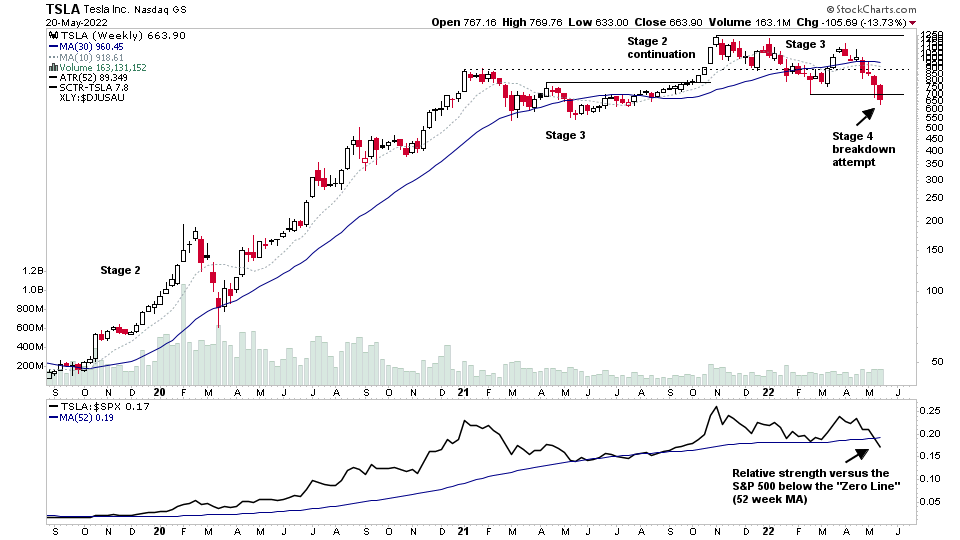

This weekends Stage Analysis Members Video features Stage Analysis of the mega caps $AAPL and $TLSA as they test major levels in early Stage 4, plus the Major Indexes Review. Then a look at the US Stocks Industry Groups Relative Strength tables and groups of interest. The Market Breadth Charts to determine The Weight of Evidence and the US Stocks Watchlist in Detail, with marked up charts of what I'm watching for on the long and short side.

Read More

Blog

19 May, 2022

Stage Analysis Members Midweek Video – 18 May 2022 (1hr 17mins)

