In this weekends members video I discuss the Stan Weinstein Interview on Twitter Spaces, as well as the regular content of the Major Indexes, Sectors Relative Strength Tables & Charts, Industry Group RS Tables and Themes, Market Breadth: Weight of Evidence, 2x Weekly Volume Stocks and the US Watchlist Stocks in detail.

Read More

Blog

26 March, 2022

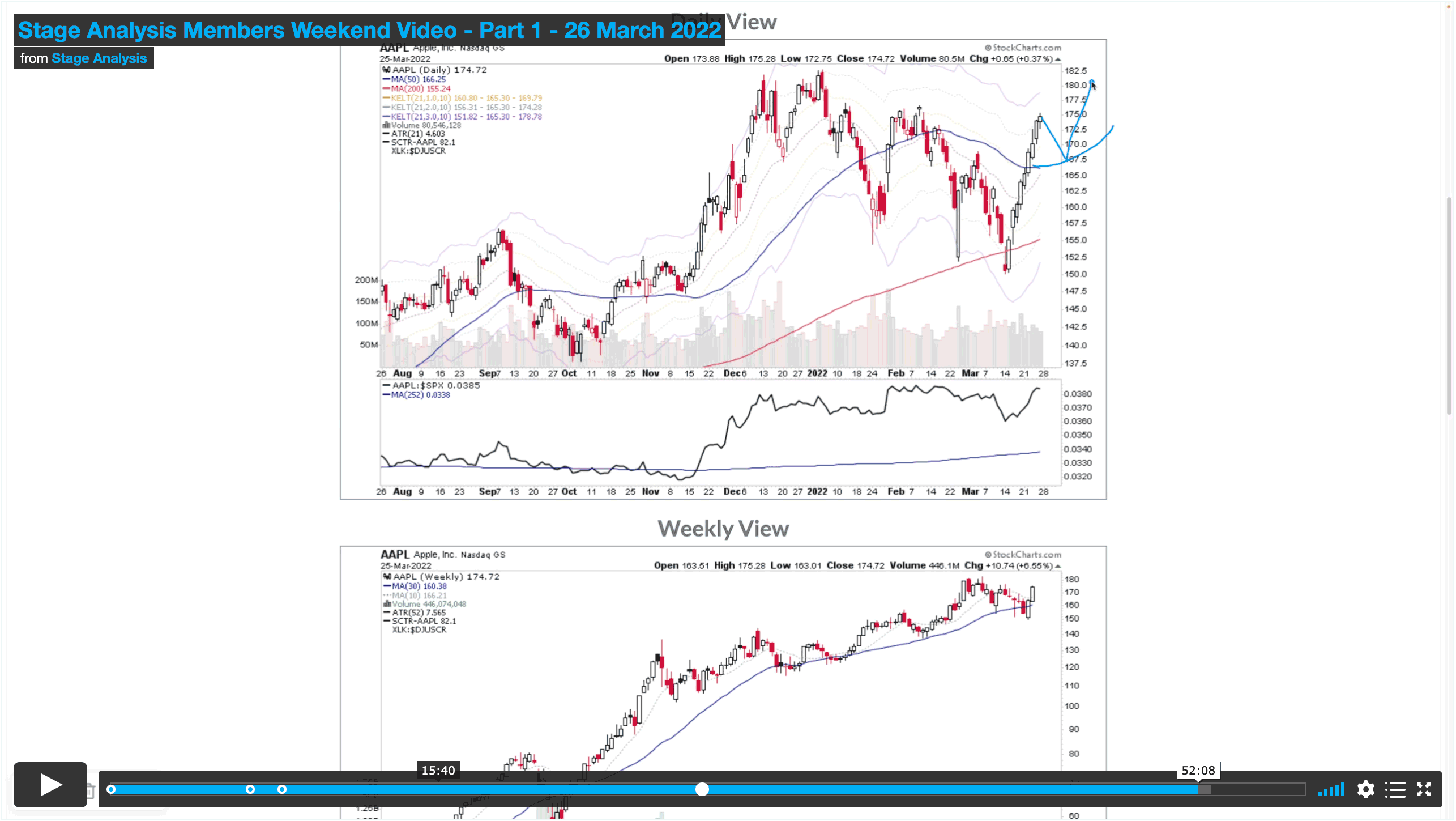

Stage Analysis Members Weekend Video – Part 1 – 26 March 2022 (57 mins)

