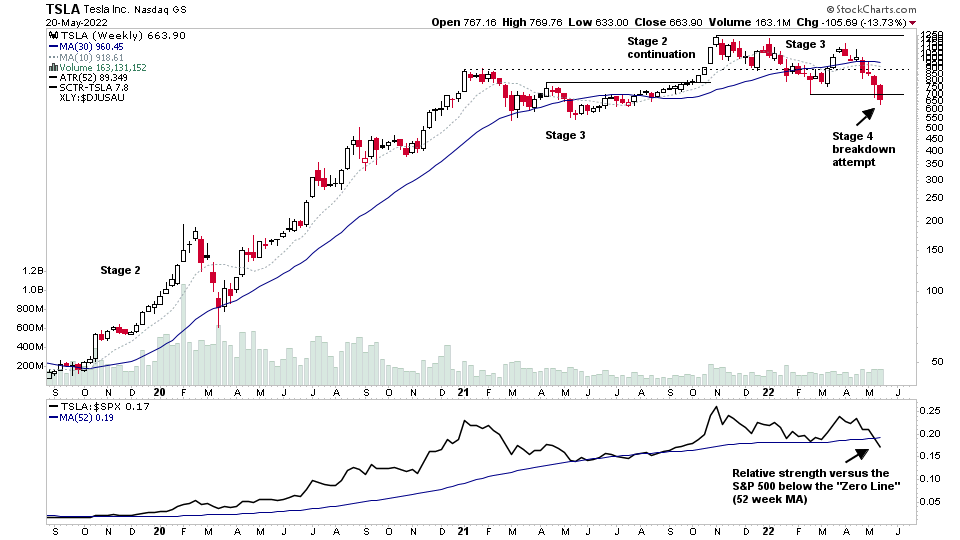

This weekends Stage Analysis Members Video features Stage Analysis of the mega caps $AAPL and $TLSA as they test major levels in early Stage 4, plus the Major Indexes Review. Then a look at the US Stocks Industry Groups Relative Strength tables and groups of interest. The Market Breadth Charts to determine The Weight of Evidence and the US Stocks Watchlist in Detail, with marked up charts of what I'm watching for on the long and short side.

Read More

20 May, 2022

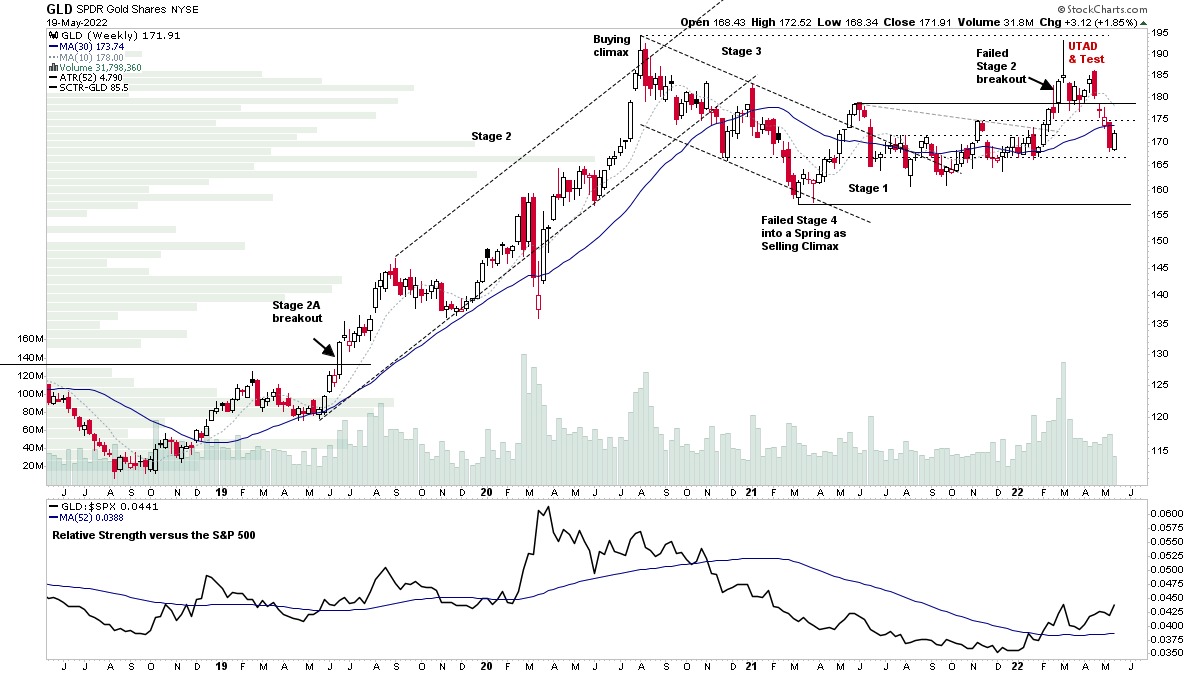

Gold Attempting To Move Back Above the 200 Day MA and the US Stocks Watchlist – 19 May 2022

Gold and Miners are coming back into focus today, with a move by the Gold continuous futures back through the 200 day MA on increased volume, and so a potential spring type event at the moving average – which has also been showing up in the individual gold miners and some of the silver miners too over the last week or so...

Read More