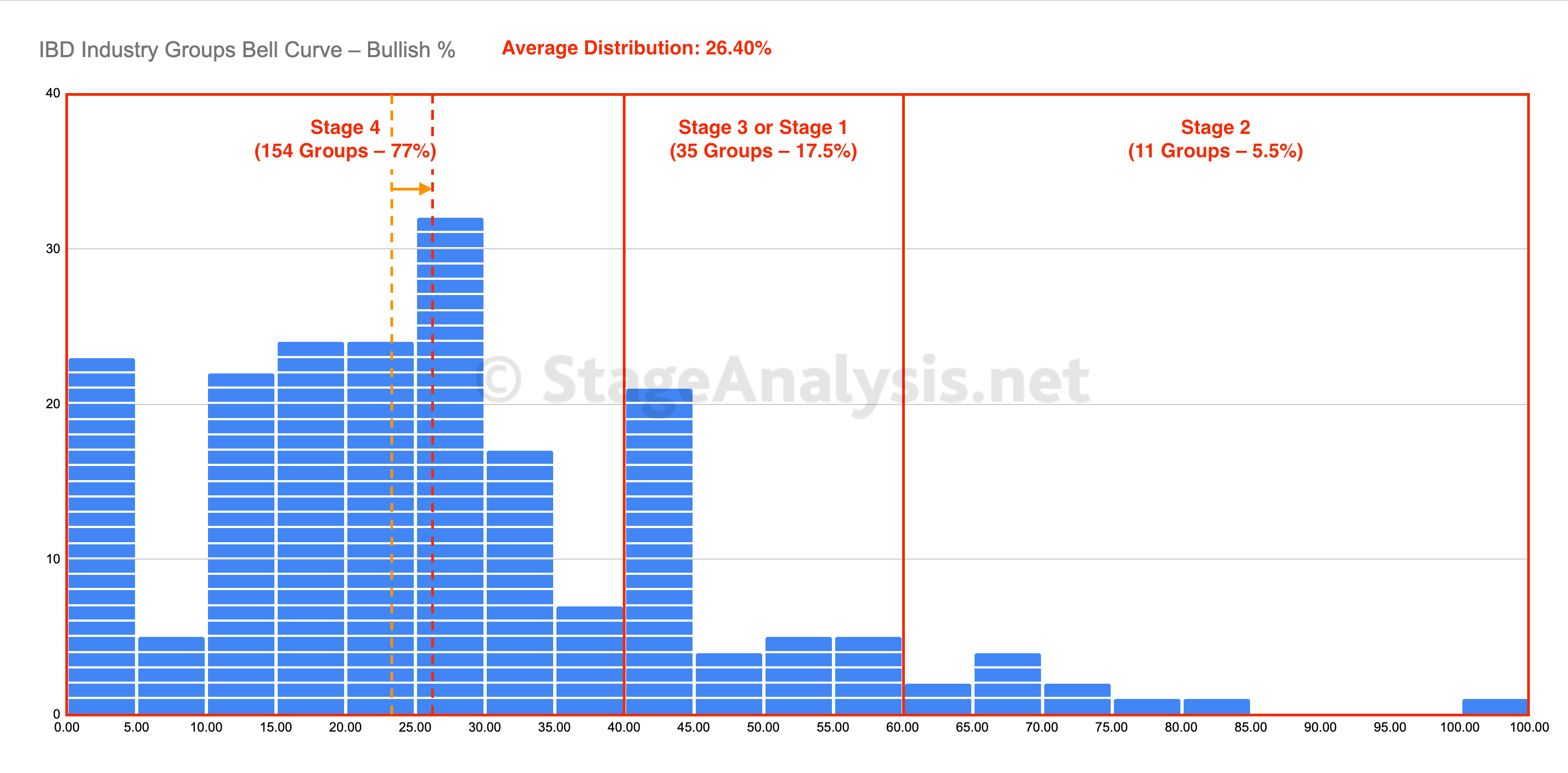

The Stage Analysis Members Midweek Video features Analysis of the Stages of the major US sectors, as well as a look at the sector breadth visual the custom IBD Industry Groups Bell Curve – Bullish % chart that I do for the members that shows the distribution of the 200 IBD Industry Groups as a bell curve chart...

Read More

12 May, 2022

Stage Analysis Members Midweek Video – 11 May 2022 (1hr 14mins)