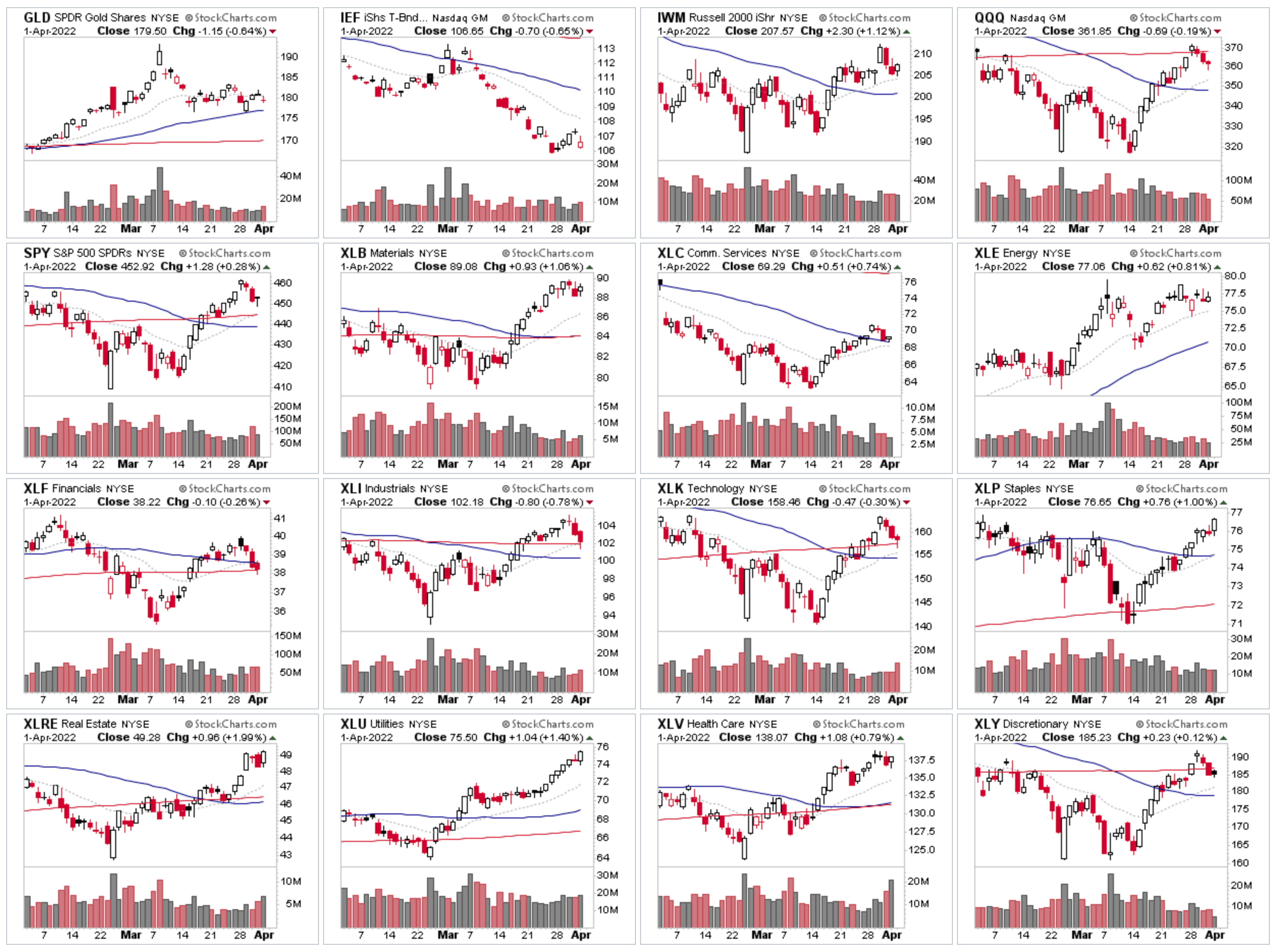

In Part 1 of the Stage Analysis Members Video I cover the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), US Sectors Relative Strength Rankings and charts, Market Breadth charts to determine the Weight of Evidence, and the US Stocks Industry Group Relative Strength Tables and the Groups in focus this week.

