+- Stage Analysis Forum - Trading & Investing using Stan Weinstein's Stocks Breakout method (https://www.stageanalysis.net/forum)

+-- Forum: Main Board (https://www.stageanalysis.net/forum/Forum-Main-Board)

+--- Forum: Stan Weinstein's Stage Analysis - Stock Charts, Technical Analysis, Learn to Trade, Stocks, ETF, NYSE, Nasdaq (https://www.stageanalysis.net/forum/Forum-Stan-Weinstein-s-Stage-Analysis-Stock-Charts-Technical-Analysis-Learn-to-Trade-Stocks-ETF-NYSE-Nasdaq)

+--- Thread: US Stocks Breakouts & Breakdowns - SP500, NYSE, & Nasdaq Stock Charts (/Thread-US-Stocks-Breakouts-Breakdowns-SP500-NYSE-Nasdaq-Stock-Charts)

Pages:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

318

319

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

366

367

368

369

370

371

372

373

374

375

376

377

378

379

380

381

382

383

384

385

386

387

388

389

390

391

392

393

394

395

396

397

398

399

400

401

402

403

404

405

406

407

408

409

410

411

412

413

414

415

416

417

418

419

420

421

422

423

424

425

426

427

428

429

430

431

432

433

434

435

436

437

438

439

440

441

442

443

444

445

446

447

448

449

450

451

452

453

454

455

456

457

458

459

460

461

462

463

464

465

466

467

468

469

470

471

472

473

474

475

476

477

478

479

480

481

482

483

484

485

486

487

488

489

490

491

492

493

494

495

496

497

498

499

500

501

502

503

504

505

506

507

508

509

510

511

512

513

514

515

516

517

518

519

520

521

522

523

524

525

526

527

528

529

530

531

532

533

534

535

536

537

538

539

540

541

542

543

544

545

546

547

548

549

550

551

552

553

554

555

556

RE: Watchlist - Investor method - isatrader - 2013-10-22

RENN is still in early Stage 2 after retesting the Stage 2A breakout level in August and September. Relative performance is above the zero line, and volume has been strong on the up moves and has contracted on the pullbacks, although they've been sharp. But there are signs of accumulation and I noticed some interesting volume action on the intraday chart the last few days, with strong volume moves higher and then a drift lower each day on much lighter volume, which could be a large player trying to hide their accumulation of the stock. But obviously that's just an assumption on my part.

Attached is the charts including the intraday chart so you can see what I mean about the volume action. Earnings are on Nov 12, 2013.

Disclosure: I am long RENN since 7th October.

RE: Watchlist - Traders method - isatrader - 2013-10-22

Thanks to gbarbs for highlighting AAPL in his journal, as I had taken my eye off it.

AAPL made it's first potential Stage 2 continuation move yesterday since the Stage 2A breakout with the relative performance now attempting to cross the weekly still declining zero line. Volume has been below average though, and it's still working through resistance. Attached are the charts

RE: Watchlist - Investor method - isatrader - 2013-10-22

Alcoa (AA) made a potential Stage 2A breakout today following positive earnings surprise two weeks ago. Relative performance has moved up to attempt to cross the zero line and volume was 4.73 times the daily average on the breakout today. Attached are the charts.

RE: Watchlist - Traders method - isatrader - 2013-10-23

CMGE (China Mobile Games and Entertainment Group) is breaking out to new all time highs, and above the IPO high on around 2x it's average weekly volume, and is showing strong relative performance versus the market. Attached is the charts.

RE: Watchlist - Traders method - isatrader - 2013-10-23

XUE attempted to make a Stage 2 continuation move today, but reversed to only close slightly higher on the day. Volume has been relatively good the last few days at around 8x the daily average and was strong on the last two continuation moves, and relative performance is above the zero line. So watch for a close above the September swing high. Attached is the charts.

RE: Watchlist - Traders method - isatrader - 2013-10-23

Every weekday I post the "Daily Breakouts and Breakdowns in the US Market" in the Elite section of the website. So to give the free members and guests a glimpse of what the daily posts are like, below is today's breakouts and breakdowns with the charts of stocks that I've highlighted today.

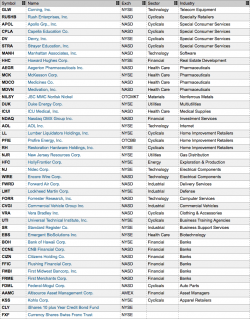

(2013-10-23, 10:12 PM)isatrader Wrote: Below is the table of today's breakouts and breakdowns in the US market. There was 43 breakouts and 18 breakdowns, which I've ordered by industry group.

US Market Breakouts - 23/10/13

US Market Breakdowns - 23/10/13

Cheers

RE: Watchlist - Traders method - isatrader - 2013-10-23

A few of today's above average volume movers in the US market - CP, STXS, SYMM

RE: Watchlist - Traders method - isatrader - 2013-10-24

CLGX (CoreLogic) made a Stage 2 continuation move on more than 6x the average daily volume today following positive earnings and broke out of a large year long Stage 3 range., and relative performance broke above the zero line. Attached is the charts.