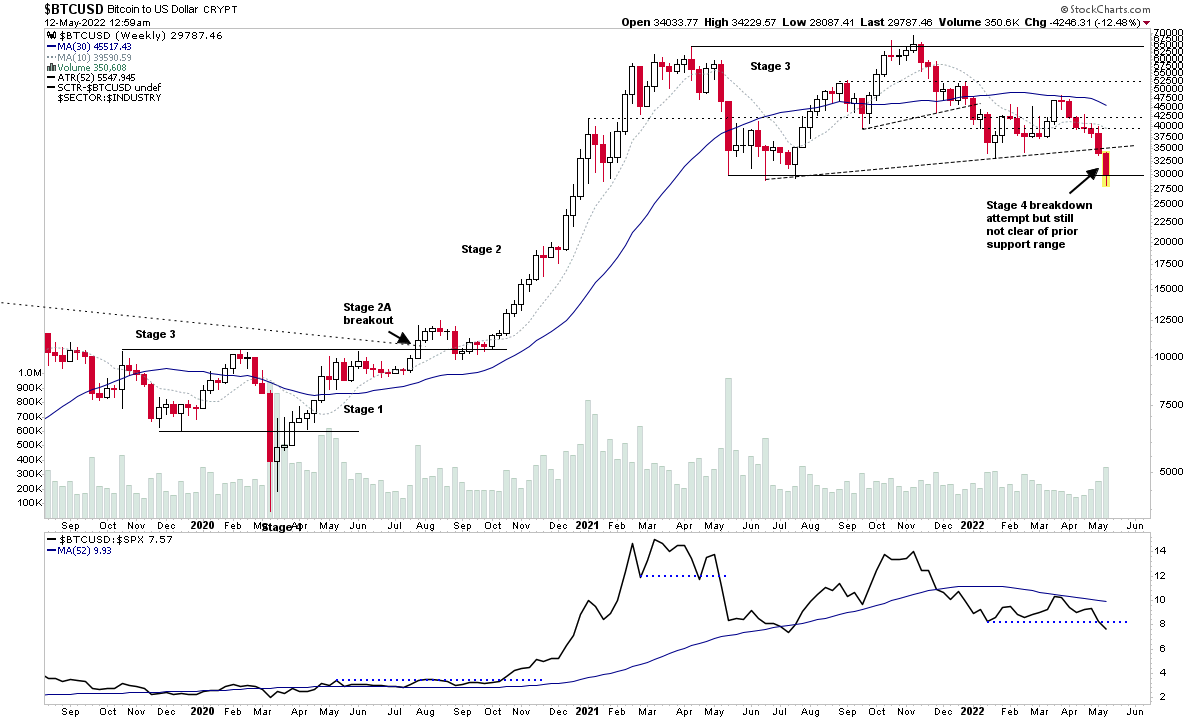

This weeks Stage Analysis Members Midweek Video features analysis of the major indexes Stage 4 declines and the VIX. Plus a detailed look at the mega caps stocks with AAPL (Apple) attempting to breakdown in Stage 4 today and join the other large cap stocks already in Stage 4...

Read More

08 May, 2022

Stage Analysis Members Weekend Video – 8 May 2022 (1hr 29mins)

This weekends Stage Analysis Members Video features analysis of the multiple Stage 2 breakouts and significant bars. Market analysis of the major indexes, US Industry Groups Relative Strength tables. The market breadth update to help to determine the weight of evidence. US stocks watchlist and finally a look at some of the most interesting stocks with earnings this coming week.

Read More

01 May, 2022

Stage Analysis Members Weekend Video – 1 May 2022 (1hr 22mins)