Read More

24 March, 2022

Stage Analysis Members Midweek Video - 23 March 2022 (54 mins)

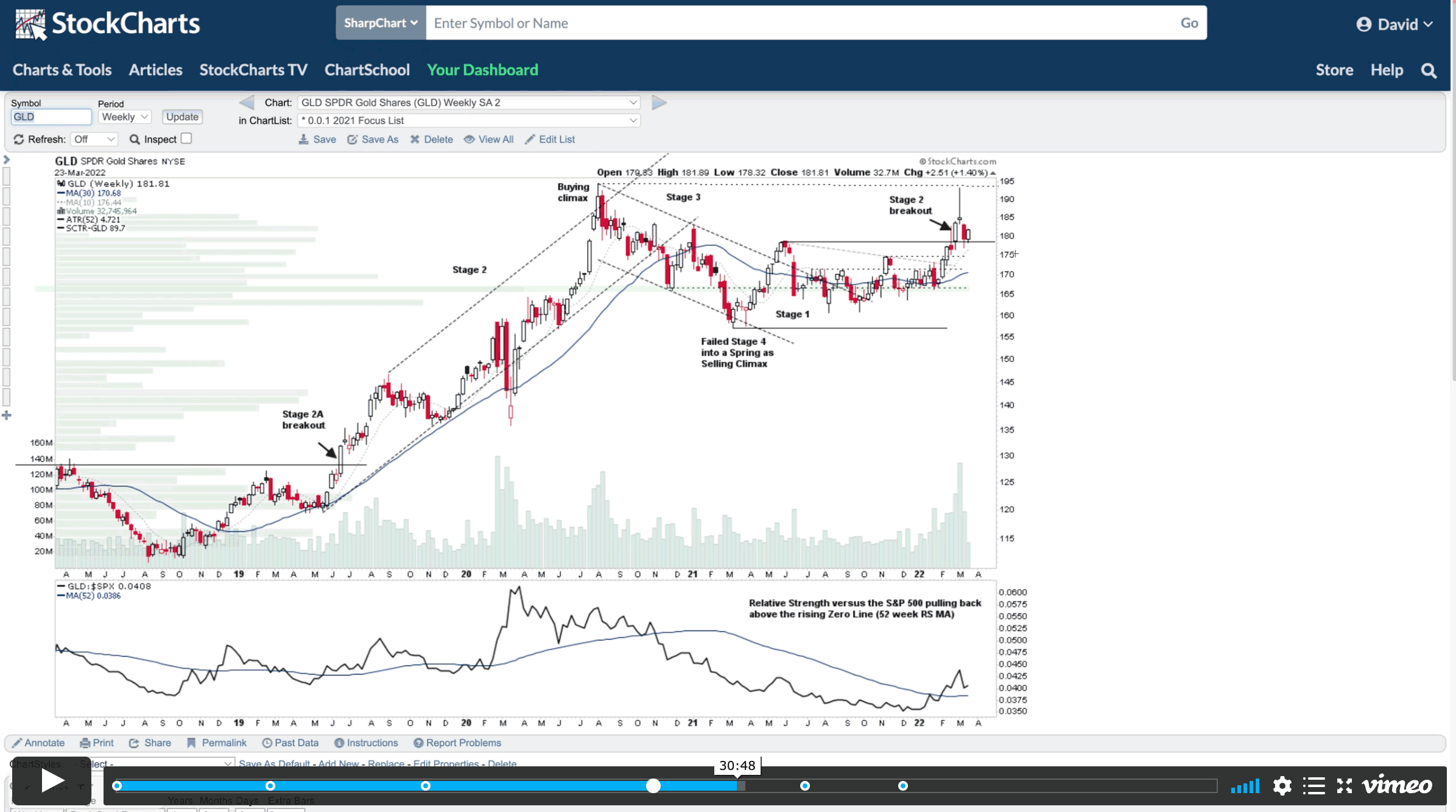

Stage Analysis Members Midweek Video covering the Major Indexes, Short Term Market Breadth Indicators, the 104 Industry Groups Exclusive Bell Curve diagram, the potential Stage 2 Backup Entry Zone for Gold, the daily Stage 1 base structures in Bitcoin & Ethereum and the US Watchlist Stocks in more detail.