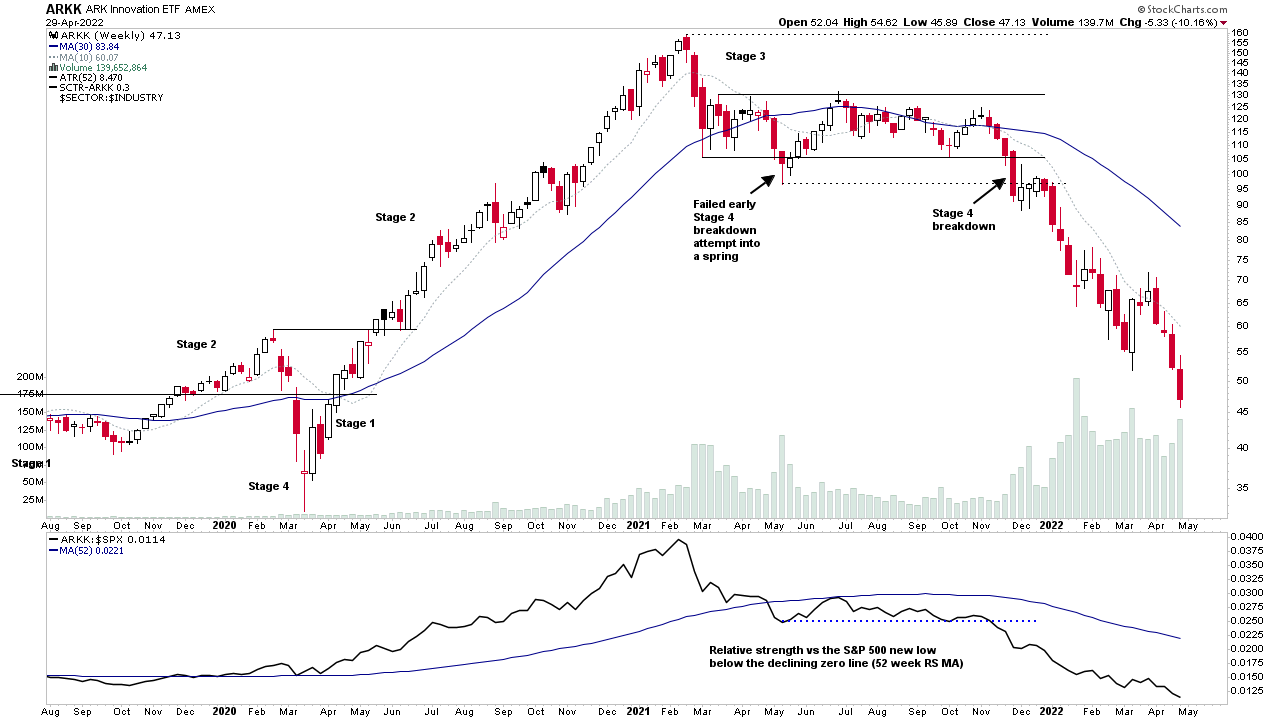

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes and ETFs – S&P 500, Nasdaq Composite, Russell 2000, IBD 50, ARKK, plus the VIX and also a look at the earnings reactions of some of the mega cap stocks that reported over the last week, including GOOGL, AAPL, MSFT, AMZN and more.