Read More

20 March, 2022

Stage Analysis Members Weekend Video – 20 March 2022 (1hr 17 mins)

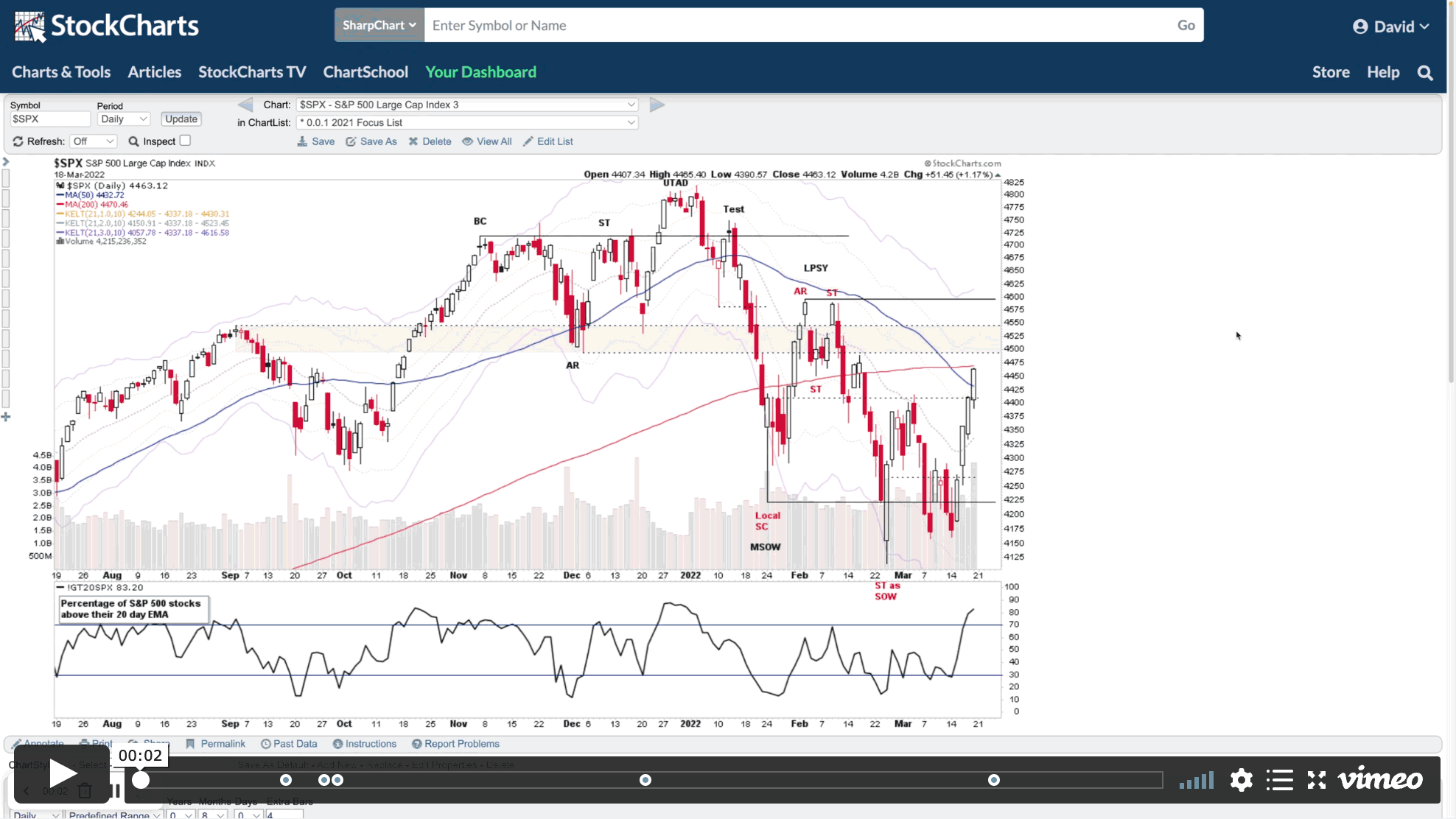

Stage Analysis Members Video covering the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength Tables and the Groups in focus this week. Plus the US Stocks Watchlist.

Read More

13 March, 2022

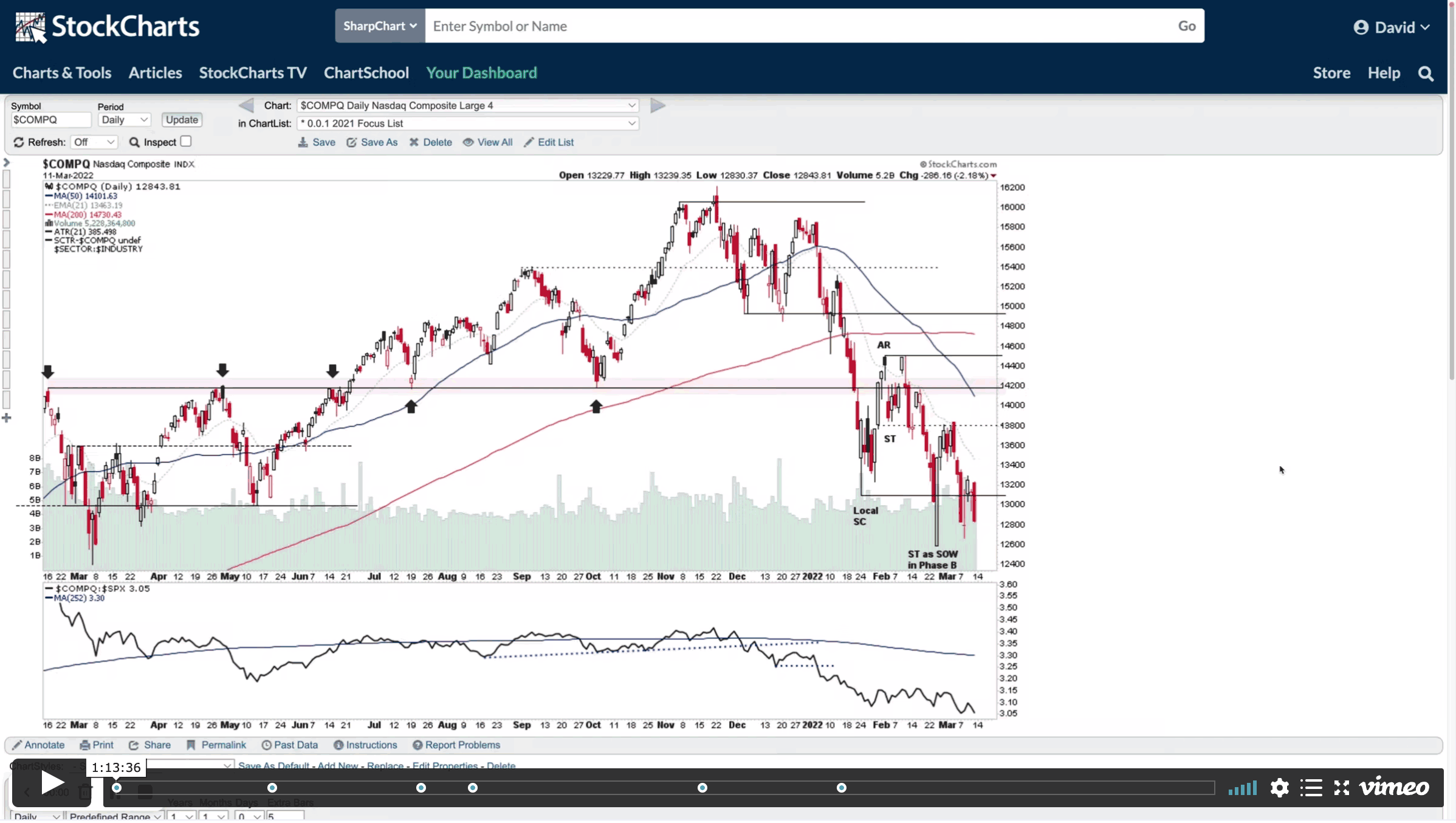

Stage Analysis Members Weekend Video - 13 March 2022

Weekend Stage Analysis Members Video covering the Major Indexes, Commodities, ETFs in focus, the Sectors and Industry Group Relative Strength, Market Breadth Update and finally the US Stocks Watchlist in detail where I mark up the price and volume action that I'm looking for in and the developing themes from the watchlist.