Read More

01 May, 2022

Major Stock Indexes Testing the Stage 4 Breakdown Level

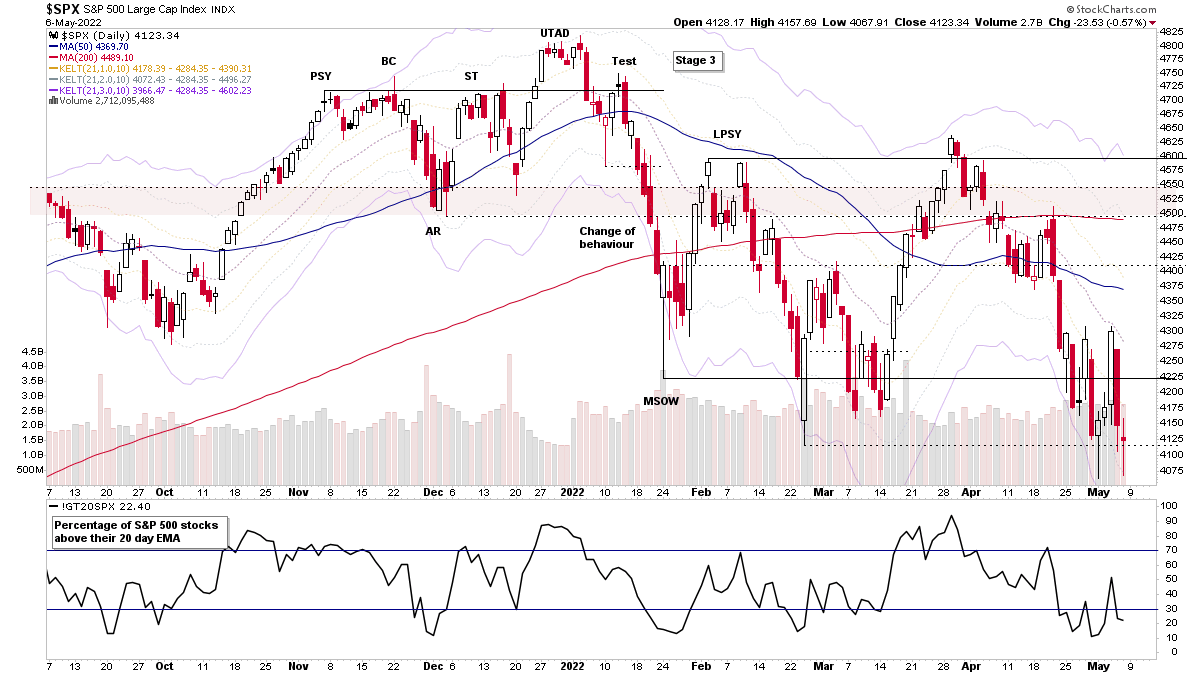

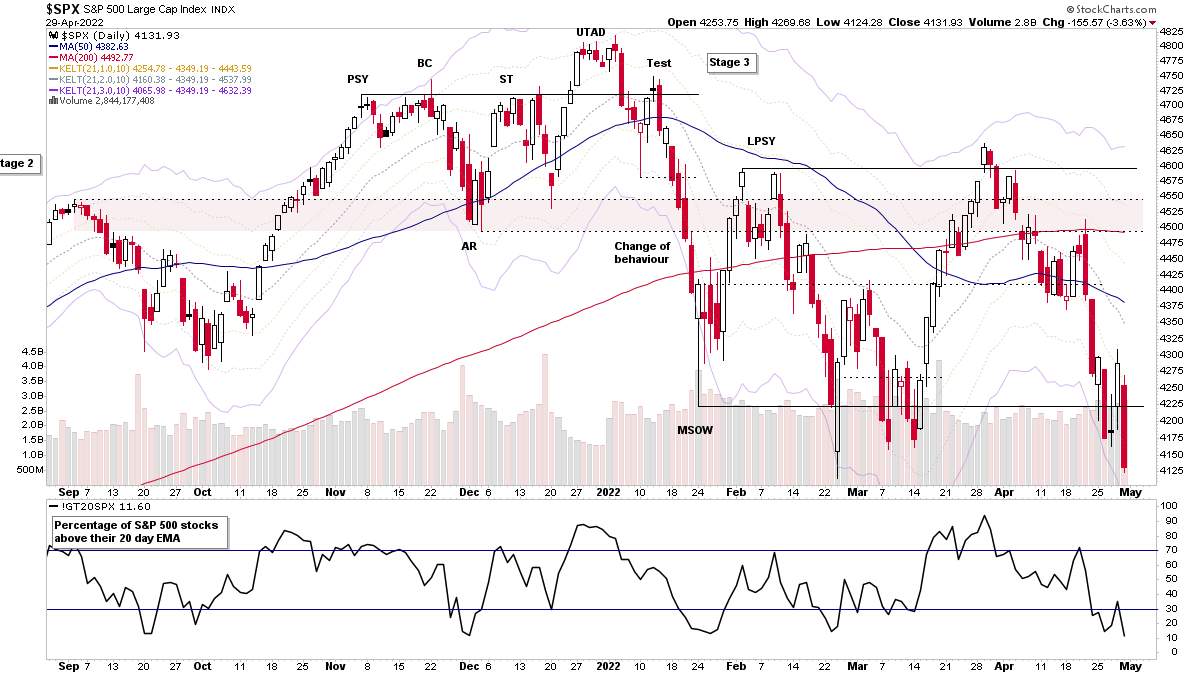

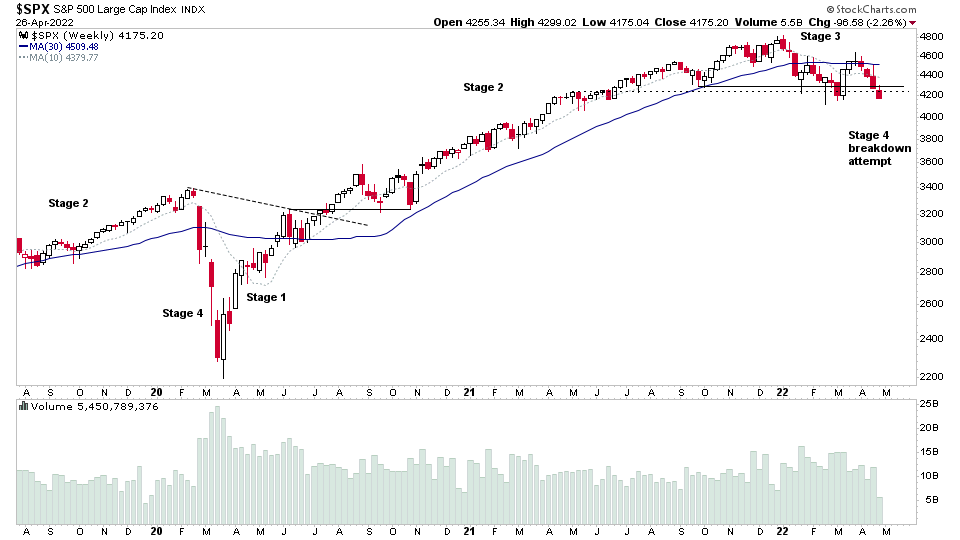

The major US indexes (i.e. the S&P 500, NYSE, Nasdaq Composite and Russell 2000 etc) all closed the week at the lows, after Thursdays bounce attempt was convincingly rejected, and with multiple indexes already in Stage 4, the holdouts have now started to breakdown as well – with the S&P 500 and NYSE both making Stage 4 breakdown attempts at the end of the week. So risk is extremely elevated of the Stage 4 decline accelerating.