Read More

06 March, 2022

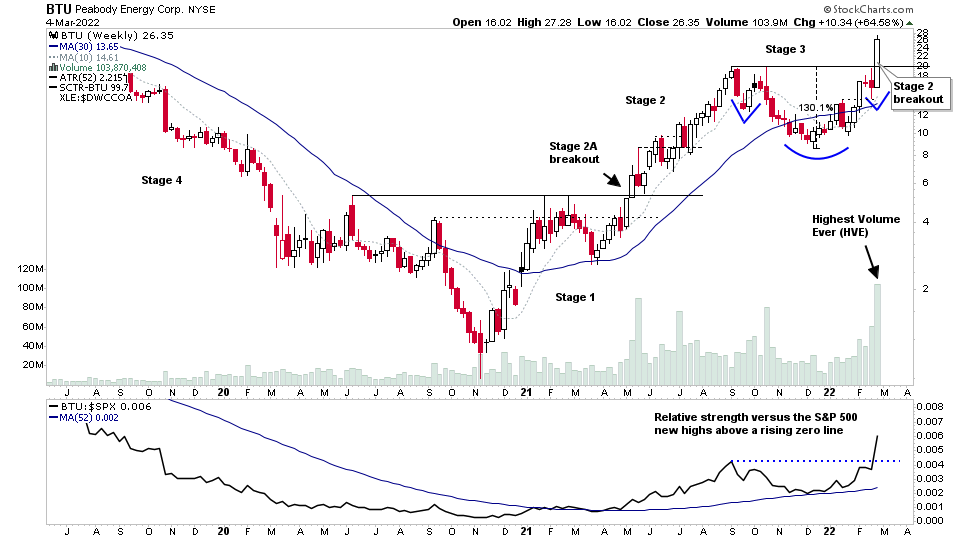

Stage Analysis Members Weekend Video - Part 1 - 6 March 2022

Stage Analysis Members Video covering - BTU Stage 2 Breakout Analysis and Targets. Group Focus on Coal, Defense, Cybersecurity. Major Indexes review: i.e. S&P 500, Nasdaq, Russell 2000 and more Market Breadth Update to Determine the Current Weight of Evidence

Read More

27 February, 2022

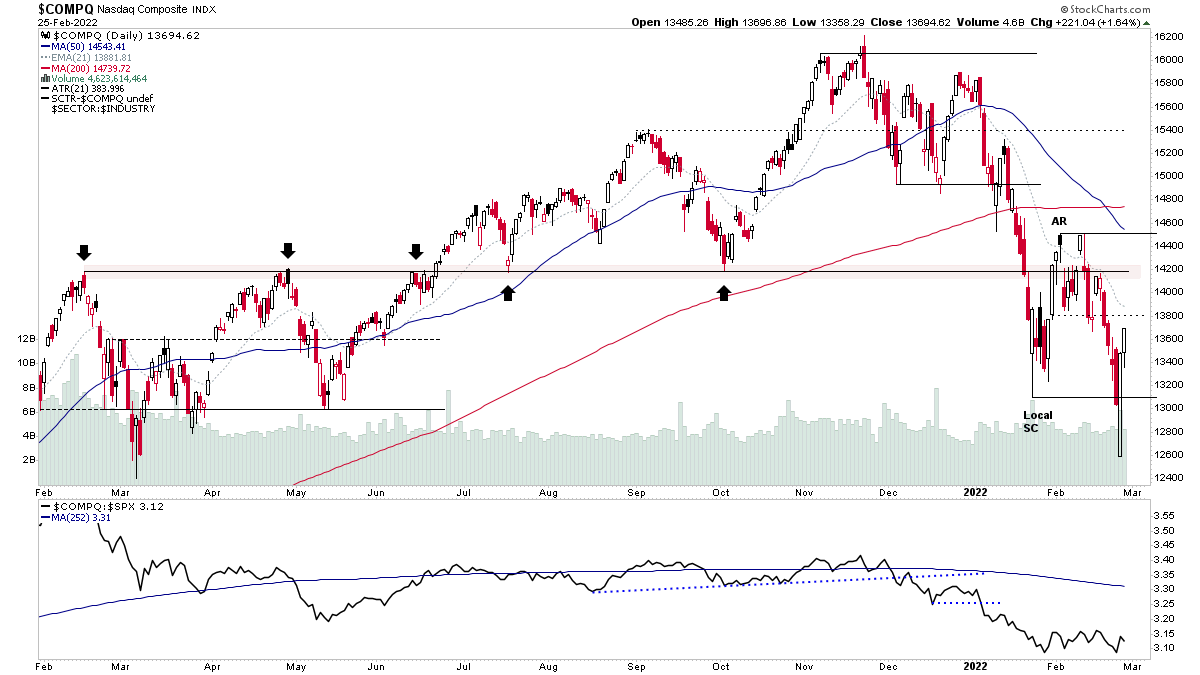

Stage Analysis Members Weekend Video - 27 February 2022 (1hr 16mins)

Weekend update covering the major indexes, market breadth, industry group relative strength tables and the weekend US stocks watchlist...