Read More

26 April, 2022

US Major Stock Market Indexes Reach Pivotal Points as Mega Cap Stocks Begin Reporting Earnings

The major indexes – S&P 500, Nasdaq Composite, NYSE, Russell 2000 and the FAANG stocks index – are all at pivotal points, with weakest already in Stage 4 declines. But now the stronger areas of the S&P 500 and NYSE are also testing their own Stage 4 breakdown levels...

Read More

24 April, 2022

Stage Analysis Members Weekend Video - 24 April 2022 (1hr 30mins)

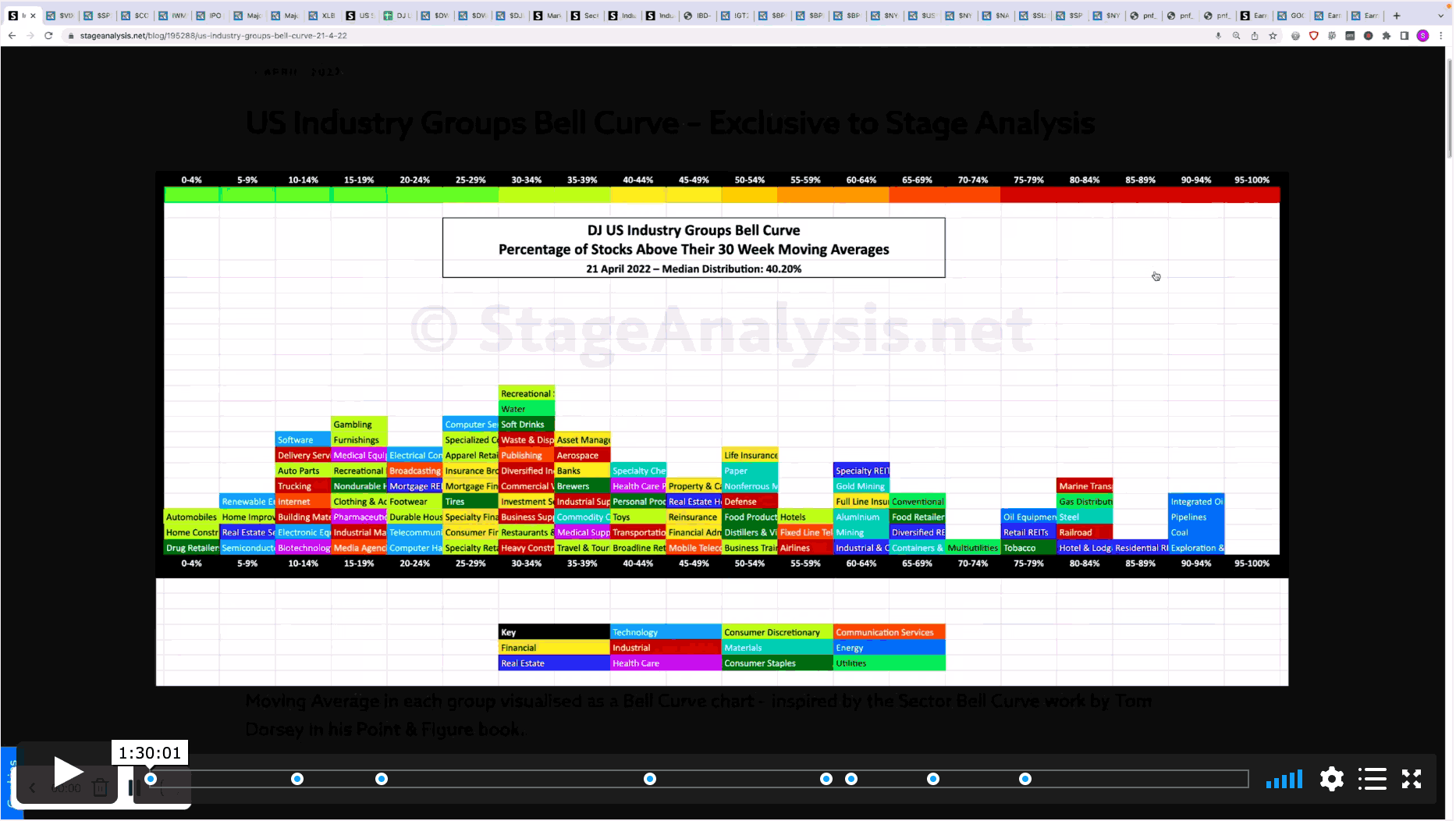

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 and the individual US Market Sectors Stages. Plus the a detailed look at the US Industry Groups Relative Strength focusing on the Change of Behaviour in the strongest RS groups...

Read More

17 April, 2022

Stage Analysis Members Weekend Video – 17 April 2022 (1hr 14mins)

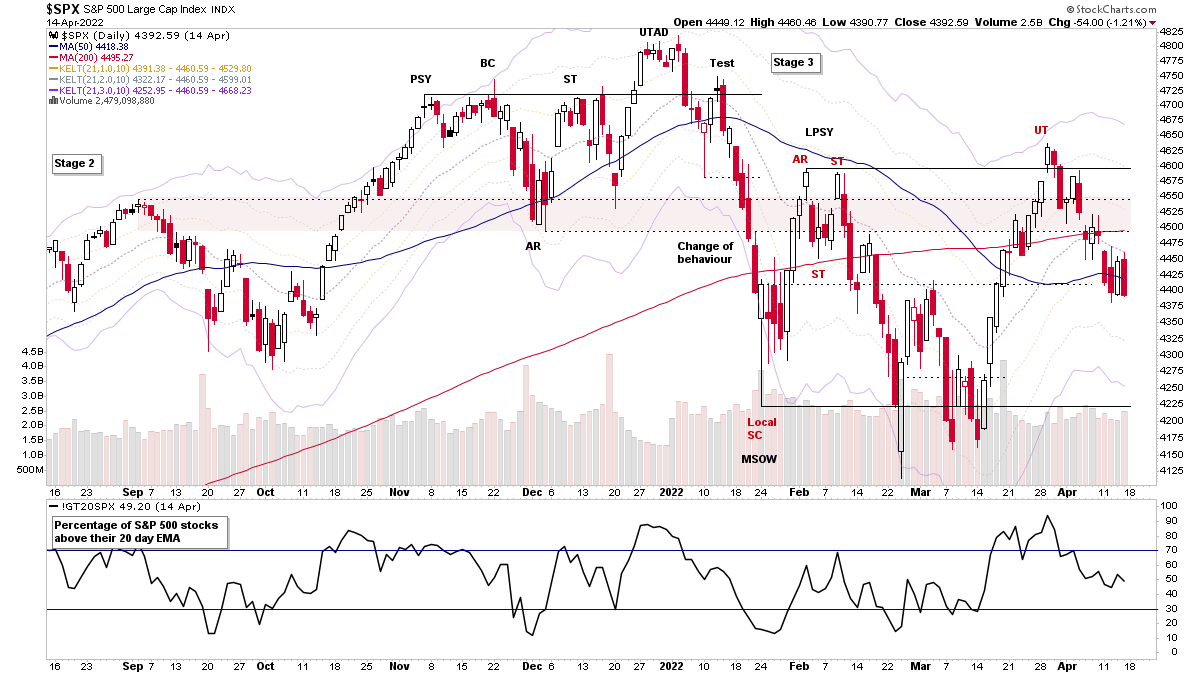

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 etc, plus a detailed run through of the key Market Breadth charts (with exclusive charts only on Stage Analysis) in order to determine the Weight of Evidence...