Read More

27 February, 2022

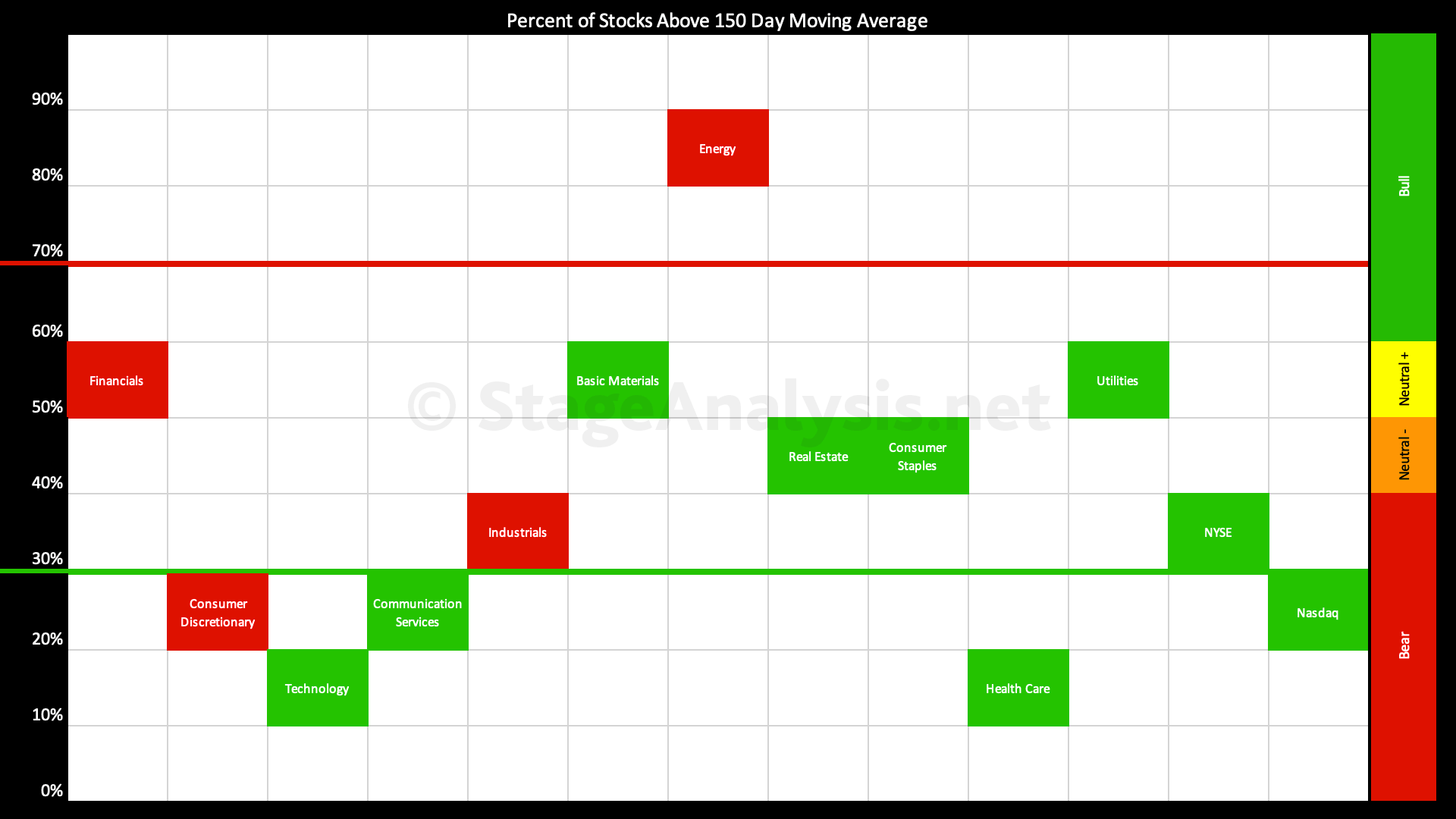

Market Breadth Update - 27 February 2022

Overview the key market breadth charts that we follow in order to determine the Weight of Evidence, which guides our strategy and risk management.