Read More

10 April, 2022

Stage Analysis Members Weekend Video – 10 April 2022 (1hr 42mins)

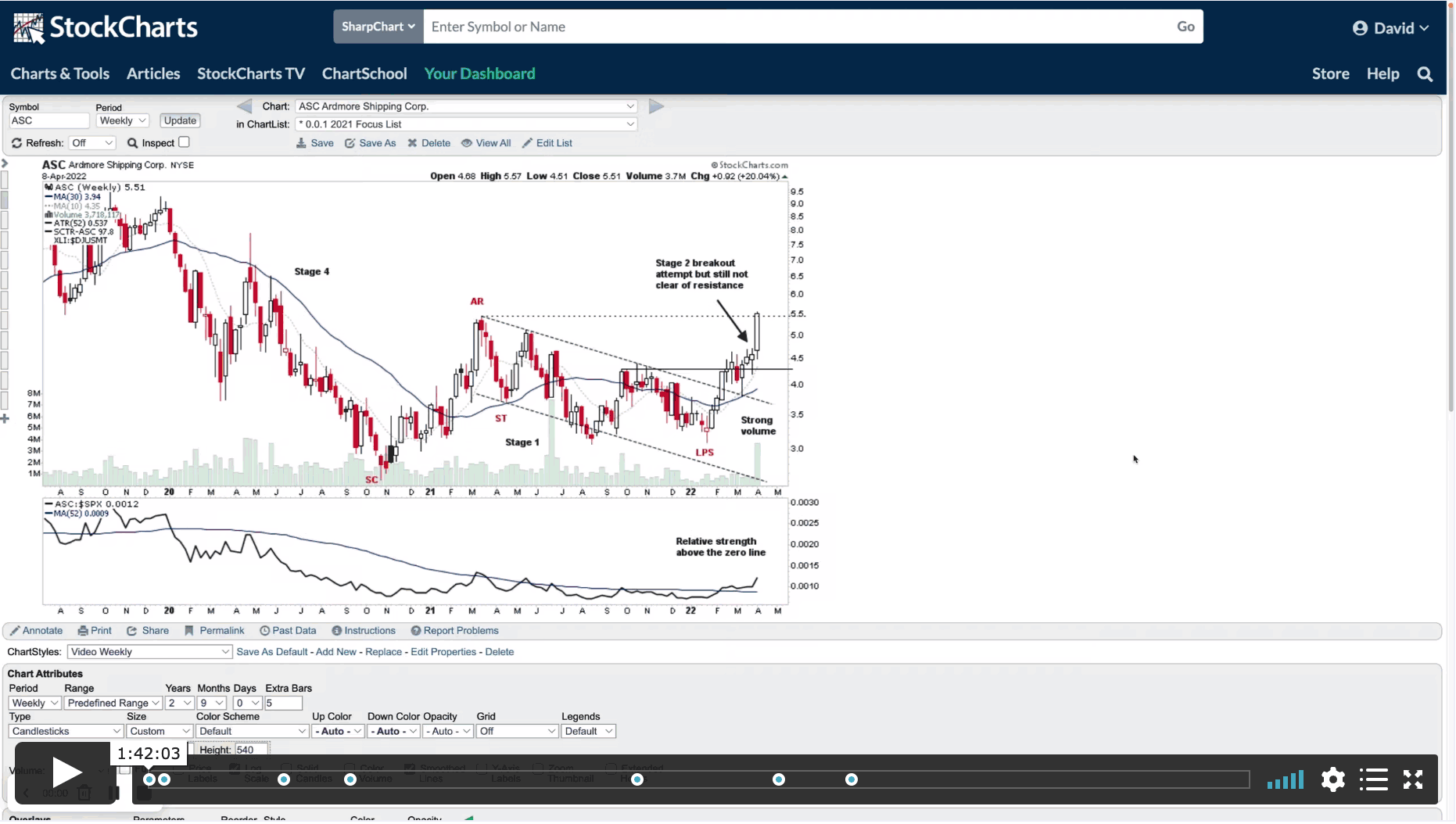

This weekends Stage Analysis Members Video features the Major Indexes – Nasdaq, S&P 500, Russell 2000, Sector Relative Strength, Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength. A Group Focus on the Uranium Stocks and the US Stocks Watchlist in detail with marked up charts and explanations of the group themes and what I'm looking for in various stocks.

Read More