Read More

20 February, 2022

Stage Analysis Members Weekend Video - 20 February 2022 (1hr 19mins)

Detailed video of the US stock market indexes, market breadth, industry groups relative strength tables and the stocks from the weekend watchlist.

Read More

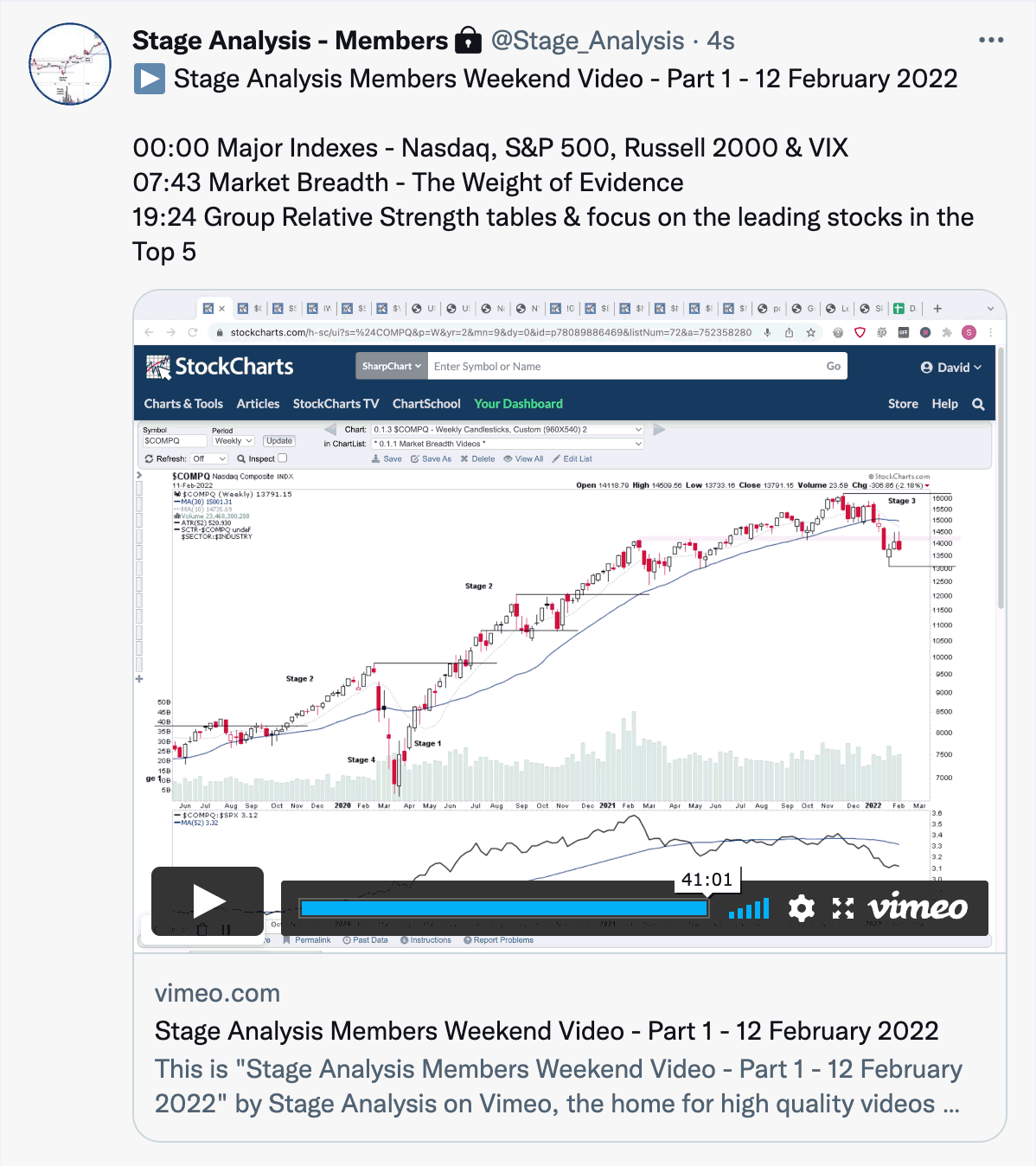

13 February, 2022

Stage Analysis Members Weekend Videos and the US Stocks Watchlist - 13 February 2022

This weekends watchlist is dominated by a few group themes with around third of the stocks from the precious metals groups as spot gold is approaching its Stage 2 breakout level once more...

Read More